Spotify Technology's Options Frenzy: What You Need to Know

Spotify Technology's Options Frenzy: What You Need to Know

Deep-pocketed investors have adopted a bearish approach towards Spotify Technology (NYSE:SPOT), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SPOT usually suggests something big is about to happen.

有實力的投資者對 Spotify Technology (紐交所:SPOT) 採取了看淡的態度,這是市場參與者不應忽視的。Benzinga 對公開期權記錄的追蹤揭示了今天這一重大動向。這些投資者的身份尚不明確,但在 SPOt 中進行如此大規模的交易通常意味着即將發生重大變化。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 18 extraordinary options activities for Spotify Technology. This level of activity is out of the ordinary.

我們從今天的觀察中獲取了這些信息,當Benzinga的期權掃描儀突出了Spotify Technology的18項非凡的期權活動。這種活躍程度是非同尋常的。

The general mood among these heavyweight investors is divided, with 33% leaning bullish and 66% bearish. Among these notable options, 4 are puts, totaling $155,090, and 14 are calls, amounting to $710,364.

這些重量級投資者中普遍情緒分歧,33%看好,66%看淡。在這些引人注目的期權中,有4個PUT,總額爲$155,090,有14個CALL,總額達到$710,364。

Expected Price Movements

預期價格波動

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $280.0 to $420.0 for Spotify Technology over the last 3 months.

考慮到這些合約的成交量和持倉量,似乎鯨魚們在過去3個月裏一直在瞄準Spotify Technology的價格區間,從$280.0到$420.0。

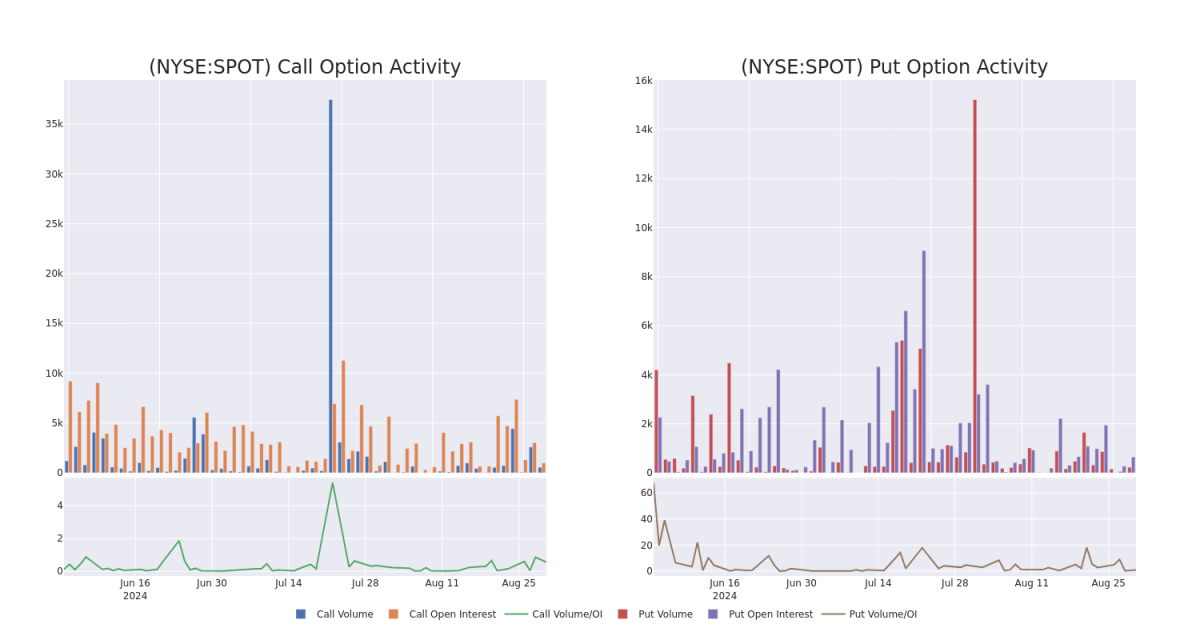

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Spotify Technology's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Spotify Technology's substantial trades, within a strike price spectrum from $280.0 to $420.0 over the preceding 30 days.

評估成交量和持倉量是期權交易中的戰略步驟。這些指標揭示了Spotify Technology特定行權價格的期權的流動性和投資者興趣。接下來的數據可視化展示了過去30天裏,與Spotify Technology大宗交易相關的成交量和持倉量的波動,涵蓋了從$280.0到$420.0的行權價區間。

Spotify Technology Option Activity Analysis: Last 30 Days

Spotify Technology期權活動分析:過去30天

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SPOT | CALL | SWEEP | BEARISH | 12/19/25 | $42.1 | $42.05 | $42.05 | $420.00 | $130.3K | 109 | 56 |

| SPOT | CALL | TRADE | BEARISH | 12/19/25 | $73.1 | $72.9 | $72.9 | $340.00 | $87.4K | 9 | 23 |

| SPOT | CALL | TRADE | BEARISH | 12/19/25 | $105.25 | $105.0 | $105.0 | $280.00 | $84.0K | 18 | 33 |

| SPOT | CALL | TRADE | BEARISH | 12/19/25 | $105.05 | $105.0 | $105.0 | $280.00 | $63.0K | 18 | 39 |

| SPOT | PUT | SWEEP | BULLISH | 09/20/24 | $10.45 | $10.15 | $10.5 | $340.00 | $51.4K | 404 | 71 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SPOT | 看漲 | SWEEP | 看淡 | 2025年12月19日 | $42.1 | BEARISH | BEARISH | $420.00 | RSI indicators hint that the underlying stock may be approaching overbought. | 109 | 56 |

| SPOT | 看漲 | 交易 | 看淡 | 2025年12月19日 | 73.1美元 | $72.9 | $72.9 | $340.00 | $87.4K | 9 | 23 |

| SPOT | 看漲 | 交易 | 看淡 | 2025年12月19日 | $105.25 | $105.0 | $105.0 | $280.00 | $84.0K | 18 | 33 |

| SPOT | 看漲 | 交易 | 看淡 | 2025年12月19日 | 105.05美元 | $105.0 | $105.0 | $280.00 | $63.0K | 18 | 39 |

| SPOT | 看跌 | SWEEP | 看好 | 09/20/24 | $10.45 | $10.15 | $10.5 | $340.00 | $51.4K | 404 | 71 |

About Spotify Technology

關於Spotify Technology

Spotify, headquartered in Stockholm, Sweden, is one of the world's largest music streaming service providers, with 602 million monthly active users at the end of 2023. The firm monetizes its users through a paid subscription model, referred to as its premium service, and an ad-based model, referred to as its ad-supported service. Revenue from premium and ad-supported services represented 86% and 14% of Spotify's 2023 total revenue, respectively.

總部位於瑞典斯德哥爾摩的Spotify是全球最大的音樂流媒體服務提供商之一,截至2023年末,擁有60200萬月活躍用戶。該公司通過付費訂閱模式(稱爲premium服務)和基於廣告的模式(稱爲ad-supported服務)從其用戶中獲得收入。2023年,來自premium和ad-supported服務的營業收入分別佔Spotify總收入的86%和14%。

Having examined the options trading patterns of Spotify Technology, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究Spotify Technology的期權交易模式後,我們現在將直接關注公司。這個轉變讓我們深入了解它目前的市場地位和表現。

Where Is Spotify Technology Standing Right Now?

Spotify Technology目前處於何種地位?

- With a volume of 387,061, the price of SPOT is up 0.19% at $341.39.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 53 days.

- SPOT的交易量爲387,061股,價格上漲0.19%,報341.39美元。

- RSI指標暗示該股票可能要超買了。

- 下一個收益預計在53天后發佈。

What Analysts Are Saying About Spotify Technology

關於Spotify Technology,分析師們都說了些什麼

1 market experts have recently issued ratings for this stock, with a consensus target price of $460.0.

1名市場專家最近對這支股票進行了評級,共識目標價爲460.0美元。

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Spotify Technology, targeting a price of $460.

- 維持他們的立場,來自Evercore ISI Group的分析師繼續持有Spotify Technology的Outperform評級,目標價爲460美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $280.0 to $420.0 for Spotify Technology over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $280.0 to $420.0 for Spotify Technology over the last 3 months.