Wednesday Market Falls Before Nvidia Report

Wednesday Market Falls Before Nvidia Report

The market fell Wednesday ahead of Nvidia earnings tonight. We will work as fast as possible in the News Room to bring you Nvidia's results as soon as they drop; tune in live for the earnings call tonight. Analysts tracked by Bloomberg expect adjusted earnings of $0.65/share on revenue of $28.86B; we will update you on the estimates and numbers throughout the day.

週三在 Nvidia 今晚的盈利前,市場下跌。我們將在新聞室儘快帶給您 Nvidia 的結果,一旦它們出來我們會進行實時直播盈利報告。據 Bloomberg 跟蹤的分析師預計調整後的每股收益爲 0.65 美元,營業收入爲 288.6 億美元;我們會在全天爲您更新估計和數據。

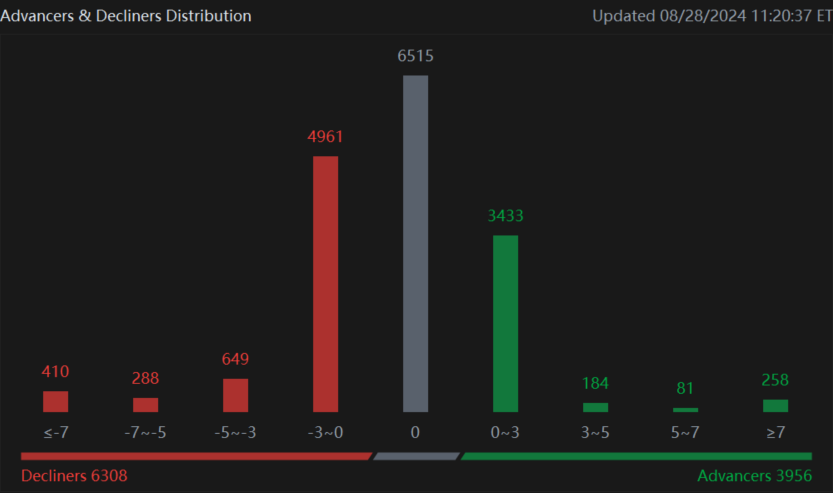

Index prices reflected traders holding their breath. Just before 4 pm ET, the $S&P 500 Index (.SPX.US)$ traded -0.60%, the $Dow Jones Industrial Average (.DJI.US)$ fell 0.39%, and the $Nasdaq Composite Index (.IXIC.US)$ shed 1.12%.

指數價格反映了交易者的緊張情緒。就在美國東部時間下午 4 點之前, $標普500指數 (.SPX.US)$ 跌了 0.60%,$道瓊斯指數 (.DJI.US)$ 下跌了 0.39%,而 $納斯達克綜合指數 (.IXIC.US)$ 下跌了 1.12%。

Every sector on the S&P 500 was in the green Friday after the Federal Reserve rate cut news, but since reaching a hair length of records, prices have stayed put in the past two trading sessions. Fed President Jerome Powell did not specify the timeline of these rate cuts, but he said he was confident the economy was on the way to 2% inflation. "The time has come to adjust, and the direction is clear," Powell said.

在聯邦儲備減息消息後,標普500指數的每個板塊週五都是綠色的,但自創紀錄以來,價格在過去的兩個交易日裏保持不變。聯儲局主席鮑威爾沒有具體說明減息的時間表,但他表示對經濟通脹率達到2%很有信心。鮑威爾說:「調整的時機已經到了,方向也很明確。」

This week in macro, investors can look forward to more macroeconomic data that might inform how the FOMC will decide on rate cuts. CB Consumer Confidence came out Tuesday morning, showing a jump in expectations. Crude Oil Inventories came out Wednesday morning, showing a cut of 800,000 barrels compared to last week's drop of 4 million.

本週宏觀經濟數據會對FOMC的減息決策產生影響。週二上午發佈了消費者信心指數(Cb Consumer Confidence),顯示預期有所增長。週三上午公佈了原油庫存(Crude Oil Inventories),數據顯示與上週的下降400萬桶相比減少了80萬桶。

Investors are awaiting a speech from Atlanta Fed President Raphael Bostic after 6 p.m. ET. Continuing and Initial Jobless claims will drop on Thursday alongside updated GDP numbers for the second quarter.

投資者正在等待亞特蘭大聯儲主席拉斐爾·博斯蒂克在美國東部時間晚上6點之後的講話。勞動力市場報告(Continuing and Initial Jobless claims)將於星期四公佈,同時公佈第二季度的GDP數據。

Friday will see the release of the July person Consumption Expenditure index (PCE), the Fed's favorite inflation measure. Last time, the PCE came in at 2.6% year over year, the lowest since 2021. Michigan consumer expectations and confidence will also drop on Friday.

星期五將發佈七月份的個人消費支出指數(PCE),這是聯儲局最喜歡的通脹衡量標準。上一次,PCE同比增長2.6%,是自2021年以來的最低水平。密歇根消費者預期和信心指數也將於星期五發布。

Interested in Options? To see these stocks and more on the options page, click here. Want to learn more about options, check out moomoo education with this link. Click here to join our exclusive options chat with personal callouts from our resident expert, Invest with Sarge.

對期權感興趣嗎?要查看這些股票以及更多內容,請點擊期權頁面 這裏想要了解更多關於期權的信息嗎, 。點擊此處註冊會議。在這裏加入我們獨家期權聊天室,獲得我們專家Sarge的個人召喚。 在這裏加入我們的獨家期權聊天,得到我們的投資專家Sarge的個人實況解說。

Yesterday, users were commenting on PDD, and how hard they were hit by this season earning reacitons.

昨天,用戶們在討論PDD,以及他們在這個季度的收益反應中受到了多大的影響。

Traders, what do you think, is the market in 2024 about following the herd? What you watching on the stock market today? What is the herd following? Let me know in the comments below!

交易員們,你們覺得,在2024年的市場中是否會跟隨群衆?今天你看到了什麼?群衆在關注什麼?請在下面的評論中告訴我!

Disclaimer: This content is for informational use only and is not a recommendation or endorsement of any particular investment or strategy. Indexes are unmanaged and cannot be directly invested into. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors' financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances, before making any investment decisions. Past performance does not indicate or guarantee future success. Moomoo makes no representation or warranty as to its adequacy, or timeliness for any particular purpose of the above content. The data and information provided has been obtained from sources considered to be reliable, but moomoo does not guarantee that the foregoing material is accurate or complete. See the link in the Moovers Community post for more information.

免責聲明:此內容僅供信息使用,不是任何特定投資或策略的推薦或認可。指數未經管理,不能直接投資。“投資涉及風險,可能導致本金損失。此內容中提供的投資信息爲一般性質,僅供舉例說明,並可能不適合所有投資者。它是在不考慮個體投資者的財務狀況、投資目標、投資時間表或風險容忍度的情況下提供的。在考慮個人相關情況之前,請先考慮此信息的適用性,然後再做出任何投資決策。過去的表現並不預示或保證未來的成功。Moomoo不對上述內容的足夠性或適時性作出任何聲明或保證。提供的數據和信息是從被認爲是可靠的來源獲得的,但是Moomoo並不保證前述材料準確無誤。有關更多信息,請參見Moovers社區發帖。link有關更多信息,請參見Moovers社區發帖中的鏈接。