MicroStrategy Options Trading: A Deep Dive Into Market Sentiment

MicroStrategy Options Trading: A Deep Dive Into Market Sentiment

Deep-pocketed investors have adopted a bearish approach towards MicroStrategy (NASDAQ:MSTR), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MSTR usually suggests something big is about to happen.

資金雄厚的投資者對MicroStrategy (NASDAQ:MSTR)採取了看淡的態度,而市場參與者不應忽視這一點。我們在Benzinga對公開期權記錄的追蹤中發現了這一重要的舉動。這些投資者的身份尚不爲人所知,但是MSTR的如此重大的舉動通常意味着即將發生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 129 extraordinary options activities for MicroStrategy. This level of activity is out of the ordinary.

根據我們今天的觀察,Benzinga的期權掃描器突出了MicroStrategy的129項非同尋常的期權交易。這種活動水平是異常的。

The general mood among these heavyweight investors is divided, with 32% leaning bullish and 51% bearish. Among these notable options, 53 are puts, totaling $3,028,988, and 76 are calls, amounting to $5,332,262.

這些大戶投資者中普遍情緒分化,32%看好,51%看淡。在這些引人注目的期權中,有53個看跌期權,總額爲3,028,988美元,還有76個看漲期權,總額爲5,332,262美元。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $20.0 to $275.0 for MicroStrategy over the last 3 months.

考慮到這些合約的成交量和未平倉合約數,過去3個月來,這些鯨魚一直將MicroStrategy的目標價格範圍定在20.0至275.0美元之間。

Volume & Open Interest Trends

成交量和未平倉量趨勢

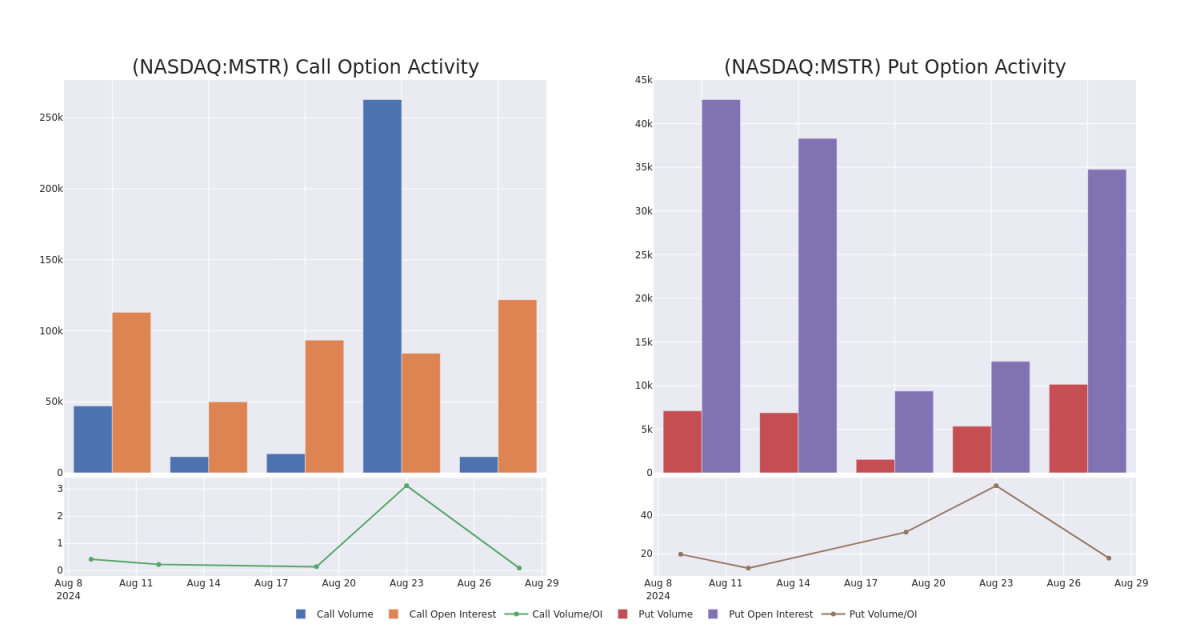

In today's trading context, the average open interest for options of MicroStrategy stands at 1863.44, with a total volume reaching 20,754.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in MicroStrategy, situated within the strike price corridor from $20.0 to $275.0, throughout the last 30 days.

在今天的交易背景下,MicroStrategy期權的平均未平倉合約爲1863.44,總成交量達到20,754.00。隨附的圖表描述了過去30天內MicroStrategy高價值交易的看漲和看跌期權成交量和未平倉合約的發展情況,這些交易位於20.0至275.0美元的行權價走廊內。

MicroStrategy Option Volume And Open Interest Over Last 30 Days

MicroStrategy在過去30天內的期權成交量和持倉量

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSTR | CALL | TRADE | BEARISH | 10/18/24 | $14.55 | $14.3 | $14.31 | $139.00 | $715.5K | 32.0K | 517 |

| MSTR | PUT | SWEEP | BEARISH | 02/21/25 | $47.4 | $47.35 | $47.35 | $158.00 | $222.5K | 25 | 13 |

| MSTR | PUT | TRADE | BEARISH | 09/27/24 | $10.7 | $10.55 | $10.7 | $130.00 | $214.0K | 993 | 233 |

| MSTR | PUT | TRADE | BULLISH | 08/30/24 | $2.71 | $2.45 | $2.55 | $130.00 | $178.4K | 2.2K | 2.1K |

| MSTR | CALL | TRADE | NEUTRAL | 12/19/25 | $49.65 | $48.25 | $49.0 | $150.00 | $161.7K | 490 | 53 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MicroStrategy | 看漲 | 交易 | 看淡 | 10/18/24 | $14.55 | $14.3 | $14.31 | 139.00美元 | $161.7K | 32.0K | 517 |

| MicroStrategy | 看跌 | SWEEP | 看淡 | 02/21/25 | $47.4 | 47.35美元 | 47.35美元 | $158.00 | $119.0K | 25 | 13 |

| MicroStrategy | 看跌 | 交易 | 看淡 | 09/27/24 | $10.7 | $10.55 | $10.7 | $130.00 | $214.0K | 993 | 233 |

| MicroStrategy | 看跌 | 交易 | 看好 | 08/30/2024 | $2.71 | $2.45 | $2.55 | $130.00 | $178.4K | 2.2K | 2.1K |

| MicroStrategy | 看漲 | 交易 | 中立 | 2025年12月19日 | 49.65美元 | $49.0 | $150.00 | $161.7K | 490 | 53 |

About MicroStrategy

關於MicroStrategy

MicroStrategy Inc is a provider of enterprise analytics and mobility software. It offers MicroStrategy Analytics platform that delivers reports and dashboards and enables users to conduct ad hoc analysis and share insights through mobile devices or the Web; MicroStrategy Server, which provides analytical processing and job management. The company's reportable operating segment is engaged in the design, development, marketing, and sales of its software platform through licensing arrangements and cloud-based subscriptions and related services.

MicroStrategy是一家企業分析和移動軟件提供商。它提供MicroStrategy Analytics平台,通過移動設備或Web提供報告和儀表板,並使用戶能夠進行臨時分析和分享見解;MicroStrategy Server提供分析處理和作業管理。該公司報告的經營部門從事通過許可安排和雲訂閱及相關服務的方式設計、開發、營銷和銷售其軟件平台。

After a thorough review of the options trading surrounding MicroStrategy, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

經過對MicroStrategy周圍期權交易的徹底審查,我們開始對該公司進行更加詳細的評估。這包括對其當前的市場地位和表現的評估。

Where Is MicroStrategy Standing Right Now?

MicroStrategy現在處於何種地位?

- Currently trading with a volume of 5,823,704, the MSTR's price is down by -5.49%, now at $132.33.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 63 days.

- RSI讀數表明該股票目前處於中立狀態,處於超買和超賣之間。

- 預計發佈收益報告還有63天。

Professional Analyst Ratings for MicroStrategy

MicroStrategy的專業分析師評級

In the last month, 3 experts released ratings on this stock with an average target price of $1424.6666666666667.

- Maintaining their stance, an analyst from Maxim Group continues to hold a Buy rating for MicroStrategy, targeting a price of $1930.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $194.

- Consistent in their evaluation, an analyst from Benchmark keeps a Buy rating on MicroStrategy with a target price of $2150.

- 在他們的評估一致的情況下,Benchmark的一位分析師保持MicroStrategy的買入評級,目標價爲2150美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MicroStrategy with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高的潛在利潤。精明的交易者通過持續學習、策略性的交易調整、利用各種因子以及關注市場動態來減輕這些風險。通過Benzinga Pro,及時了解MicroStrategy的最新期權交易情況。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $20.0 to $275.0 for MicroStrategy over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $20.0 to $275.0 for MicroStrategy over the last 3 months.