Zscaler Unusual Options Activity For August 29

Zscaler Unusual Options Activity For August 29

Deep-pocketed investors have adopted a bullish approach towards Zscaler (NASDAQ:ZS), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ZS usually suggests something big is about to happen.

資深投資者對Zscaler (納斯達克:zscaler) 採取了看好的態度,市場玩家不應忽視這一點。我們在Benzinga公開期權記錄中追蹤到了這一重大舉措。這些投資者的身份仍然是未知的,但這種對ZS的重大舉措通常意味着即將發生一些大事。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for Zscaler. This level of activity is out of the ordinary.

今天,我們從觀察中獲得了這些信息。當Benzinga的期權掃描儀突出顯示Zscaler的9個非同尋常期權活動時,這種活躍水平是不同尋常的。

The general mood among these heavyweight investors is divided, with 44% leaning bullish and 33% bearish. Among these notable options, 3 are puts, totaling $96,752, and 6 are calls, amounting to $296,168.

這些大宗投資者的整體情緒存在分歧,有44%傾向看漲,33%看跌。在這些顯著的期權中,有3個看跌,總額爲96,752美元,有6個看漲,總額爲296,168美元。

Expected Price Movements

預期價格波動

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $177.5 and $290.0 for Zscaler, spanning the last three months.

在評估了成交量和未平倉合約之後,顯而易見,主要的市場推動者將重點放在Zscaler的價格區間在177.5美元和290.0美元之間,跨越了過去三個月。

Volume & Open Interest Trends

成交量和未平倉量趨勢

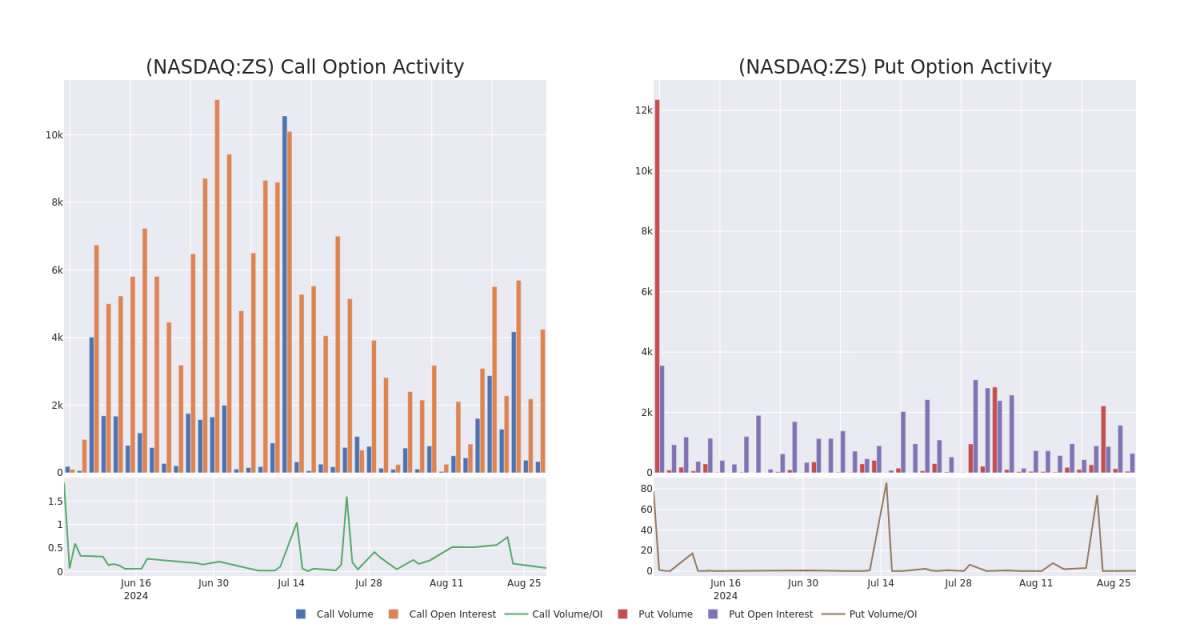

In terms of liquidity and interest, the mean open interest for Zscaler options trades today is 542.78 with a total volume of 384.00.

在流動性和興趣方面,Zscaler期權今日的平均未平倉合約爲542.78,總成交量爲384.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Zscaler's big money trades within a strike price range of $177.5 to $290.0 over the last 30 days.

在下面的圖表中,我們可以跟蹤Zscaler股票大手交易的成交量和未平倉合約的發展,範圍在177.5美元到290.0美元之間,涵蓋過去30天。

Zscaler Option Activity Analysis: Last 30 Days

Zscaler期權活動分析:最近30天

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ZS | CALL | TRADE | BULLISH | 09/20/24 | $10.0 | $9.8 | $10.0 | $207.50 | $96.0K | 205 | 100 |

| ZS | CALL | TRADE | NEUTRAL | 09/20/24 | $16.35 | $15.65 | $15.95 | $195.00 | $47.8K | 1.1K | 3 |

| ZS | CALL | SWEEP | BULLISH | 01/17/25 | $2.99 | $2.84 | $2.99 | $290.00 | $45.4K | 358 | 152 |

| ZS | CALL | TRADE | NEUTRAL | 06/20/25 | $40.7 | $39.45 | $40.0 | $190.00 | $40.0K | 55 | 10 |

| ZS | PUT | SWEEP | BULLISH | 12/20/24 | $20.0 | $19.65 | $19.65 | $200.00 | $39.3K | 250 | 20 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ZS | 看漲 | 交易 | 看好 | 09/20/24 | $10.0 | $9.8 | $10.0 | $207.50 | $96.0K | 205 | 100 |

| ZS | 看漲 | 交易 | 中立 | 09/20/24 | $16.35 | $15.65 | $15.95 | $195.00 | $47.8K | 1.1千 | 3 |

| ZS | 看漲 | SWEEP | 看好 | 01/17/25 | $2.99 | $2.84 | $2.99 | $290.00 | $45.4K | 358 | 152 |

| ZS | 看漲 | 交易 | 中立 | 06/20/25 | $40.7 | $39.45 | $40.0 | $190.00 | $40.0千美元 | 55 | 10 |

| ZS | 看跌 | SWEEP | 看好 | 12/20/24 | $20.0 | $19.65 | $19.65 | 。 | $39.3K | 250 | 20 |

About Zscaler

關於Zscaler

Zscaler is a software-as-a-service, or SaaS, firm focusing on providing cloud-native cybersecurity solutions to primarily enterprise customers. Zscaler's offerings can be broadly partitioned into Zscaler Internet Access, which provides secure access to external applications, and Zscaler Private Access, which provides secure access to internal applications. The firm is headquartered in San Jose, California, and went public in 2018.

Zscaler是一家軟件即服務公司,專注於爲主要面向企業客戶提供基於雲計算的網絡安全解決方案。Zscaler的產品可大致分爲Zscaler互聯網訪問(Zscaler Internet Access)和Zscaler私有訪問(Zscaler Private Access)兩類,分別提供對外部應用程序和內部應用程序的安全訪問。該公司總部位於加利福尼亞州聖何塞,並於2018年上市。

Following our analysis of the options activities associated with Zscaler, we pivot to a closer look at the company's own performance.

在分析與Zscaler相關的期權交易活動後,我們轉而更近地審視該公司的業績。

Current Position of Zscaler

Zscaler的當前情況

- Trading volume stands at 608,492, with ZS's price up by 2.6%, positioned at $199.02.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 5 days.

- RSI指標顯示該股票可能接近超買。

- 預計5天內將公佈業績報告。

What The Experts Say On Zscaler

專家對Zscaler的看法

3 market experts have recently issued ratings for this stock, with a consensus target price of $215.0.

- An analyst from Morgan Stanley persists with their Equal-Weight rating on Zscaler, maintaining a target price of $215.

- An analyst from Cantor Fitzgerald downgraded its action to Neutral with a price target of $200.

- Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Zscaler with a target price of $230.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $177.5 and $290.0 for Zscaler, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $177.5 and $290.0 for Zscaler, spanning the last three months.