Oracle Unusual Options Activity

Oracle Unusual Options Activity

Deep-pocketed investors have adopted a bearish approach towards Oracle (NYSE:ORCL), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ORCL usually suggests something big is about to happen.

有雄厚財力的投資者對甲骨文(紐交所:ORCL)採取了看淡的態度,這是市場參與者不應忽視的事情。我們在Benzinga對公開期權記錄的追蹤揭示了這一重大舉動。雖然這些投資者的身份仍然是個迷,但是這樣一個大規模的操作通常意味着有重大的事情即將發生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for Oracle. This level of activity is out of the ordinary.

我們從觀察中獲得了這一信息,當Benzinga的期權掃描器突出了Oracle的13項非凡期權活動時。這種活動水平超出了常規範疇。

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 61% bearish. Among these notable options, 6 are puts, totaling $320,495, and 7 are calls, amounting to $354,071.

這些重量級投資者的整體情緒分爲兩派,30%看好,61%看淡。在這些顯著的期權交易中,有6個看跌期權,總計$320,495,有7個看漲期權,總計$354,071。

What's The Price Target?

目標價是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $120.0 to $145.0 for Oracle during the past quarter.

分析這些合約的成交量和持倉量,看起來大戶在過去的一個季度裏一直關注甲骨文的股價區間是$120.0到$145.0。

Volume & Open Interest Trends

成交量和未平倉量趨勢

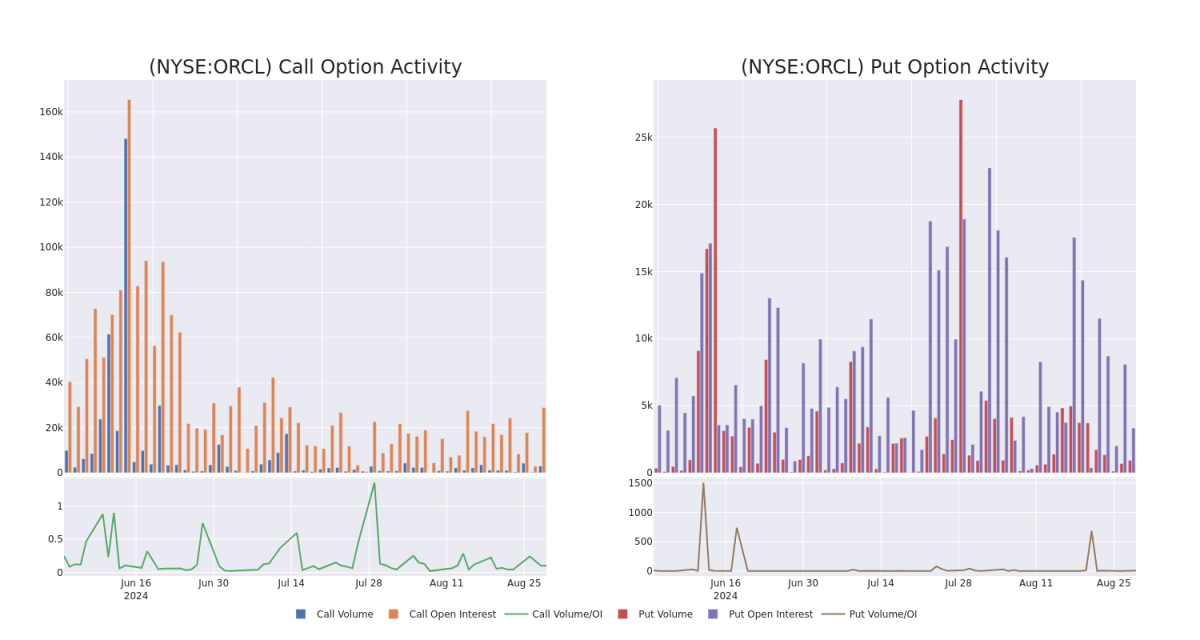

In today's trading context, the average open interest for options of Oracle stands at 3231.0, with a total volume reaching 3,910.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Oracle, situated within the strike price corridor from $120.0 to $145.0, throughout the last 30 days.

在今天的交易情境中,甲骨文期權的平均持倉量爲3231.0,總成交量達到3,910.00。下面的圖表描述了過去30天內甲骨文高價值交易中看漲和看跌期權的成交量和持倉量的變化情況,這些交易位於$120.0到$145.0的行權價區間內。

Oracle Call and Put Volume: 30-Day Overview

Oracle看漲期權和看跌期權成交量:30天概覽

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | PUT | SWEEP | BEARISH | 09/13/24 | $6.45 | $6.35 | $6.4 | $142.00 | $83.2K | 30 | 5 |

| ORCL | CALL | SWEEP | NEUTRAL | 08/30/24 | $1.41 | $1.35 | $1.42 | $140.00 | $80.1K | 3.8K | 1.8K |

| ORCL | PUT | SWEEP | BEARISH | 01/17/25 | $7.55 | $7.5 | $7.55 | $135.00 | $70.9K | 1.4K | 97 |

| ORCL | CALL | SWEEP | BEARISH | 08/30/24 | $1.9 | $1.81 | $1.81 | $140.00 | $60.8K | 3.8K | 869 |

| ORCL | CALL | TRADE | BULLISH | 09/20/24 | $9.5 | $8.1 | $9.43 | $135.00 | $58.4K | 6.5K | 12 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | 看跌 | SWEEP | 看淡 | 09/13/24 | $6.45 | $ 6.35 | 6.4美元 | $142.00 | $83.2K | 30 | 5 |

| ORCL | 看漲 | SWEEP | 中立 | 08/30/2024 | $1.41 | $1.35 | $1.42 | $140.00 | $80.1K | 3.8K | 1.8K |

| ORCL | 看跌 | SWEEP | 看淡 | 01/17/25 | $7.55 | $7.5 | $7.55 | $135.00 | $70.9千 | 1.4千 | 97 |

| ORCL | 看漲 | SWEEP | 看淡 | 08/30/2024 | $1.9 | $1.81 | $1.81 | $140.00 | $60.8K | 3.8K | 869 |

| ORCL | 看漲 | 交易 | 看好 | 09/20/24 | $9.5 | $8.1 | $9.43 | $135.00 | 58.4K美元 | 6.5K | 12 |

About Oracle

關於Oracle

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has 430,000 customers in 175 countries, supported by its base of 136,000 employees.

Oracle向全球企業提供數據庫技術和企業資源規劃(ERP)軟件。Oracle成立於1977年,是第一個商用SQL數據庫管理系統的創始人。如今,Oracle在175個國家擁有430,000個客戶,由136,000名員工支持。

Having examined the options trading patterns of Oracle, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Oracle's Current Market Status

Oracle當前的市場狀況

- Trading volume stands at 1,299,549, with ORCL's price up by 1.82%, positioned at $140.39.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 11 days.

- RSI指標顯示該股票可能接近超買。

- 預計在11天內公佈收益報告。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $120.0 to $145.0 for Oracle during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $120.0 to $145.0 for Oracle during the past quarter.