Looking At Broadcom's Recent Unusual Options Activity

Looking At Broadcom's Recent Unusual Options Activity

Financial giants have made a conspicuous bullish move on Broadcom. Our analysis of options history for Broadcom (NASDAQ:AVGO) revealed 65 unusual trades.

金融巨頭在博通股票上採取了明顯的看好舉動。我們對博通(納斯達克: AVGO)的期權歷史進行了分析,發現了65次非常規交易。

Delving into the details, we found 47% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $597,225, and 55 were calls, valued at $3,809,452.

深入研究細節,我們發現47%的交易者看好,而30%的交易者看淡。在我們發現的所有交易中,有10次看跌期權,價值597,225美元,也有55次看漲期權,價值3,809,452美元。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $235.0 for Broadcom, spanning the last three months.

在評估交易量和持倉量後,很明顯市場的主要推動者將注意力集中在博通的股價區間爲$50.0到$235.0之間的範圍內,跨越過去三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

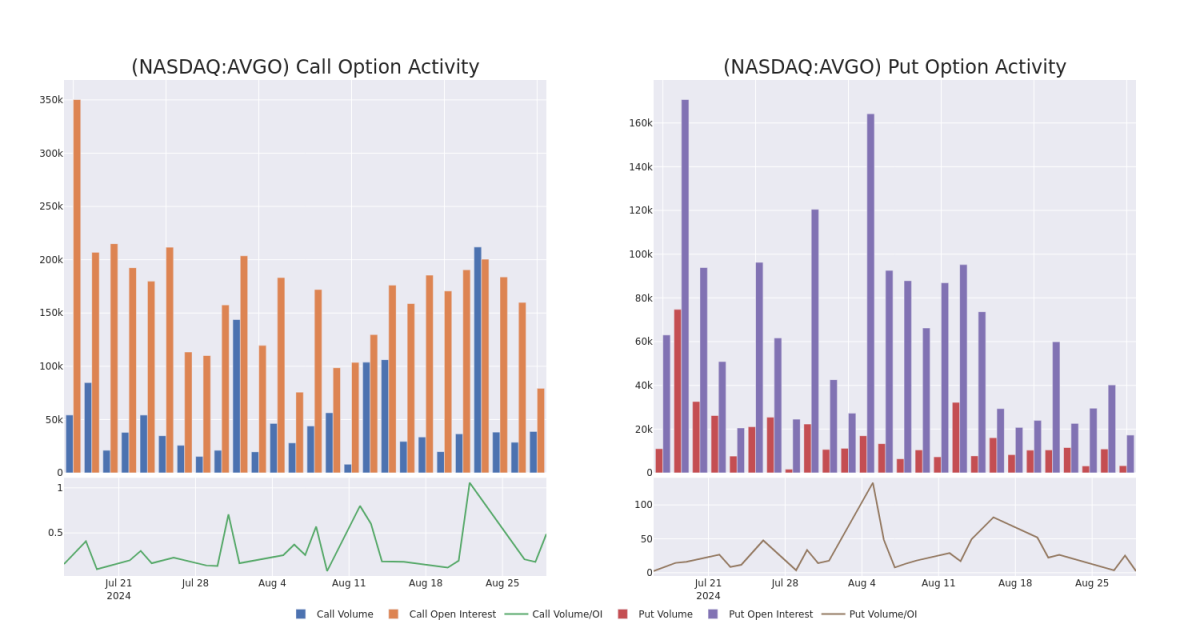

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Broadcom's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Broadcom's significant trades, within a strike price range of $50.0 to $235.0, over the past month.

通過對成交量和持倉量的觀察,對股票研究提供了重要的見解。這些信息在判斷博通期權在特定行使價格上的流動性和興趣水平方面至關重要。下面,我們展示了過去一個月內,在$50.0到$235.0的行使價格範圍內博通重要交易中看漲期權和看跌期權的成交量和持倉量趨勢的快照。

Broadcom 30-Day Option Volume & Interest Snapshot

博通30天期權成交量和持倉量快照

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AVGO | CALL | SWEEP | BULLISH | 08/30/24 | $1.2 | $1.15 | $1.2 | $163.00 | $583.4K | 1.4K | 5.8K |

| AVGO | CALL | SWEEP | BEARISH | 11/15/24 | $8.1 | $7.9 | $7.9 | $175.00 | $335.3K | 2.1K | 1.0K |

| AVGO | PUT | SWEEP | NEUTRAL | 10/18/24 | $12.7 | $12.4 | $12.5 | $165.00 | $251.4K | 569 | 263 |

| AVGO | CALL | TRADE | BULLISH | 01/16/26 | $113.0 | $111.3 | $112.5 | $50.00 | $225.0K | 130 | 20 |

| AVGO | CALL | SWEEP | BULLISH | 11/15/24 | $8.0 | $7.9 | $8.0 | $175.00 | $217.9K | 2.1K | 272 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 博通 | 看漲 | SWEEP | 看好 | 08/30/2024 | $1.2 | $1.15 | $1.2 | $163.00 | Current RSI values indicate that the stock is may be approaching overbought. | 1.4千 | 5.8K |

| 博通 | 看漲 | SWEEP | 看淡 | 11/15/24 | $8.1 | $7.9 | $7.9 | $175.00 | WDAY | 2.1K | 1.0K |

| 博通 | 看跌 | SWEEP | 中立 | 10/18/24 | $12.7 | $12.4 | $12.5 | 165.00美元 | RSI indicators hint that the underlying stock may be overbought. | 569 | 263 |

| 博通 | 看漲 | 交易 | 看好 | 01/16/26 | 113.0 | 我們第二季度向投資者支付了1.113億美元的分紅派息。 | $50.00 | $225.0K | 130 | 20 | |

| 博通 | 看漲 | SWEEP | 看好 | 11/15/24 | $8.0 | $7.9 | $8.0 | $175.00 | $217.9K | 2.1K | 272 |

About Broadcom

關於博通

Broadcom is the sixth-largest semiconductor company globally and has expanded into various software businesses, with over $30 billion in annual revenue. It sells 17 core semiconductor product lines across wireless, networking, broadband, storage, and industrial markets. It is primarily a fabless designer but holds some manufacturing in-house, like for its best-of-breed FBAR filters that sell into the Apple iPhone. In software, it sells virtualization, infrastructure, and security software to large enterprises, financial institutions, and governments.Broadcom is the product of consolidation. Its businesses are an amalgamation of former companies like legacy Broadcom and Avago Technologies in chips, as well as Brocade, CA Technologies, and Symantec in software.

博通是全球第六大半導體公司,已擴展到各種軟件業務,年收入超過300億美元。它在無線、網絡、寬帶、存儲和工業市場銷售17個核心半導體產品系列。它主要是一家半導體設計公司,但擁有一些內部製造能力,例如爲蘋果iPhone銷售的最佳FBAR濾波器。在軟件方面,它向大型企業、金融機構和政府銷售虛擬化、基礎設施和安全軟件。博通是合併的產物。其業務是由之前的公司如傳統的博通和芯訊科技以及Brocade、CA技術和賽門鐵克在軟件方面的業務組成的。

After a thorough review of the options trading surrounding Broadcom, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Broadcom Standing Right Now?

博通現在處於什麼位置?

- With a trading volume of 7,396,047, the price of AVGO is up by 2.12%, reaching $161.54.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 7 days from now.

- 當前RSI值表明該股票可能接近超買狀態。

- 下一個收益報告計劃在7天后發佈。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Broadcom with Benzinga Pro for real-time alerts.

期權交易涉及更大的風險,但也可能帶來更高的利潤。精明的交易員通過持續教育、戰略性的交易調整、利用各種因子和保持對市場動態的關注來減輕這些風險。通過Benzinga Pro實時警報了解博通的最新期權交易。