Spotlight on AT&T: Analyzing the Surge in Options Activity

Spotlight on AT&T: Analyzing the Surge in Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on AT&T.

資金雄厚的鯨魚們對AT&t持有明顯的看淡態度。

Looking at options history for AT&T (NYSE:T) we detected 8 trades.

查看AT&t (紐交所:T) 的期權歷史,我們發現了8次交易。

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 75% with bearish.

如果考慮每個交易的具體情況,可以準確地說,有25%的投資者以看好期望來開倉,75%以看淡爲主。

From the overall spotted trades, 3 are puts, for a total amount of $399,640 and 5, calls, for a total amount of $449,366.

從總體交易中看,看跌期權共有3筆,總金額爲399,640美元;看漲期權共有5筆,總金額爲449,366美元。

Expected Price Movements

預期價格波動

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $15.0 to $25.0 for AT&T during the past quarter.

通過分析這些合約的成交量和持倉量,我們發現大戶對AT&T股票在過去的一個季度中將價格窗口設定在15.0到25.0美元之間。

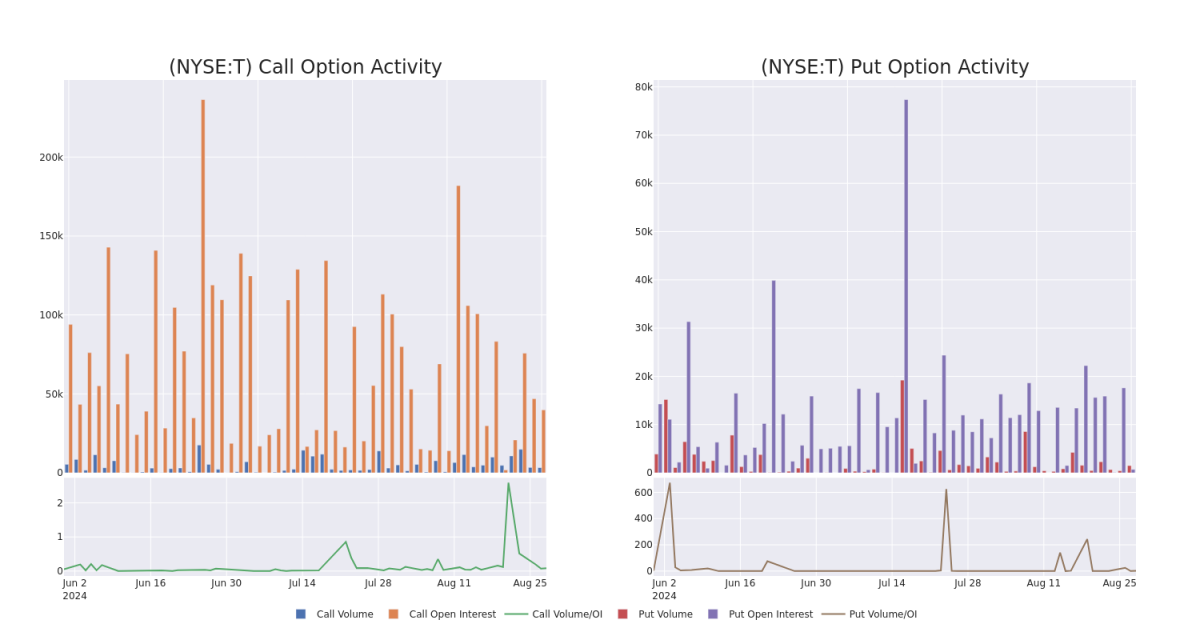

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for AT&T's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of AT&T's whale trades within a strike price range from $15.0 to $25.0 in the last 30 days.

在交易期權時,觀察成交量和持倉量是一個重要的步驟。這些數據可以幫助你跟蹤AT&T期權在特定行使價上的流動性和興趣。下面,我們可以觀察到過去30天內,對於價格區間在15.0到25.0美元之間的AT&T特大交易的看漲期權和看跌期權的成交量和持倉量的演變。

AT&T 30-Day Option Volume & Interest Snapshot

AT&T 30天期權成交量和持倉量快照

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| T | CALL | SWEEP | BEARISH | 10/18/24 | $3.05 | $2.93 | $2.93 | $17.00 | $175.8K | 5.1K | 600 |

| T | PUT | SWEEP | BEARISH | 12/20/24 | $4.45 | $4.4 | $4.45 | $24.00 | $133.5K | 702 | 600 |

| T | PUT | SWEEP | BEARISH | 12/20/24 | $4.45 | $4.4 | $4.45 | $24.00 | $133.0K | 702 | 601 |

| T | PUT | SWEEP | BEARISH | 12/20/24 | $4.45 | $4.4 | $4.45 | $24.00 | $133.0K | 702 | 300 |

| T | CALL | SWEEP | BEARISH | 06/20/25 | $5.1 | $5.0 | $5.0 | $15.00 | $100.0K | 15.3K | 207 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| T | 看漲 | SWEEP | 看淡 | 10/18/24 | $3.05 | $2.93 | $2.93 | $17.00 | $175.8K | 5.1K | 600 |

| T | 看跌 | SWEEP | 看淡 | 12/20/24 | $4.45 | $4.4 | $4.45 | 24.00美元 | $133.5K | 702 | 600 |

| T | 看跌 | SWEEP | 看淡 | 12/20/24 | $4.45 | $4.4 | $4.45 | 24.00美元 | $133.0K | 702 | 601 |

| T | 看跌 | SWEEP | 看淡 | 12/20/24 | $4.45 | $4.4 | $4.45 | 24.00美元 | $133.0K | 702 | 300 |

| T | 看漲 | SWEEP | 看淡 | 06/20/25 | $5.1 | $5.0 | $5.0 | 15.00美元 | $100.0K | 15.3K | 207 |

About AT&T

關於AT&T

The wireless business contributes nearly 70% of AT&T's revenue. The firm is the third-largest US wireless carrier, connecting 72 million postpaid and 17 million prepaid phone customers. Fixed-line enterprise services, which account for about 16% of revenue, include internet access, private networking, security, voice, and wholesale network capacity. Residential fixed-line services, about 11% of revenue, primarily consist of broadband internet access, serving 14 million customers. AT&T also has a sizable presence in Mexico, with 23 million customers, but this business only accounts for 4% of revenue. The firm still holds a 70% equity stake in satellite television provider DirecTV but does not consolidate this business in its financial statements.

無線業務貢獻了近70%的AT&T收入。該公司是美國第三大無線運營商,連接着7200萬後付費和1700萬預付費手機客戶。固定線企業服務佔收入的16%,包括互聯網接入、私人網絡、安全、語音和批發網絡容量。住宅固定線服務佔收入約11%,主要包括寬帶互聯網接入,爲1400萬客戶提供服務。AT&T在墨西哥也擁有較大的業務,有2300萬客戶,但這項業務只佔其財務報表的4%。該公司仍然持有衛星電視提供商DirecTV的70%股權,但不會將其納入財務報表。

Having examined the options trading patterns of AT&T, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在審查了AT&T的期權交易模式後,我們的注意力現在直接轉向了該公司。 這一轉變使我們能夠深入了解其目前的市場地位和績效。

Where Is AT&T Standing Right Now?

- Currently trading with a volume of 8,256,974, the T's price is up by 0.61%, now at $19.77.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 56 days.

- RSI讀數表明該股目前可能接近超買水平。

- 預計的盈利發佈還有56天。

What Analysts Are Saying About AT&T

In the last month, 1 experts released ratings on this stock with an average target price of $18.0.

在過去的一個月中,有1個專家對該股票發表了評級,平均目標價爲18.0美元。

- Consistent in their evaluation, an analyst from MoffettNathanson keeps a Neutral rating on AT&T with a target price of $18.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。