Altria Group Unusual Options Activity

Altria Group Unusual Options Activity

Investors with a lot of money to spend have taken a bullish stance on Altria Group (NYSE:MO).

有大量資金可以花的投資者對奧馳亞集團(紐約證券交易所代碼:MO)採取了看漲立場。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

今天,當我們在本辛加追蹤的公開期權歷史記錄中出現頭寸時,我們注意到了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MO, it often means somebody knows something is about to happen.

無論這些是機構還是僅僅是富人,我們都不知道。但是,當密蘇里州發生這麼大的事情時,通常意味着有人知道某件事即將發生。

Today, Benzinga's options scanner spotted 8 options trades for Altria Group.

今天,Benzinga的期權掃描儀發現了奧馳亞集團的8筆期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 75% bullish and 25%, bearish.

這些大筆交易者的整體情緒分爲75%的看漲和25%的看跌。

Out of all of the options we uncovered, there was 1 put, for a total amount of $85,840, and 7, calls, for a total amount of $1,036,992.

在我們發現的所有期權中,有1份看跌期權,總額爲85,840美元,還有7份看漲期權,總額爲1,036,992美元。

Predicted Price Range

預測的價格區間

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $40.0 to $57.5 for Altria Group during the past quarter.

分析這些合約的交易量和未平倉合約,看來大型企業一直在關注奧馳亞集團在過去一個季度的價格範圍從40.0美元到57.5美元不等。

Volume & Open Interest Development

交易量和未平倉合約的發展

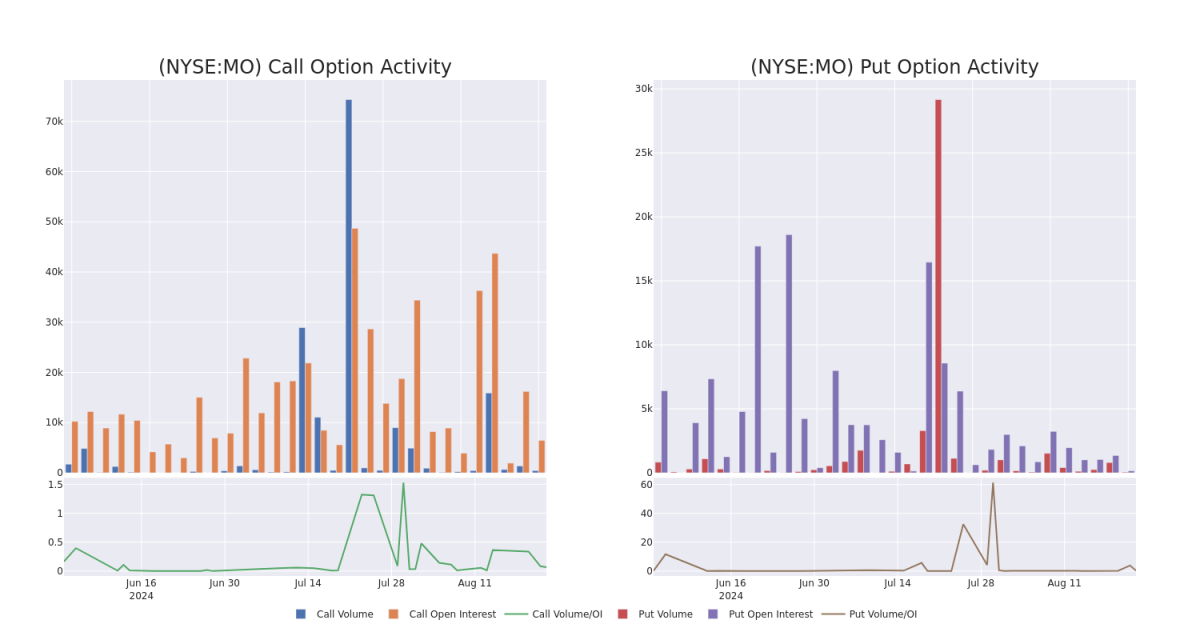

In terms of liquidity and interest, the mean open interest for Altria Group options trades today is 3401.25 with a total volume of 3,158.00.

就流動性和利息而言,今天奧馳亞集團期權交易的平均未平倉合約爲3401.25,總交易量爲3,158.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Altria Group's big money trades within a strike price range of $40.0 to $57.5 over the last 30 days.

在下圖中,我們可以跟蹤過去30天在40.0美元至57.5美元的行使價區間內,奧馳亞集團大額資金交易的看漲期權和未平倉合約的發展情況。

Altria Group Option Activity Analysis: Last 30 Days

奧馳亞集團期權活動分析:過去 30 天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MO | CALL | SWEEP | BULLISH | 06/20/25 | $13.35 | $13.25 | $13.35 | $40.00 | $385.8K | 2.2K | 290 |

| MO | CALL | SWEEP | BULLISH | 06/20/25 | $13.3 | $13.2 | $13.3 | $40.00 | $339.1K | 2.2K | 301 |

| MO | CALL | SWEEP | BULLISH | 06/20/25 | $13.3 | $13.2 | $13.3 | $40.00 | $164.9K | 2.2K | 726 |

| MO | PUT | TRADE | BEARISH | 01/17/25 | $6.0 | $5.5 | $5.8 | $57.50 | $85.8K | 372 | 0 |

| MO | CALL | SWEEP | BULLISH | 06/20/25 | $13.3 | $13.2 | $13.3 | $40.00 | $59.8K | 2.2K | 601 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MO | 打電話 | 掃 | 看漲 | 06/20/25 | 13.35 美元 | 13.25 美元 | 13.35 美元 | 40.00 美元 | 385.8 萬美元 | 2.2K | 290 |

| MO | 打電話 | 掃 | 看漲 | 06/20/25 | 13.3 美元 | 13.2 美元 | 13.3 美元 | 40.00 美元 | 339.1 萬美元 | 2.2K | 301 |

| MO | 打電話 | 掃 | 看漲 | 06/20/25 | 13.3 美元 | 13.2 美元 | 13.3 美元 | 40.00 美元 | 164.9 萬美元 | 2.2K | 726 |

| MO | 放 | 貿易 | 粗魯的 | 01/17/25 | 6.0 美元 | 5.5 美元 | 5.8 美元 | 57.50 美元 | 85.8 萬美元 | 372 | 0 |

| MO | 打電話 | 掃 | 看漲 | 06/20/25 | 13.3 美元 | 13.2 美元 | 13.3 美元 | 40.00 美元 | 59.8 萬美元 | 2.2K | 601 |

About Altria Group

關於奧馳亞集團

Altria comprises Philip Morris USA, US Smokeless Tobacco, John Middleton, Horizon Innovations, and Helix Innovations. Through its tobacco subsidiaries, Altria maintains the leading position in cigarettes and smokeless tobacco in the United States and the number-two spot in machine-made cigars. The company's Marlboro brand is the leading cigarette brand in the US with 42% annual share in 2023. Beyond its core business, it holds an 8% interest in the world's largest brewer, Anheuser-Busch InBev, a 42% stake in cannabis manufacturer Cronos, acquired Njoy Holdings in 2023, and operates a joint venture with Japan Tobacco in the heated tobacco category. It also recently disposed of its investment in Juul Labs.

奧馳亞包括美國菲利普·莫里斯、美國無煙菸草公司、約翰·米德爾頓、地平線創新和Helix Innovations。通過其菸草子公司,奧馳亞在美國香菸和無煙菸草領域保持領先地位,在機制雪茄中排名第二。該公司的萬寶路品牌是美國領先的捲菸品牌,2023年年份額爲42%。除了核心業務外,它還持有全球最大的啤酒生產商安海斯-布希英博8%的權益,持有大麻製造商克羅諾斯42%的股份,於2023年收購了Njoy Holdings,並與日本菸草公司在加熱菸草類別經營合資企業。它最近還出售了對Juul Labs的投資。

Where Is Altria Group Standing Right Now?

奧馳亞集團現在的立場在哪裏?

- Currently trading with a volume of 883,490, the MO's price is up by 0.24%, now at $53.35.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 56 days.

- 密蘇里州目前的交易量爲883,490美元,價格上漲了0.24%,目前爲53.35美元。

- RSI讀數表明該股目前可能處於超買狀態。

- 預計業績將在56天后發佈。

Professional Analyst Ratings for Altria Group

奧馳亞集團的專業分析師評級

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $48.5.

在過去的30天中,共有2位專業分析師對該股發表了看法,將平均目標股價設定爲48.5美元。

- Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on Altria Group with a target price of $54.

- Maintaining their stance, an analyst from Barclays continues to hold a Underweight rating for Altria Group, targeting a price of $43.

- Stifel的一位分析師在評估中保持了對奧馳亞集團的買入評級,目標價爲54美元。

- 巴克萊銀行的一位分析師保持立場,繼續對奧馳亞集團持有減持評級,目標股價爲43美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。