Meta Platforms's Options Frenzy: What You Need to Know

Meta Platforms's Options Frenzy: What You Need to Know

Deep-pocketed investors have adopted a bullish approach towards Meta Platforms (NASDAQ:META), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in META usually suggests something big is about to happen.

資本雄厚的投資者對meta平台(NASDAQ:META)採取了看好的態度,這是市場參與者不能忽視的事情。我們在Benzinga的公共期權記錄跟蹤中發現了這個重大的舉動。這些投資者的身份仍然未知,但META的如此重大的舉動通常意味着即將發生一些重要事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 52 extraordinary options activities for Meta Platforms. This level of activity is out of the ordinary.

我們從觀察中獲得了這些信息,當Benzinga的期權掃描器突出了Meta Platforms的52項非同尋常的期權交易活動。這種活動水平是非同尋常的。

The general mood among these heavyweight investors is divided, with 21% leaning bullish and 21% bearish. Among these notable options, 5 are puts, totaling $278,493, and 47 are calls, amounting to $5,171,925.

這些重量級投資者中普遍情緒分爲兩種,21%看漲,21%看淡。在這些引人注目的期權中,有5份看跌期權,總額278,493美元,有47份看漲期權,總額5,171,925美元。

Expected Price Movements

預期價格波動

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $300.0 to $535.0 for Meta Platforms during the past quarter.

通過分析這些合同的成交量和持倉量,似乎大戶在過去一季度中一直關注Meta Platforms的股價區間爲300.0美元到535.0美元。

Insights into Volume & Open Interest

成交量和持倉量分析

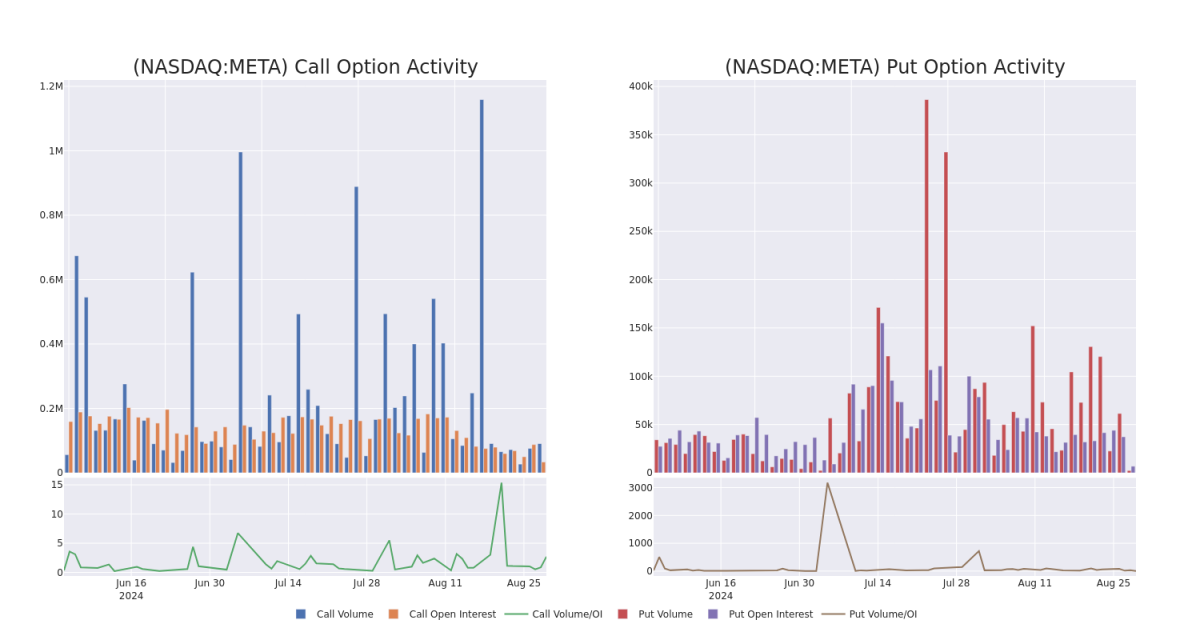

In terms of liquidity and interest, the mean open interest for Meta Platforms options trades today is 2691.0 with a total volume of 92,948.00.

就流動性和利益而言,Meta Platforms期權交易今天的平均持倉量爲2691.0,總成交量爲92,948.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Meta Platforms's big money trades within a strike price range of $300.0 to $535.0 over the last 30 days.

在下圖中,我們能夠追蹤Meta Platforms的看漲和看跌期權在過去30天內在300.0美元到535.0美元的行權價區間內的成交量和持倉量的發展。

Meta Platforms 30-Day Option Volume & Interest Snapshot

Meta平台30天期權成交量和持倉快照

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| META | CALL | SWEEP | NEUTRAL | 08/30/24 | $25.75 | $25.1 | $25.43 | $497.50 | $869.0K | 1.7K | 1.0K |

| META | CALL | SWEEP | NEUTRAL | 08/30/24 | $20.95 | $20.3 | $20.63 | $502.50 | $704.9K | 2.1K | 1.0K |

| META | CALL | SWEEP | BULLISH | 08/30/24 | $3.35 | $3.25 | $3.35 | $525.00 | $280.3K | 3.1K | 1.0K |

| META | CALL | SWEEP | NEUTRAL | 08/30/24 | $21.7 | $20.35 | $21.02 | $505.00 | $241.5K | 2.1K | 146 |

| META | CALL | TRADE | NEUTRAL | 08/30/24 | $21.7 | $21.0 | $21.35 | $505.00 | $196.4K | 2.1K | 638 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| meta platforms | 看漲 | SWEEP | 中立 | 08/30/2024 | $25.75 | $25.1 | NEUTRAL | 08/30/24 | $20.95 | 1.7K | 1.0K |

| meta platforms | 看漲 | SWEEP | 中立 | 08/30/2024 | $20.95 | $20.3 | 1.0K | $502.50 | CALL | 2.1K | 1.0K |

| meta platforms | 看漲 | SWEEP | 看好 | 08/30/2024 | $3.35 | $3.25 | $3.35 | 525.00美元 | $196.4K | 3.1K | 1.0K |

| meta platforms | 看漲 | SWEEP | 中立 | 08/30/2024 | $21.7 | $20.35 | $505.00應翻譯爲$505.00 | $241.5K | 2.1K | 146 | |

| meta platforms | 看漲 | 交易 | 中立 | 08/30/2024 | $21.7 | $21.0 | $21.35 | $505.00應翻譯爲$505.00 | $196.4K | 2.1K | 638 |

About Meta Platforms

關於meta平台

Meta is the world's largest online social network, with nearly 4 billion family of apps monthly active users. Users engage with each other in different ways, exchanging messages and sharing news events, photos, and videos. The firm's ecosystem consists mainly of the Facebook app, Instagram, Messenger, WhatsApp, and many features surrounding these products. Users can access Facebook on mobile devices and desktops. Advertising revenue represents more than 90% of the firm's total revenue, with more than 45% coming from the US and Canada and over 20% from Europe.

Meta是世界上最大的在線社交網絡,擁有近40億月活躍用戶。用戶以不同的方式進行互動,交換消息並分享新聞事件、照片和視頻。該公司的生態系統主要由臉書應用程序、Instagram、Messenger、WhatsApp以及圍繞這些產品的許多功能組成。用戶可以在移動設備和臺式機上使用Facebook。廣告收入佔公司總收入的90%以上,其中超過45%來自美國和加拿大,超過20%來自歐洲。

In light of the recent options history for Meta Platforms, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Meta Platforms

Meta Platforms的現有市場地位

- Currently trading with a volume of 1,207,189, the META's price is up by 1.25%, now at $523.22.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 55 days.

- RSI讀數表明該股目前可能接近超買水平。

- 預計的盈利發佈時間爲55天后。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Meta Platforms with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略性的交易調整、利用各種指標以及保持對市場動態的關注來減輕這些風險。通過Benzinga Pro獲取Meta平台的最新期權交易,以獲得實時警報。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $300.0 to $535.0 for Meta Platforms during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $300.0 to $535.0 for Meta Platforms during the past quarter.