A Closer Look at Procter & Gamble's Options Market Dynamics

A Closer Look at Procter & Gamble's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bearish stance on Procter & Gamble.

資金充裕的鯨魚明顯持看淡態度,看待寶潔(Procter & Gamble)。

Looking at options history for Procter & Gamble (NYSE:PG) we detected 8 trades.

查看Procter & Gamble (紐交所:PG)的期權交易歷史,我們發現了8筆交易。

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 50% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,25%的投資者抱着看漲期望,50%的投資者持看淡態度

From the overall spotted trades, 3 are puts, for a total amount of $197,623 and 5, calls, for a total amount of $222,691.

在所有被發現的交易中,有3筆看跌期權,總金額爲$197,623,以及5筆看漲期權,總金額爲$222,691。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $160.0 to $170.0 for Procter & Gamble over the last 3 months.

考慮到這些合約的成交量和持倉量,我們發現過去3個月來,大戶們一直在將Procter & Gamble的價格範圍定爲$160.0至$170.0。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

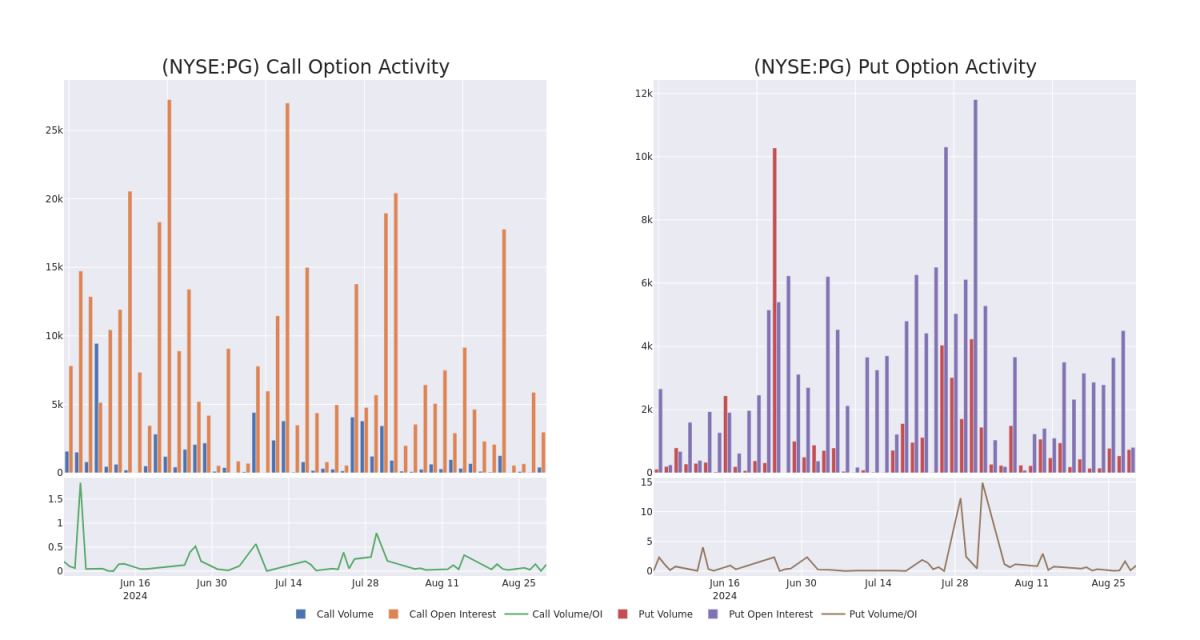

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Procter & Gamble's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Procter & Gamble's substantial trades, within a strike price spectrum from $160.0 to $170.0 over the preceding 30 days.

評估成交量和持倉量是期權交易的戰略步驟。這些指標揭示了Procter & Gamble特定行權價的期權流動性和投資者興趣。即將到來的數據將圖形化顯示過去30天內,與Procter & Gamble的大手交易相關的看漲和看跌期權的成交量和持倉量的波動情況,在$160.0至$170.0的行權價範圍內。

Procter & Gamble Option Activity Analysis: Last 30 Days

寶潔公司期權活動分析:過去30天

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PG | CALL | TRADE | NEUTRAL | 01/16/26 | $23.75 | $21.4 | $22.6 | $160.00 | $97.1K | 544 | 43 |

| PG | PUT | TRADE | BULLISH | 01/17/25 | $5.5 | $5.35 | $5.4 | $170.00 | $91.8K | 805 | 265 |

| PG | PUT | SWEEP | BULLISH | 01/17/25 | $5.5 | $5.35 | $5.35 | $170.00 | $58.3K | 805 | 374 |

| PG | PUT | SWEEP | NEUTRAL | 01/17/25 | $5.5 | $5.35 | $5.35 | $170.00 | $47.5K | 805 | 95 |

| PG | CALL | TRADE | BEARISH | 09/06/24 | $1.87 | $1.77 | $1.77 | $170.00 | $37.1K | 443 | 264 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PG | 看漲 | 交易 | 中立 | 01/16/26 | $23.75 | $21.4 | $22.6 | $160.00 | $97.1K | 544 | 43 |

| PG | 看跌 | 交易 | 看好 | 01/17/25 | $5.5 | $5.35 | $5.4 | $170.00 | $91.8K | 805 | 265 |

| PG | 看跌 | SWEEP | 看好 | 01/17/25 | $5.5 | $5.35 | $5.35 | $170.00 | $58.3K | 805 | 374 |

| PG | 看跌 | SWEEP | 中立 | 01/17/25 | $5.5 | $5.35 | $5.35 | $170.00 | $47.5K | 805 | 95 |

| PG | 看漲 | 交易 | 看淡 | 09/06/24 | $1.87 | $1.77 | $1.77 | $170.00 | 37.1K美元 | 443 | 264 |

About Procter & Gamble

關於寶潔公司

Since its founding in 1837, Procter & Gamble has become one of the world's largest consumer product manufacturers, generating more than $80 billion in annual sales. It operates with a lineup of leading brands, including more than 20 that generate north of $1 billion each in annual global sales, such as Tide laundry detergent, Charmin toilet paper, Pantene shampoo, and Pampers diapers. Sales outside its home turf represent more than half of the firm's consolidated total.

In light of the recent options history for Procter & Gamble, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考慮到寶潔公司的最近期權歷史,現在應該專注於公司本身。我們旨在探索其當前表現。

Procter & Gamble's Current Market Status

寶潔公司當前市場狀況

- With a trading volume of 1,751,474, the price of PG is up by 0.05%, reaching $170.11.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 47 days from now.

- 當前RSI值表明該股票可能接近超買狀態。

- 下一季度業績將在47天后公佈。

What Analysts Are Saying About Procter & Gamble

關於Procter & Gamble,分析師們的看法是什麼

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $176.5.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Procter & Gamble, targeting a price of $163.

- An analyst from DZ Bank has elevated its stance to Buy, setting a new price target at $190.

- 巴克萊銀行的一位分析師繼續持有 Procter & Gamble 股票,並將目標價設定爲163美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Procter & Gamble options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。精明的交易者通過不斷教育自己、調整策略、監控多個因子並密切關注市場動向來管理這些風險。通過Benzinga Pro提供的實時提示了解最新的寶潔公司期權交易動態。

From the overall spotted trades, 3 are puts, for a total amount of $197,623 and 5, calls, for a total amount of $222,691.

From the overall spotted trades, 3 are puts, for a total amount of $197,623 and 5, calls, for a total amount of $222,691.