Decoding Blackstone's Options Activity: What's the Big Picture?

Decoding Blackstone's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bearish move on Blackstone. Our analysis of options history for Blackstone (NYSE:BX) revealed 8 unusual trades.

金融巨頭對黑石(紐交所:BX)採取了明顯的看淡舉動。我們對黑石期權歷史進行的分析發現了8次非常規交易。

Delving into the details, we found 12% of traders were bullish, while 75% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $267,400, and 2 were calls, valued at $71,760.

深入了解細節,我們發現12%的交易者看漲,而75%的交易者顯示出看淡傾向。我們發現的交易中,有6筆爲看跌期權,價值爲267,400美元,而有2筆爲看漲期權,價值爲71,760美元。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $130.0 to $145.0 for Blackstone over the last 3 months.

考慮到這些合約的成交量和持倉量,黑石過去3個月的股價區間似乎是從130.0美元到145.0美元。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

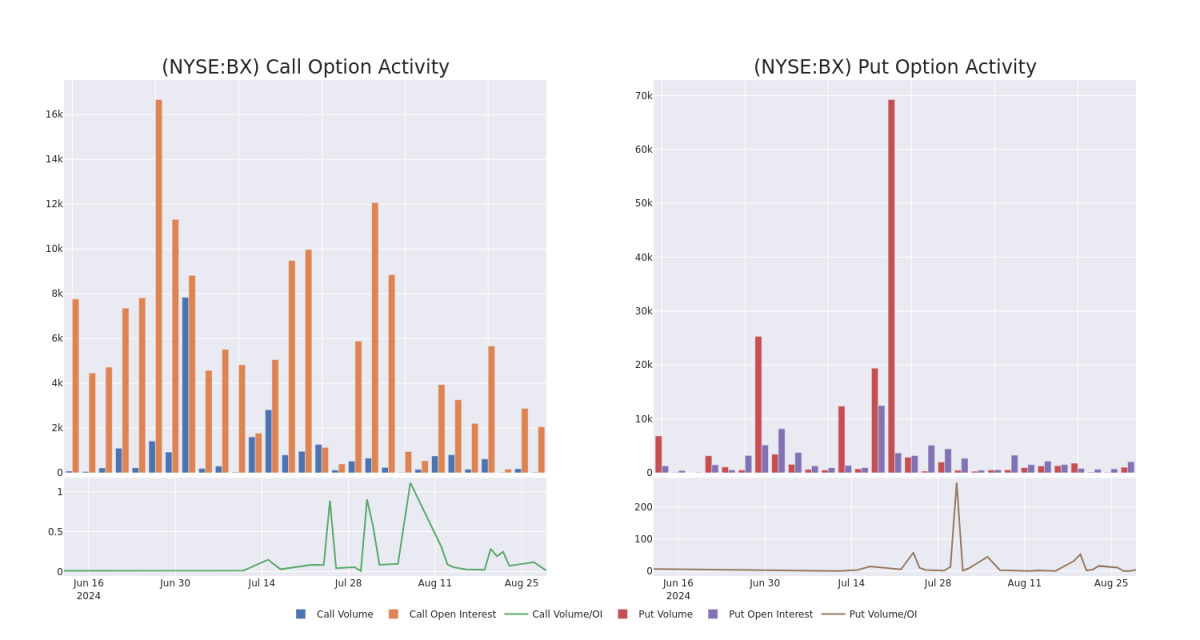

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Blackstone's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Blackstone's whale trades within a strike price range from $130.0 to $145.0 in the last 30 days.

在交易期權時,觀察成交量和持倉量是一種強有力的策略。這些數據可以幫助您追蹤特定行權價格的黑石期權的流動性和興趣。下面,我們可以觀察到在過去30天內,在130.0美元到145.0美元行權價格範圍內,看漲和看跌期權的成交量和持倉量的變化情況,這是所有黑石大宗交易的數據。

Blackstone Option Activity Analysis: Last 30 Days

Blackstone期權活動分析:最近30天

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BX | PUT | TRADE | BEARISH | 06/20/25 | $9.95 | $8.65 | $9.55 | $130.00 | $47.7K | 264 | 201 |

| BX | PUT | TRADE | BEARISH | 06/20/25 | $9.75 | $8.75 | $9.5 | $130.00 | $47.5K | 264 | 392 |

| BX | PUT | TRADE | BULLISH | 06/20/25 | $9.8 | $9.55 | $9.6 | $130.00 | $46.0K | 264 | 101 |

| BX | PUT | SWEEP | BEARISH | 12/20/24 | $8.7 | $8.55 | $8.7 | $140.00 | $45.2K | 1.7K | 52 |

| BX | PUT | SWEEP | BEARISH | 12/20/24 | $8.75 | $8.5 | $8.7 | $140.00 | $42.6K | 1.7K | 101 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BX | 看跌 | 交易 | 看淡 | 06/20/25 | $9.95 | $ 8.65 | $9.55 | $130.00 | $47.7K | 264 | 201 |

| BX | 看跌 | 交易 | 看淡 | 06/20/25 | $9.75 | $8.75 | $9.5 | $130.00 | $47.5K | 264 | 392 |

| BX | 看跌 | 交易 | 看好 | 06/20/25 | $9.8 | $9.55 | 9.6 | $130.00 | $46.0K | 264 | 101 |

| BX | 看跌 | SWEEP | 看淡 | 12/20/24 | $8.7 | $8.55 | $8.7 | $140.00 | $45.2千 | 1.7K | 52 |

| BX | 看跌 | SWEEP | 看淡 | 12/20/24 | $8.75 | $8.5 | $8.7 | $140.00 | $42.6K | 1.7K | 101 |

About Blackstone

關於M&T Realty Capital Corporation() M&T Realty Capital Corporation()是M&T銀行的全資子公司,M&T銀行是M&T銀行公司的主要銀行子公司,該公司是美國前15家基於商業銀行控股公司的公司之一。M&T Realty Capital Corporation專門爲全國的多戶型物業、商業出租物業和醫療保健設施提供有競爭力的融資。M&T Realty Capital Corporation是一家完全獲得認可的Fannie Mae DUS貸方,是一家獲得Freddie Mac Optigo貸方認證的公司,是一家獲得FHA/HUD MAP和LEAN貸方認證的公司,也通過通訊關係提供人壽保險公司和CMBS融資。

Blackstone is the world's largest alternative-asset manager with $1.076 trillion in total asset under management, including $808.7 billion in fee-earning assets under management, at the end of June 2024. The company has four core business segments: private equity (25% of fee-earning AUM and 28% of base management fees), real estate (37% and 42%), credit and insurance (29% and 23%), and multi-asset investing (9% and 7%). While the firm primarily serves institutional investors (87% of AUM), it also caters to clients in the high-net-worth channel (13%). Blackstone operates through 25 offices in the Americas (8), Europe and the Middle East (9), and the Asia-Pacific region (8).

In light of the recent options history for Blackstone, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Blackstone

- Currently trading with a volume of 1,353,442, the BX's price is up by 0.07%, now at $140.18.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 49 days.

- RSI讀數表明該股目前可能接近超買水平。

- 預計還有49天就要發佈收益報告了。

What The Experts Say On Blackstone

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $140.0.

- An analyst from Redburn Atlantic downgraded its action to Neutral with a price target of $134.

- An analyst from Deutsche Bank has decided to maintain their Buy rating on Blackstone, which currently sits at a price target of $146.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Blackstone's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Blackstone's whale trades within a strike price range from $130.0 to $145.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Blackstone's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Blackstone's whale trades within a strike price range from $130.0 to $145.0 in the last 30 days.