Wall Street's Most Accurate Analysts Give Their Take On 3 Tech And Telecom Stocks Delivering High-Dividend Yields

Wall Street's Most Accurate Analysts Give Their Take On 3 Tech And Telecom Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

在市場動盪和不確定的時期,許多投資者會轉向股息收益股,這些通常是具有較高的自由現金流並以高紅利派息獎勵股東的公司。

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

本文我將介紹一下分析師評級頁面, 通過訪問即可查看最新分析師對其最喜歡的股票的看法. 交易員可以在Benzinga的大量分析師評級數據庫中進行排序,包括通過分析師準確率進行排序。

Below are the ratings of the most accurate analysts for three high-yielding stocks in the communication services sector.

以下是通信-半導體行業三隻高股息股票最準確的分析師評級。

Verizon Communications Inc. (NYSE:VZ)

Verizon Communications Inc. (紐交所:VZ)

- Dividend Yield: 6.45%

- Scotiabank analyst Maher Yaghi maintained a Sector Perform rating and raised the price target from $45.5 to $46.5 on July 10. This analyst has an accuracy rate of 70%.

- Tigress Financial analyst Ivan Feinseth maintained a Buy rating and raised the price target from $50 to $52 on May 17. This analyst has an accuracy rate of 71%.

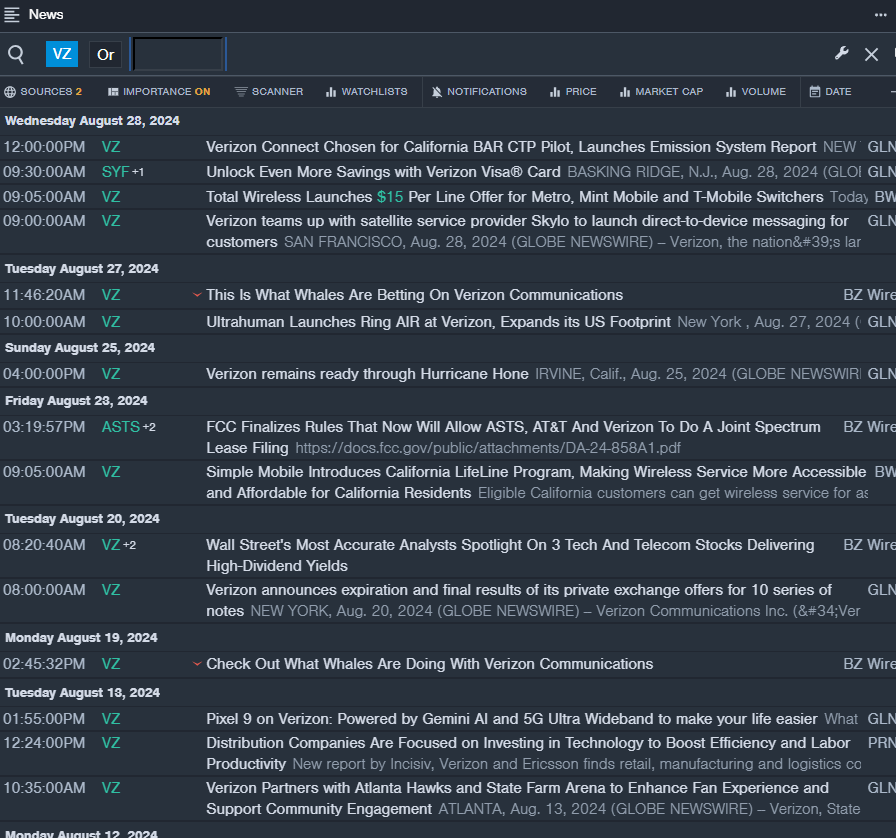

- Recent News: Verizon inked a new Enterprise Infrastructure Solutions (EIS) deal with the National Labor Relations Board (NLRB), an independent federal agency that focuses on the rights of private sector employees.

- Benzinga Pro's real-time newsfeed alerted to latest VZ news.

- 股息收益率: 6.45%

- Scotiabank分析師Maher Yaghi於7月10日維持了板塊表現評級,並將價格目標從45.5美元提高到46.5美元。該分析師的準確率爲70%。

- Tigress Financial分析師Ivan Feinseth於5月17日維持了買入評級,並將價格目標從50美元提高到52美元。該分析師的準確率爲71%。

- 資訊:Verizon與關注私營部門僱員權利的獨立聯邦機構——國家勞工關係委員會(National Labor Relations Board,NLRB)簽署了新的企業基礎設施解決方案(EIS)合同。

- Benzinga Pro的實時新聞通知了最新的VZ資訊。

AT&T Inc. (NYSE:T)

AT&T Inc. (紐交所:T)

- Dividend Yield: 5.62%

- Scotiabank analyst Jeff Fan maintained a Sector Outperform rating and raised the price target from $23 to $24 on July 25. This analyst has an accuracy rate of 75%.

- Oppenheimer analyst Timothy Horan maintained an Outperform rating and increased the price target from $21 to $23 on July 25. This analyst has an accuracy rate of 70%.

- Recent News: The company will release third-quarter 2024 results on Wednesday, Oct. 23.

- Benzinga Pro's charting tool helped identify the trend in T stock.

- 股息收益率:5.62%

- Scotiabank分析師Jeff Fan維持了板塊的強於市場預期評級,並將價格目標從23美元提高到24美元,日期爲7月25日。該分析師的準確率爲75%。

- Oppenheimer分析師Timothy Horan維持了優於市場預期的評級,並將價格目標從21美元提高到23美元,日期爲7月25日。該分析師的準確率爲70%。

- 近期資訊:公司將於2024年10月23日星期三發佈第三季度業績。

- Benzinga Pro的圖表工具幫助識別了t股票的趨勢。

TEGNA Inc. (NYSE:TGNA)

tegna公司(紐交所:TGNA)

- Dividend Yield: 3.63%

- Benchmark analyst Daniel Kurnos reiterated a Buy rating with a price target of $21 on Aug. 8. This analyst has an accuracy rate of 72%.

- JP Morgan analyst David Karnovsky maintained a Neutral rating and slashed the price target from $17 to $15 on March 1. This analyst has an accuracy rate of 70%.

- Recent News: On Aug. 29, TEGNA named Carrie Yates as President and General Manager at WZDX in Huntsville.

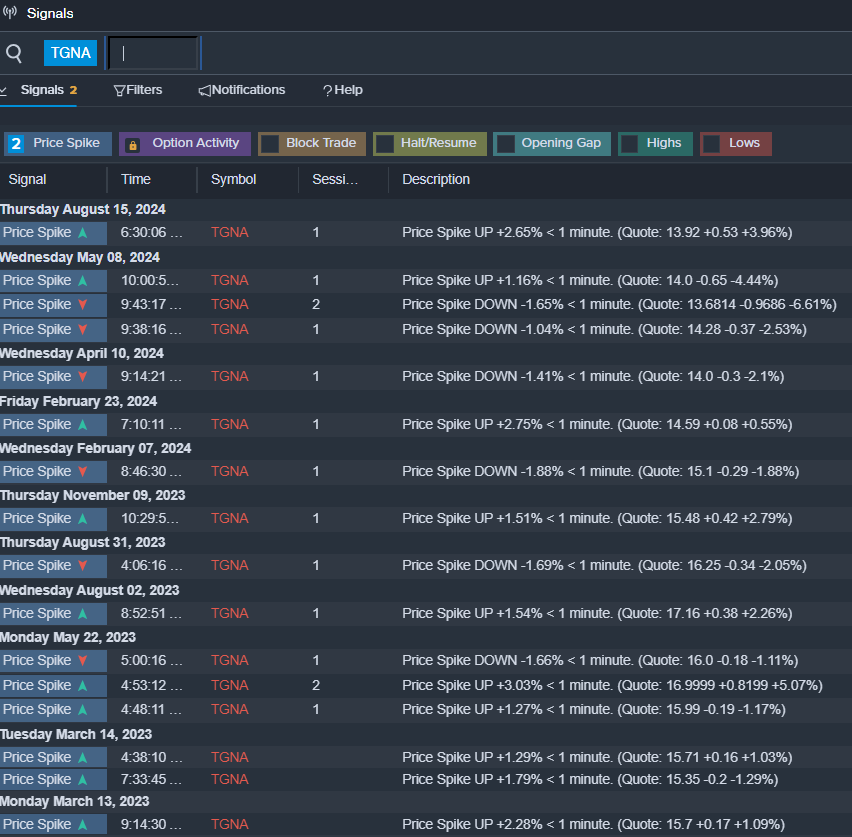

- Benzinga Pro's signals feature notified of a potential breakout in TGNA shares.

- 股息收益率:3.63%

- Benchmark分析師Daniel Kurnos於8月8日重申對該股票的買入評級,目標價爲21美元。該分析師的準確率爲72%。

- JP Morgan分析師David Karnovsky於3月1日維持該股票的中立評級,並將目標價從17美元下調至15美元。該分析師的準確率爲70%。

- 最新資訊:8月29日,TEGNA任命Carrie Yates爲亨茨維爾的WZDX的總裁兼總經理。

- Benzinga Pro的信號功能顯示TGNA股票可能出現突破。

Read More:

閱讀更多:

- Dow Notches New Record Close But Nasdaq Falls Amid Decline In Nvidia Shares: Fear Index Enters 'Greed' Zone

- 道瓊斯指數創下新的收盤紀錄,但納斯達克指數下跌,英偉達股票下跌: 恐懼指數進入'貪婪'區域