AbbVie Options Trading: A Deep Dive Into Market Sentiment

AbbVie Options Trading: A Deep Dive Into Market Sentiment

Deep-pocketed investors have adopted a bearish approach towards AbbVie (NYSE:ABBV), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ABBV usually suggests something big is about to happen.

有錢的投資者對艾伯維公司(紐交所:ABBV)採取了看淡的態度,這是市場參與者不應該忽視的事情。我們在彭博社公開期權記錄中的追蹤發現了這一重大動作。這些投資者的身份還不爲人所知,但ABBV的這樣一次重大動作通常意味着即將發生重大變化。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for AbbVie. This level of activity is out of the ordinary.

當Benzinga的期權掃描儀突顯了ABBV股票的9項異常期權活動時,我們發現了這個信息。這種水平的活動是不尋常的。

The general mood among these heavyweight investors is divided, with 22% leaning bullish and 66% bearish. Among these notable options, 6 are puts, totaling $245,058, and 3 are calls, amounting to $384,516.

這些重量級投資者的整體情緒是分歧的,22%看好,66%看淡。在這些顯著的期權中,有6個看跌期權,總值245,058美元,有3個看漲期權,總值384,516美元。

What's The Price Target?

目標價是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $155.0 and $210.0 for AbbVie, spanning the last three months.

在評估交易量和未平倉量後,很明顯,主要市場操縱者的關注點是艾伯維公司的價格區間在155.0美元和210.0美元之間,橫跨最近三個月。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

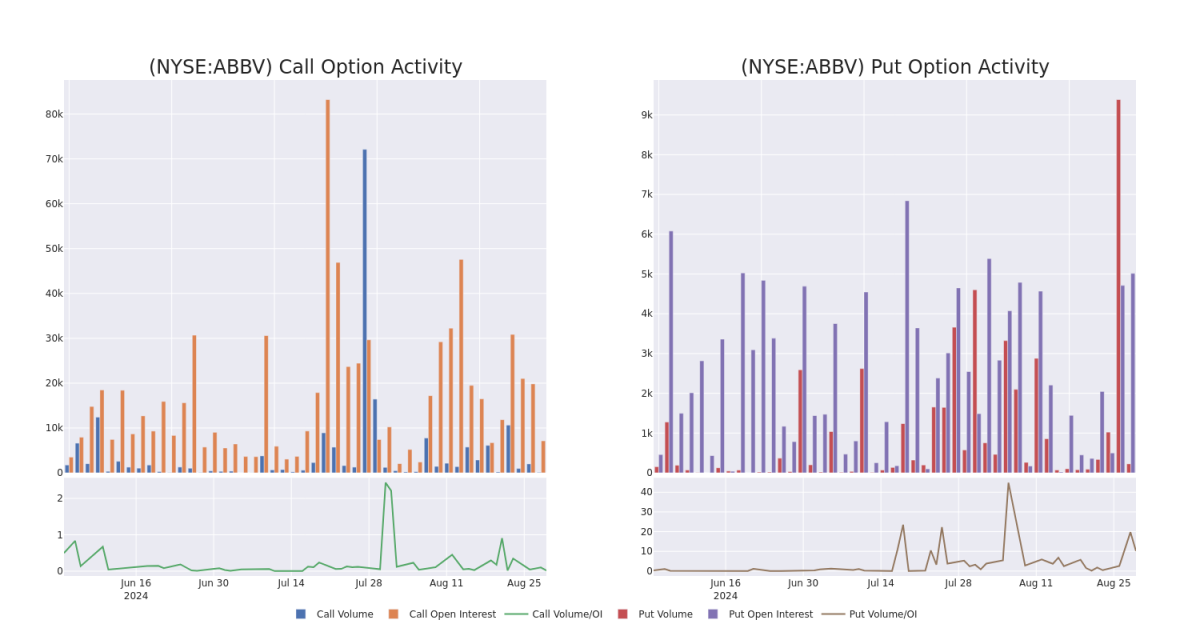

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for AbbVie's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of AbbVie's whale trades within a strike price range from $155.0 to $210.0 in the last 30 days.

在交易期權時,查看成交量和未平倉量是一個強有力的舉措。這些數據可以幫助您跟蹤艾伯維公司特定行權價的期權的流動性和興趣。在下面,我們可以觀察到過去30天內,對於艾伯維公司在155.0美元到210.0美元行權價區間內的所有大宗交易的看漲和看跌期權的成交量和未平倉量的演變。

AbbVie 30-Day Option Volume & Interest Snapshot

艾伯維公司30天期權成交量和持倉量快照

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABBV | CALL | SWEEP | BEARISH | 01/17/25 | $38.95 | $38.5 | $38.5 | $160.00 | $231.0K | 3.1K | 62 |

| ABBV | CALL | TRADE | BEARISH | 09/20/24 | $41.1 | $40.95 | $40.95 | $155.00 | $126.9K | 250 | 31 |

| ABBV | PUT | SWEEP | NEUTRAL | 01/17/25 | $9.25 | $9.1 | $9.2 | $195.00 | $73.6K | 435 | 82 |

| ABBV | PUT | TRADE | BEARISH | 06/20/25 | $16.45 | $15.7 | $16.45 | $200.00 | $52.6K | 175 | 37 |

| ABBV | PUT | TRADE | BEARISH | 06/20/25 | $8.8 | $8.05 | $8.8 | $180.00 | $35.2K | 849 | 40 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 艾伯維公司 | 看漲 | SWEEP | 看淡 | 01/17/25 | $38.95 | $38.5 | $38.5 | $160.00 | 231.0千美元 | 3.1K | 62 |

| 艾伯維公司 | 看漲 | 交易 | 看淡 | 09/20/24 | $41.1 | $40.95 | $40.95 | $155.00 | $126.9K | 250 | 31 |

| 艾伯維公司 | 看跌 | SWEEP | 中立 | 01/17/25 | 9.25美元 | $9.1 | $9.2 | $195.00 | 73.6K | 435 | 82 |

| 艾伯維公司 | 看跌 | 交易 | 看淡 | 06/20/25 | $16.45 | 15.7 | $16.45 | 。 | $52.6K | 175 | 37 |

| 艾伯維公司 | 看跌 | 交易 | 看淡 | 06/20/25 | $ 8.8 | $8.05 | $ 8.8 | 180.00美元 | $35.2K | 849 | 40 |

About AbbVie

關於艾伯維公司

AbbVie is a pharmaceutical firm with a strong exposure to immunology (with Humira, Skyrizi, and Rinvoq) and oncology (with Imbruvica and Venclexta). The company was spun off from Abbott in early 2013. The 2020 acquisition of Allergan added several new products and drugs in aesthetics (including Botox).

AbbVie是一家藥品公司,其在免疫學(包括Humira、Skyrizi和Rinvoq)和腫瘤學(包括Imbruvica和Venclexta)方面擁有強大的業務。該公司於2013年初從Abbott分拆而來。2020年收購雅培使其在美容業務(包括Botox)中新增了一些產品和藥品。

After a thorough review of the options trading surrounding AbbVie, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對ABBV周邊期權交易進行詳盡複審後,我們將更詳細地檢查該公司的市場狀況和表現。

Current Position of AbbVie

艾伯維公司的當前頭寸

- With a trading volume of 2,078,162, the price of ABBV is up by 0.01%, reaching $195.42.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 57 days from now.

- 當前RSI值表明該股票可能接近超買狀態。

- 下一個業績將在57天后發佈。

Expert Opinions on AbbVie

關於艾伯維公司的專家意見

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $209.0.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on AbbVie with a target price of $218.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $200.

- Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for AbbVie, targeting a price of $209.

- 摩根士丹利的一位分析師在其評估中持續認爲艾伯維公司具有超配的評級,並保持218美元的目標價。

- 出於謹慎考慮,Cantor Fitzgerald的一位分析師將評級下調爲超配,設定了$200的目標價。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for AbbVie with Benzinga Pro for real-time alerts.

交易期權涉及更高風險,但同時也提供實現更高利潤的潛力。精明的交易者通過持續教育、戰略性交易調整、利用各種因子以及保持對市場動態的關注來減輕這些風險。使用Benzinga Pro跟蹤AbbVie的最新期權交易以獲取實時警報。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $155.0 and $210.0 for AbbVie, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $155.0 and $210.0 for AbbVie, spanning the last three months.