American Express's Options Frenzy: What You Need to Know

American Express's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bullish stance on American Express.

有很多錢可以花的鯨魚在美國運通上採取了明顯的看漲態度。

Looking at options history for American Express (NYSE:AXP) we detected 24 trades.

從美國運通(紐交所:AXP)的期權交易歷史數據來看,我們發現了24筆交易。

If we consider the specifics of each trade, it is accurate to state that 58% of the investors opened trades with bullish expectations and 33% with bearish.

如果我們考慮每一個交易的具體情況,準確地說,58%的投資者開設了看好期權,33%的投資者開設了看跌期權。

From the overall spotted trades, 5 are puts, for a total amount of $261,030 and 19, calls, for a total amount of $4,508,729.

從總交易中,有5筆爲看跌期權,總金額爲261,030美元;19筆爲看漲期權,總金額爲4,508,729美元。

What's The Price Target?

目標價是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $240.0 to $320.0 for American Express during the past quarter.

分析這些合約的成交量和未平倉頭寸,似乎大戶在過去的季度裏一直密切關注美國運通股價在240.0美元至320.0美元的價格區間內的動向。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

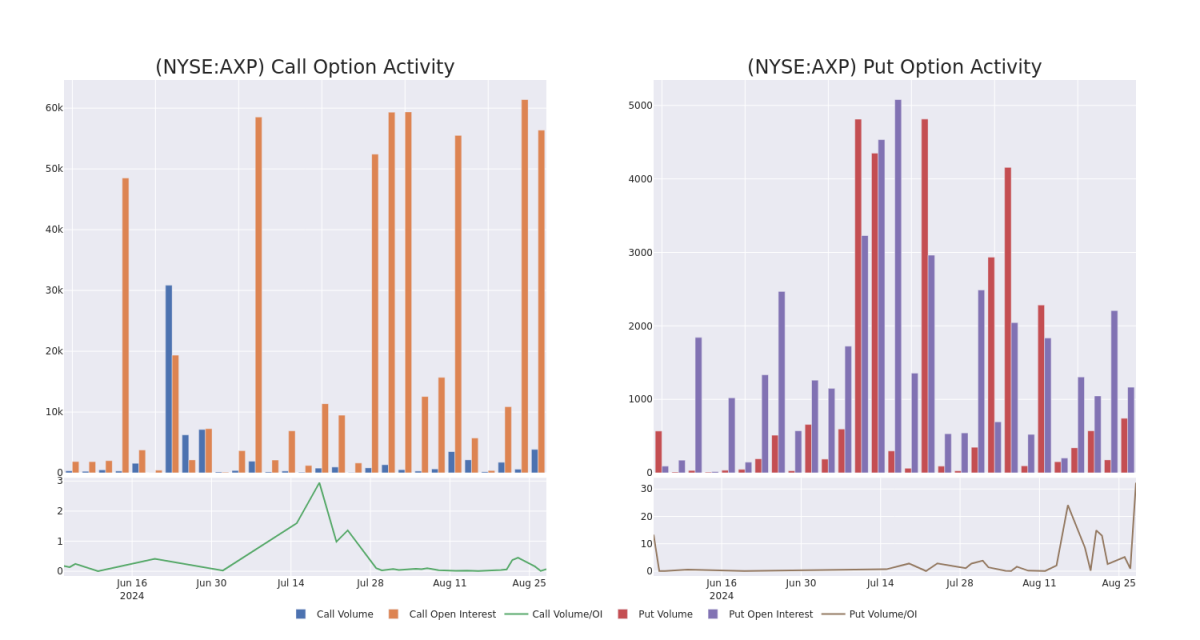

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for American Express's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across American Express's significant trades, within a strike price range of $240.0 to $320.0, over the past month.

分析成交量和未平倉頭寸爲股票研究提供了重要的見解。這些信息對於評估美國運通期權在特定行權價的流動性和利益水平至關重要。下面,我們提供了過去一個月內美國運通重要交易的看漲和看跌期權在240.0美元至320.0美元行權價範圍內的成交量和未平倉頭寸的趨勢快照。

American Express Call and Put Volume: 30-Day Overview

美國運通看漲和看跌期權的成交量:30天總覽

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AXP | CALL | TRADE | BULLISH | 01/16/26 | $15.1 | $14.4 | $15.0 | $320.00 | $2.3M | 46.5K | 1.7K |

| AXP | CALL | TRADE | NEUTRAL | 01/16/26 | $32.95 | $32.05 | $32.5 | $270.00 | $487.5K | 136 | 150 |

| AXP | CALL | TRADE | BEARISH | 01/16/26 | $38.45 | $36.5 | $37.05 | $260.00 | $222.3K | 1.7K | 60 |

| AXP | CALL | SWEEP | BEARISH | 03/21/25 | $10.45 | $10.25 | $10.45 | $290.00 | $158.8K | 384 | 160 |

| AXP | CALL | SWEEP | BULLISH | 01/16/26 | $15.0 | $14.65 | $15.0 | $320.00 | $135.0K | 46.5K | 1.8K |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AXP | 看漲 | 交易 | 看好 | 01/16/26 | $15.1 | 14.4美元 | $15.0 | $320.00 | $2.3M | 46.5千 | 1.7K |

| AXP | 看漲 | 交易 | 中立 | 01/16/26 | $32.95 | $32.05 | $32.5 | $270.00 | $487.5K | 136 | 150 |

| AXP | 看漲 | 交易 | 看淡 | 01/16/26 | $38.45 | $36.5 | $37.05 | $260.00 | 1.7K | 60 | |

| AXP | 看漲 | SWEEP | 看淡 | 03/21/25 | $10.45 | $10.25 | $10.45 | $290.00 | 384 | 160 | |

| AXP | 看漲 | SWEEP | 看好 | 01/16/26 | $15.0 | $14.65 | $15.0 | $320.00 | $135.0K | 46.5千 | 1.8K |

About American Express

關於美國運通

American Express is a global financial institution, operating in about 130 countries, that provides consumers and businesses charge and credit card payment products. The company also operates a highly profitable merchant payment network. Since 2018, it has operated in three segments: global consumer services, global commercial services, and global merchant and network services. In addition to payment products, the company's commercial business offers expense management tools, consulting services, and business loans.

美國運通是一家全球性的金融機構,業務遍及約130個國家,提供針對消費者和企業的信用和借記卡支付產品,並運營高度盈利的商戶支付網絡。自2018年以來,它一直在三個業務領域運營:全球消費者服務、全球商業服務和全球商戶和網絡服務。除支付產品外,該公司的商業業務還提供費用管理工具、諮詢服務和商業貸款。

After a thorough review of the options trading surrounding American Express, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在深入研究美國運通期權交易後,我們繼續對該公司進行更詳細的審查,包括評估其當前的市場地位和表現。

Where Is American Express Standing Right Now?

美國運通現在處於什麼位置?交易量爲1182884股,而AXP的股價上漲了0.34%,位於225.29美元。

- Trading volume stands at 995,428, with AXP's price up by 1.41%, positioned at $260.71.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 50 days.

- RSI指標顯示該股票可能接近超買。

- 盈利公告預計在50天內公佈。

What The Experts Say On American Express

關於美國運通的專家意見

1 market experts have recently issued ratings for this stock, with a consensus target price of $263.0.

- An analyst from B of A Securities downgraded its action to Neutral with a price target of $263.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest American Express options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。精明的交易者通過不斷學習,調整策略,監測多個因子並密切關注市場動態來管理這些風險。通過Benzinga Pro的實時警報了解最新的美國運通期權交易信息。

From the overall spotted trades, 5 are puts, for a total amount of $261,030 and 19, calls, for a total amount of $4,508,729.

From the overall spotted trades, 5 are puts, for a total amount of $261,030 and 19, calls, for a total amount of $4,508,729.