UnitedHealth Group's Options Frenzy: What You Need to Know

UnitedHealth Group's Options Frenzy: What You Need to Know

Investors with a lot of money to spend have taken a bullish stance on UnitedHealth Group (NYSE:UNH).

資金雄厚的投資者看好聯合健康集團(紐交所:UNH)。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄上看到交易時發現了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with UNH, it often means somebody knows something is about to happen.

無論是機構投資者還是富裕個人投資者,我們並不清楚。但是當UNH發生如此大的變動時,通常意味着有人知道即將發生什麼。

So how do we know what these investors just did?

那麼我們如何知道這些投資者剛剛做了什麼呢?

Today, Benzinga's options scanner spotted 13 uncommon options trades for UnitedHealth Group.

今天,Benzinga的期權掃描器發現了13筆聯合健康集團的非常規期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 38% bullish and 38%, bearish.

這些大手交易商的整體情緒在38%看好和38%看淡之間分歧。

Out of all of the special options we uncovered, 4 are puts, for a total amount of $250,460, and 9 are calls, for a total amount of $488,431.

在我們發現的所有特殊期權中,4個是看跌期權,總金額爲250,460美元,有9個是看漲期權,總金額爲488,431美元。

Expected Price Movements

預期價格波動

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $560.0 to $650.0 for UnitedHealth Group over the recent three months.

根據交易活動,顯然重要投資者的目標價位在過去三個月中從560.0美元到650.0美元的區間內。

Volume & Open Interest Trends

成交量和未平倉量趨勢

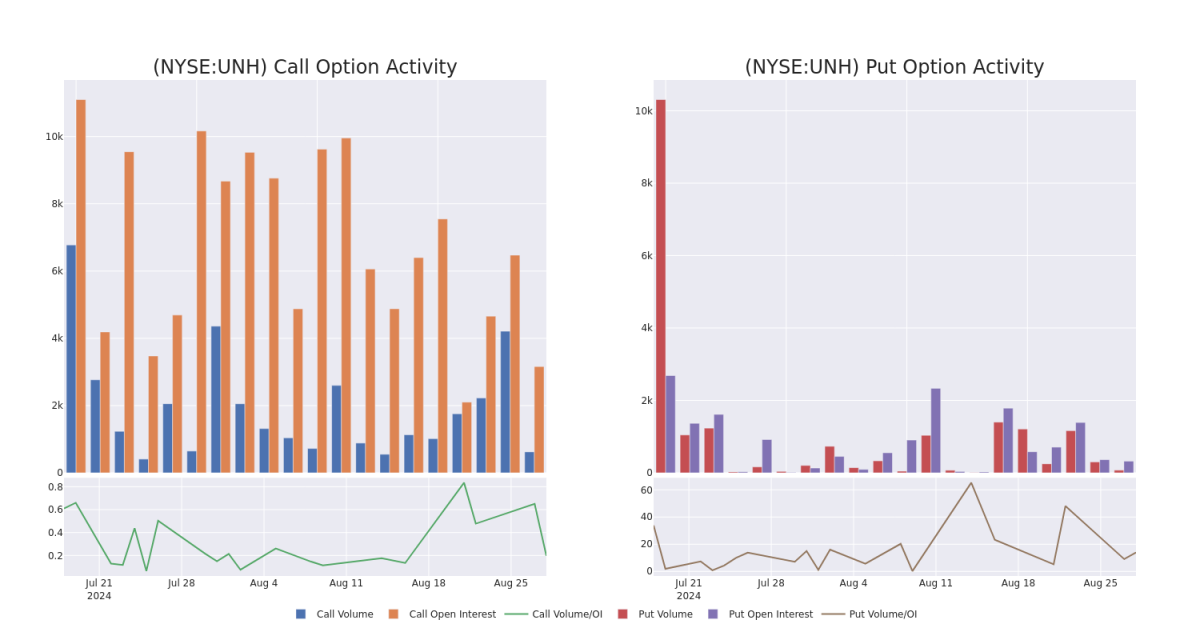

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for UnitedHealth Group's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across UnitedHealth Group's significant trades, within a strike price range of $560.0 to $650.0, over the past month.

研究成交量和持倉量提供了關鍵的洞察力。這些信息在評估聯合健康集團對某些行使價格的期權的流動性和利益水平時非常重要。下面,我們將介紹過去一個月內在560.0美元到650.0美元區間內的聯合健康集團的看漲期權和看跌期權的成交量和持倉量的趨勢快照。

UnitedHealth Group Option Activity Analysis: Last 30 Days

聯合健康集團期權活動分析:過去30天

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UNH | PUT | TRADE | NEUTRAL | 01/16/26 | $90.7 | $85.3 | $88.15 | $650.00 | $141.0K | 24 | 16 |

| UNH | CALL | SWEEP | BEARISH | 09/20/24 | $8.65 | $8.35 | $8.44 | $600.00 | $112.8K | 1.3K | 166 |

| UNH | CALL | SWEEP | BULLISH | 10/18/24 | $16.35 | $16.2 | $16.35 | $600.00 | $98.1K | 1.2K | 61 |

| UNH | CALL | SWEEP | BEARISH | 09/20/24 | $8.75 | $8.65 | $8.65 | $600.00 | $50.1K | 1.3K | 250 |

| UNH | PUT | TRADE | BULLISH | 11/15/24 | $20.4 | $20.1 | $20.1 | $580.00 | $40.2K | 184 | 20 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 聯合健康 | 看跌 | 交易 | 中立 | 01/16/26 | $69.8K | $85.3 | $88.15 | $650.00 | $141.0K | 24 | 16 |

| 聯合健康 | 看漲 | SWEEP | 看淡 | 09/20/24 | $ 8.65 | $8.35 | $600.00 | $112.8K | 1.3K | 166 | |

| 聯合健康 | 看漲 | SWEEP | 看好 | 10/18/24 | $16.35 | $16.2 | $16.35 | $600.00 | $98.1K | 1.2K | 61 |

| 聯合健康 | 看漲 | SWEEP | 看淡 | 09/20/24 | $8.75 | $ 8.65 | $ 8.65 | $600.00 | $50.1K | 1.3K | 250 |

| 聯合健康 | 看跌 | 交易 | 看好 | 11/15/24 | $20.4 | $20.1 | $20.1 | $40.2K | 184 | 20 |

About UnitedHealth Group

關於聯合健康集團

UnitedHealth Group is one of the largest private health insurers, providing medical benefits to about 50 million members globally, including 1 million outside the us as June 2024. As a leader in employer-sponsored, self-directed, and government-backed insurance plans, UnitedHealth has obtained massive scale in managed care. Along with its insurance assets, UnitedHealth's continued investments in its Optum franchises have created a healthcare services colossus that spans everything from medical and pharmaceutical benefits to providing outpatient care and analytics to both affiliated and third-party customers.

聯合健康集團是全球最大的私人醫療保險提供商之一,爲包括2024年6月外美國的約5000萬會員提供醫療保障。作爲僱主贊助、自主選擇和政府支持的保險計劃的領導者,聯合健康在託管護理方面獲得了大規模的規模。除了其保險資產外,聯合健康繼續投資於其Optum公司,創造了一個醫療保健服務巨頭,涵蓋從醫療和藥品福利到爲關聯和第三方客戶提供門診護理和分析。

Following our analysis of the options activities associated with UnitedHealth Group, we pivot to a closer look at the company's own performance.

在分析聯合健康集團的期權活動之後,我們將轉向公司本身的績效。

UnitedHealth Group's Current Market Status

聯合健康集團的當前市場狀態

- Currently trading with a volume of 325,949, the UNH's price is up by 0.64%, now at $591.08.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 44 days.

- RSI讀數表明該股目前可能接近超買水平。

- 預期四十四天後公佈收益。

What The Experts Say On UnitedHealth Group

專家對聯合健康集團的看法

1 market experts have recently issued ratings for this stock, with a consensus target price of $591.0.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $591.

- 考慮到關切,Cantor Fitzgerald的一位分析師將其評級下調至超配,新的目標價爲591美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest UnitedHealth Group options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在回報。精明的交易者通過不斷學習、調整策略、監控多個因素和密切關注市場變化來管理這些風險。通過Benzinga Pro的實時提醒了解聯合健康集團最新的期權交易動態。