Moderna Unusual Options Activity

Moderna Unusual Options Activity

Financial giants have made a conspicuous bearish move on Moderna. Our analysis of options history for Moderna (NASDAQ:MRNA) revealed 19 unusual trades.

金融巨頭對Moderna採取了明顯的看淡態度。我們對Moderna(納斯達克:MRNA)的期權歷史進行了分析,發現了19筆異常交易。

Delving into the details, we found 42% of traders were bullish, while 47% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $856,535, and 7 were calls, valued at $481,149.

深入了解細節後,我們發現42%的交易者看好,而47%的交易者表現出看淡趨勢。在我們發現的所有交易中,有12筆看跌期權,價值856,535美元,有7筆看漲期權,價值481,149美元。

What's The Price Target?

目標價是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $60.0 and $150.0 for Moderna, spanning the last three months.

在評估交易量和持倉量後,很明顯市場的主要動向是在60.0美元和150.0美元之間的價格區間內,這一情況持續了三個月。對於Moderna來說,這個價格區間成爲主要的市場動向。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

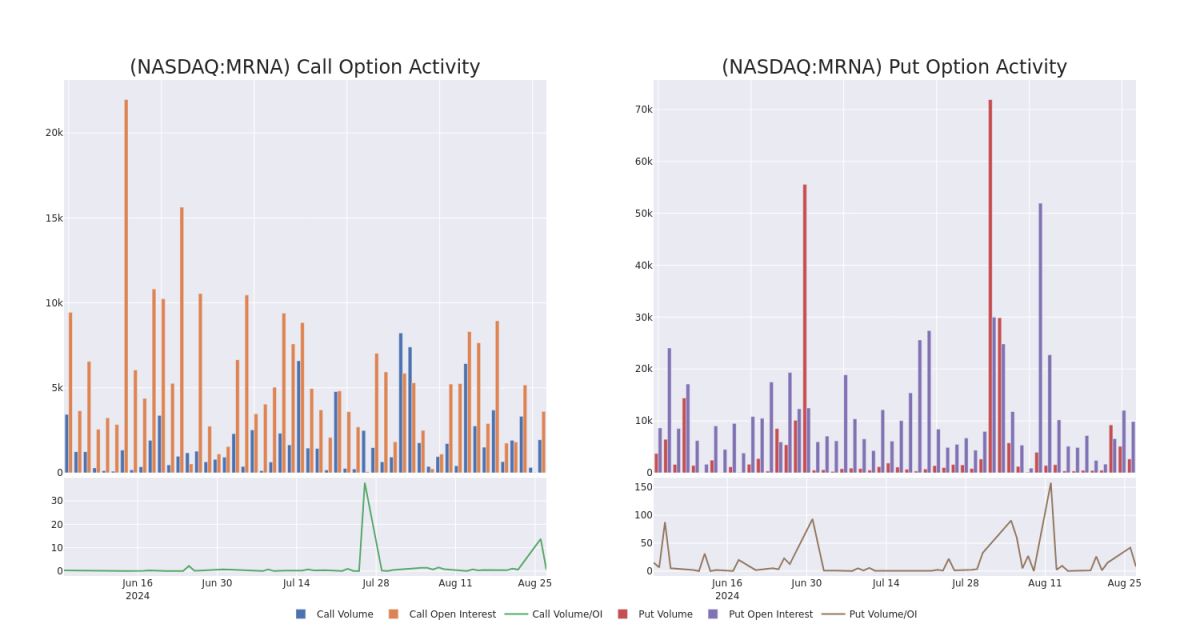

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Moderna's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Moderna's whale trades within a strike price range from $60.0 to $150.0 in the last 30 days.

在交易期權時,關注成交量和持倉量是一個強有力的策略。這些數據可以幫助您跟蹤給定行權價的Modern的期權的流動性和興趣。下面,我們可以觀察過去30天內所有現貨交易中,行權價範圍從60.0美元到150.0美元的看漲和看跌期權的成交量和持倉量的變化。

Moderna 30-Day Option Volume & Interest Snapshot

Moderna 30天期權成交量和利息快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRNA | PUT | SWEEP | BEARISH | 06/20/25 | $6.05 | $5.95 | $6.02 | $60.00 | $362.0K | 668 | 600 |

| MRNA | CALL | TRADE | BEARISH | 09/06/24 | $1.28 | $1.2 | $1.21 | $83.00 | $180.8K | 151 | 1.5K |

| MRNA | CALL | TRADE | BEARISH | 09/06/24 | $1.15 | $0.93 | $1.01 | $84.00 | $136.3K | 167 | 27 |

| MRNA | PUT | SWEEP | BULLISH | 01/17/25 | $14.1 | $13.95 | $13.95 | $85.00 | $100.4K | 3.3K | 72 |

| MRNA | PUT | SWEEP | BULLISH | 09/13/24 | $2.39 | $2.15 | $2.21 | $77.00 | $70.0K | 69 | 317 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Moderna | 看跌 | SWEEP | 看淡 | 06/20/25 | $6.05 | $5.95 | $6.02 | $60.00 | RSI indicators hint that the underlying stock may be oversold. | 668 | 600 |

| Moderna | 看漲 | 交易 | 看淡 | 09/06/24 | $1.28 | $1.2 | $1.21 | 83美元 | 151 | 1.5K | |

| Moderna | 看漲 | 交易 | 看淡 | 09/06/24 | $1.15 | $0.93 | $1.01 | 84美元 | $136.3K | 167 | 27 |

| Moderna | 看跌 | SWEEP | 看好 | 01/17/25 | $14.1 | $13.95 | $13.95 | $85.00 | $100.4K | 3.3K | 72 |

| Moderna | 看跌 | SWEEP | 看好 | 09/13/24 | $2.39 | $2.15 | $2.21 | $77.00 | $70.0K | 69 | 317 |

About Moderna

關於現代

Moderna is a commercial-stage biotech that was founded in 2010 and had its initial public offering in December 2018. The firm's mRNA technology was rapidly validated with its COVID-19 vaccine, which was authorized in the United States in December 2020. Moderna had 39 mRNA development candidates in clinical trials as of mid-2023. Programs span a wide range of therapeutic areas, including infectious disease, oncology, cardiovascular disease, and rare genetic diseases.

Moderna是一家成立於2010年並於2018年12月進行首次公開發行的商業化生物技術公司。該公司的mRNA技術得到了驗證,其COVID-19疫苗在2020年12月獲得美國授權。截至2023年中期,Moderna共有39個mRNA開發候選藥物處於臨床試驗中。這些項目涉及多個治療領域,包括傳染病、腫瘤、心血管疾病和罕見遺傳疾病。

In light of the recent options history for Moderna, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於Moderna的最近期權歷史,現在應該關注該公司本身。我們打算探討其當前表現。

Current Position of Moderna

Moderna現有狀態

- With a volume of 2,549,863, the price of MRNA is down -3.43% at $78.86.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 65 days.

- RSI指標表明該基礎股票可能被超賣。

- 下一季度業績將在65天內發佈。

Professional Analyst Ratings for Moderna

Moderna的專業分析師評級

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $127.2.

- Reflecting concerns, an analyst from RBC Capital lowers its rating to Sector Perform with a new price target of $90.

- Maintaining their stance, an analyst from Goldman Sachs continues to hold a Buy rating for Moderna, targeting a price of $178.

- An analyst from RBC Capital persists with their Outperform rating on Moderna, maintaining a target price of $125.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Neutral rating for Moderna, targeting a price of $88.

- An analyst from Barclays has decided to maintain their Overweight rating on Moderna, which currently sits at a price target of $155.

- RBC Capital的分析師仍然堅持對Moderna的跑贏大盤評級,目標價爲125美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Moderna with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供更高的利潤潛力。精明的交易者通過持續教育、戰略性交易調整、利用各種因子、並密切關注市場動態來減輕這些風險。使用Benzinga Pro實時警報, 追蹤Moderna的最新期權交易。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Moderna's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Moderna's whale trades within a strike price range from $60.0 to $150.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Moderna's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Moderna's whale trades within a strike price range from $60.0 to $150.0 in the last 30 days.