Spotlight on Cisco Systems: Analyzing the Surge in Options Activity

Spotlight on Cisco Systems: Analyzing the Surge in Options Activity

Investors with a lot of money to spend have taken a bullish stance on Cisco Systems (NASDAQ:CSCO).

擁有大量資金的投資者對思科系統(納斯達克:CSCO)採取了看好的態度。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄上看到交易時發現了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CSCO, it often means somebody knows something is about to happen.

無論這些投資者是機構還是富人,我們都不清楚。但是當這麼大的事情發生在CSCO時,通常意味着有人知道即將發生的事情。

So how do we know what these investors just did?

那麼我們如何知道這些投資者剛剛做了什麼呢?

Today, Benzinga's options scanner spotted 10 uncommon options trades for Cisco Systems.

今天,Benzinga的期權掃描器發現了10筆思科系統的非常規期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 60% bullish and 40%, bearish.

這些大資金交易者的總體情緒分爲60%看好和40%看淡。

Out of all of the special options we uncovered, 7 are puts, for a total amount of $290,948, and 3 are calls, for a total amount of $93,975.

在我們發現的所有特殊期權中,有7個看跌期權,總金額爲290,948美元,有3個看漲期權,總金額爲93,975美元。

What's The Price Target?

目標價是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $25.0 to $55.0 for Cisco Systems over the recent three months.

根據交易活動,看來重要投資者的目標價格區間在思科系統最近三個月的股價25.0到55.0之間。

Volume & Open Interest Trends

成交量和未平倉量趨勢

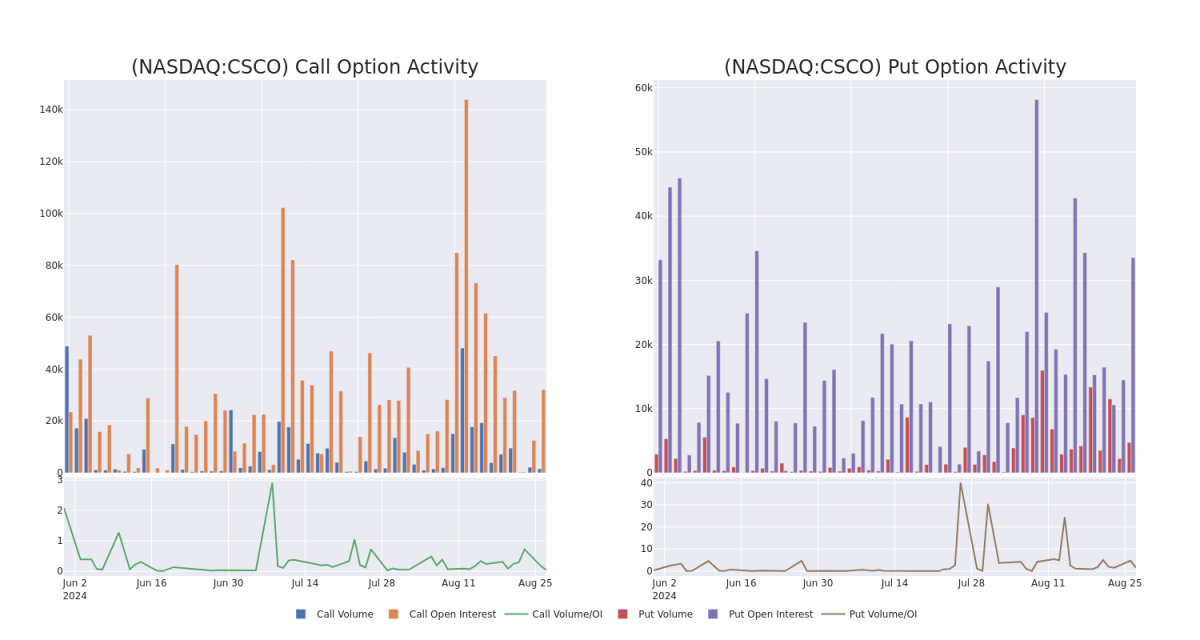

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Cisco Systems's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Cisco Systems's significant trades, within a strike price range of $25.0 to $55.0, over the past month.

通過研究成交量和持倉量,可以提供重要的股票研究見解。這些信息對於在某些行權價上計量思科系統期權的流動性和興趣水平至關重要。下面,我們展示了思科系統在過去一個月內,在股價區間25.0到55.0之間的看漲和看跌期權的成交量和持倉量趨勢快照。

Cisco Systems Call and Put Volume: 30-Day Overview

思科系統看漲和看跌成交量:30天概述

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CSCO | PUT | SWEEP | BULLISH | 01/16/26 | $6.95 | $6.9 | $6.9 | $55.00 | $69.0K | 1.7K | 100 |

| CSCO | PUT | SWEEP | BEARISH | 01/16/26 | $4.4 | $4.3 | $4.38 | $50.00 | $43.9K | 1.4K | 100 |

| CSCO | PUT | SWEEP | BULLISH | 11/15/24 | $0.79 | $0.78 | $0.76 | $47.50 | $42.4K | 3.2K | 2.4K |

| CSCO | PUT | SWEEP | BEARISH | 01/17/25 | $2.03 | $2.0 | $2.02 | $50.00 | $40.4K | 26.0K | 696 |

| CSCO | CALL | SWEEP | BULLISH | 01/17/25 | $0.96 | $0.92 | $0.95 | $55.00 | $36.3K | 29.2K | 777 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 思科系統 | 看跌 | SWEEP | 看好 | 01/16/26 | $6.95 | $6.9 | $6.9 | $55.00 | $69.0K | 1.7K | 100 |

| 思科系統 | 看跌 | SWEEP | 看淡 | 01/16/26 | $4.4 | $4.3 | $4.38 | $50.00 | $43.9K | 1.4千 | 100 |

| 思科系統 | 看跌 | SWEEP | 看好 | 11/15/24 | $0.79 | $0.78 | $0.76 | $47.50 | $42.4K | 3.2K | 2.4K |

| 思科系統 | 看跌 | SWEEP | 看淡 | 01/17/25 | $2.03 | $2.0 | $2.02 | $50.00 | $40.4K | 26.0K | 696 |

| 思科系統 | 看漲 | SWEEP | 看好 | 01/17/25 | 0.96美元 | 0.92美元 | 0.95美元 | $55.00 | $36.3千 | 777 |

About Cisco Systems

關於思科系統的相關情況

Cisco Systems is the largest provider of networking equipment in the world and one of the largest software companies in the world. Its largest businesses are selling networking hardware and software (where it has leading market shares) and cybersecurity software such as firewalls. It also has collaboration products, like its Webex suite, and observability tools. It primarily outsources its manufacturing to third parties and has a large sales and marketing staff—25,000 strong across 90 countries. Overall, Cisco employs 80,000 people and sells its products globally.

思科系統是世界上最大的網絡設備供應商之一,也是全球最大的軟件公司之一。它的主要業務是銷售網絡硬件和軟件(在這些領域擁有領先的市場份額),以及諸如防火牆之類的網絡安全軟件。它還有協作產品,如其Webex套件,以及可觀測性工具。它主要將製造外包給第三方,並擁有一個25,000人的龐大的銷售和營銷人員,在90個國家和地區都有業務。總的來說,思科系統僱用了80,000人,並在全球銷售其產品。

Present Market Standing of Cisco Systems

思科系統目前的市場地位

- Currently trading with a volume of 10,087,648, the CSCO's price is down by -0.2%, now at $50.69.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 78 days.

- RSI讀數表明該股目前可能接近超買水平。

- 預期的收益發布還有78天。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CSCO, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CSCO, it often means somebody knows something is about to happen.