Unpacking the Latest Options Trading Trends in GameStop

Unpacking the Latest Options Trading Trends in GameStop

Financial giants have made a conspicuous bullish move on GameStop. Our analysis of options history for GameStop (NYSE:GME) revealed 9 unusual trades.

金融巨頭在遊戲驛站(GME)上展開了惹眼的看好買盤。我們分析了遊戲驛站(NYSE:GME)的期權交易歷史記錄,發現了9筆異常交易。

Delving into the details, we found 77% of traders were bullish, while 22% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $183,360, and 7 were calls, valued at $319,250.

深入研究細節,我們發現77%的交易員看漲,而22%的人表現出看淡的傾向。我們發現的所有交易中,有2筆看跌交易,總價值爲183,360美元,還有7筆看漲交易,總價值爲319,250美元。

Expected Price Movements

預期價格波動

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $125.0 for GameStop over the recent three months.

基於交易活動,看起來大量投資者在以$10.0到$125.0的價格區間內瞄準GameStop,在最近三個月內進行交易。

Volume & Open Interest Trends

成交量和未平倉量趨勢

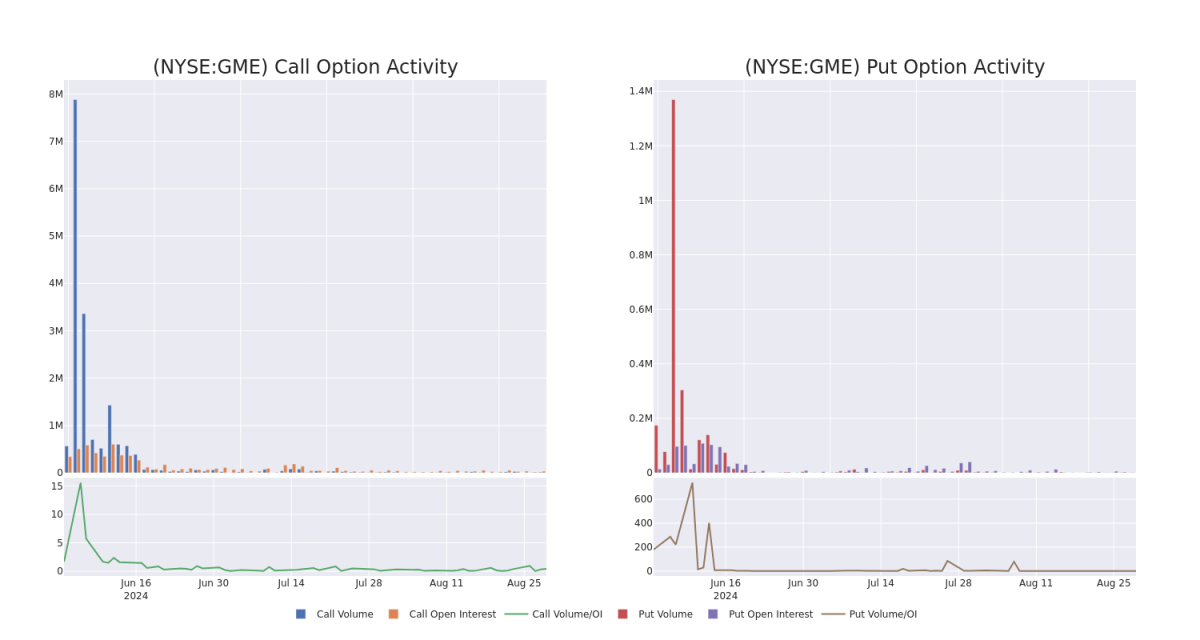

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for GameStop's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of GameStop's whale trades within a strike price range from $10.0 to $125.0 in the last 30 days.

在交易期權時,查看成交量和未平倉合約是非常有用的。這些數據可以幫助您追蹤GameStop期權在給定行權價格上的流動性和興趣度。下面,我們可以觀察GameStop所有鯨魚交易的認購和認沽的成交量和未平倉合約變化,範圍是從$10.0到$125.0的行權價區間,最近30天內發生。

GameStop Option Volume And Open Interest Over Last 30 Days

GameStop近30天期權成交量和持倉量

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | PUT | TRADE | BEARISH | 10/18/24 | $103.0 | $102.8 | $103.0 | $125.00 | $154.5K | 0 | 15 |

| GME | CALL | TRADE | BULLISH | 01/17/25 | $4.15 | $4.0 | $4.1 | $25.00 | $81.9K | 6.5K | 841 |

| GME | CALL | TRADE | BULLISH | 01/17/25 | $4.15 | $3.9 | $4.1 | $25.00 | $81.9K | 6.5K | 230 |

| GME | CALL | TRADE | BULLISH | 09/20/24 | $2.25 | $2.1 | $2.2 | $22.00 | $44.0K | 3.1K | 514 |

| GME | CALL | TRADE | BULLISH | 09/13/24 | $1.5 | $1.47 | $1.5 | $23.00 | $29.7K | 1.8K | 349 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | 看跌 | 交易 | 看淡 | 10/18/24 | $103.0 | $102.8 | $103.0 | $125.00 | $154.5K | 0 | 15 |

| GME | 看漲 | 交易 | 看好 | 01/17/25 | $4.15 | $4.0 | $4.1 | $25.00 | $81.9K | 6.5K | 841 |

| GME | 看漲 | 交易 | 看好 | 01/17/25 | $4.15 | $3.9 | $4.1 | $25.00 | $81.9K | 6.5K | 14.3% |

| GME | 看漲 | 交易 | 看好 | 09/20/24 | 每千立方英尺2.25美元 | $2.1 | $2.2 | $22.00 | $44.0K | 3.1K | 514 |

| GME | 看漲 | 交易 | 看好 | 09/13/24 | $1.5 | $1.47 | $1.5 | $23.00 | $29.7K | 1.8K | 349 |

About GameStop

關於遊戲驛站

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

GameStop Corp是美國的一家多渠道視頻遊戲、消費電子和服務零售商。該公司在歐洲、加拿大、澳洲和美國等地區運營。GameStop主要通過GameStop、Eb Games和Micromania商店以及國際電子商務網站銷售新和二手視頻遊戲硬件、實體和數字視頻遊戲軟件和視頻遊戲配件。銷售收入的大部分來自美國。

After a thorough review of the options trading surrounding GameStop, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在徹底審查了圍繞GameStop的期權交易後,我們進一步研究該公司。這包括評估其當前市場地位和表現。

Where Is GameStop Standing Right Now?

GameStop現在處於什麼位置?

- Currently trading with a volume of 2,546,353, the GME's price is up by 1.72%, now at $21.88.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 11 days.

- RSI讀數表明該股目前可能接近超買水平。

- 預期利潤髮布時間爲11天后。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for GameStop with Benzinga Pro for real-time alerts.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for GameStop's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of GameStop's whale trades within a strike price range from $10.0 to $125.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for GameStop's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of GameStop's whale trades within a strike price range from $10.0 to $125.0 in the last 30 days.