Here's How Much You Would Have Made Owning Chubb Stock In The Last 10 Years

Here's How Much You Would Have Made Owning Chubb Stock In The Last 10 Years

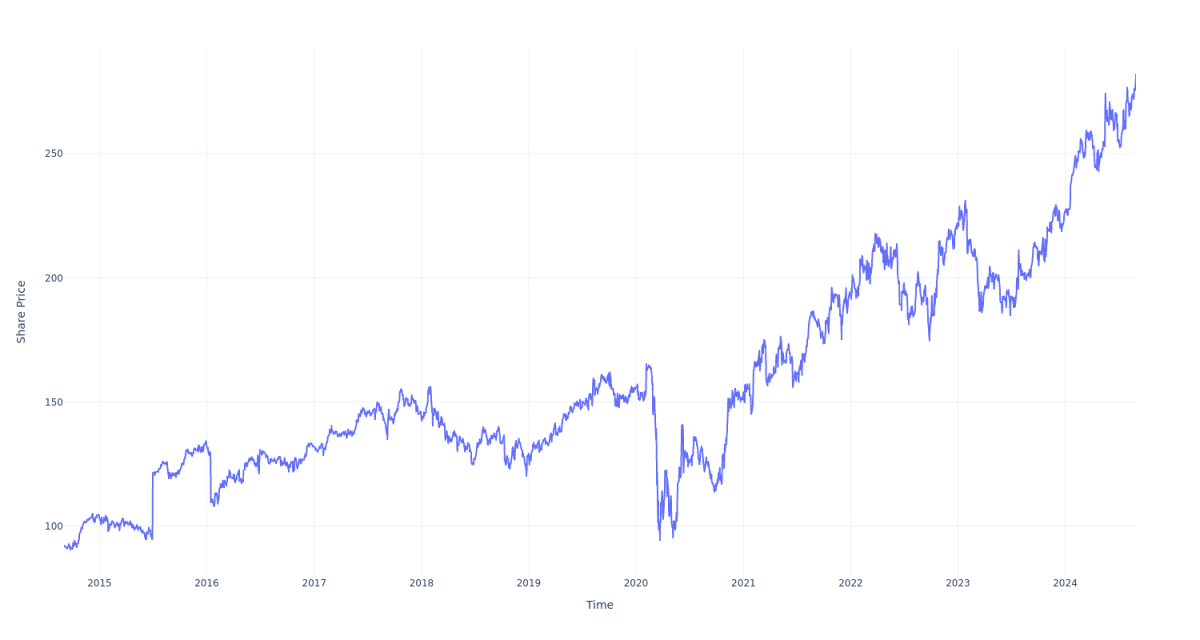

Chubb (NYSE:CB) has outperformed the market over the past 10 years by 1.06% on an annualized basis producing an average annual return of 11.84%. Currently, Chubb has a market capitalization of $113.70 billion.

在過去的10年裏,Chubb(紐交所:CB)的表現超過了市場,年化基礎上的表現超過市場平均1.06%,年均回報率達到了11.84%。目前,Chubb的市值爲1137億美元。

Buying $100 In CB: If an investor had bought $100 of CB stock 10 years ago, it would be worth $306.53 today based on a price of $281.47 for CB at the time of writing.

購買CB股票100美元:如果投資者在10年前購買了100美元的Cb股票,根據CB當時的價格281.47美元,今天它將價值306.53美元。

Chubb's Performance Over Last 10 Years

過去10年的太平洋證券業績表現

Finally -- what's the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

最終,所有這些的意義是什麼?從這篇文章中得出的核心見解是注意到複利對於一段時間內現金增長的巨大影響。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自動化內容引擎生成並由編輯審查。