Shareholders Should Be Pleased With Wayfair Inc.'s (NYSE:W) Price

Shareholders Should Be Pleased With Wayfair Inc.'s (NYSE:W) Price

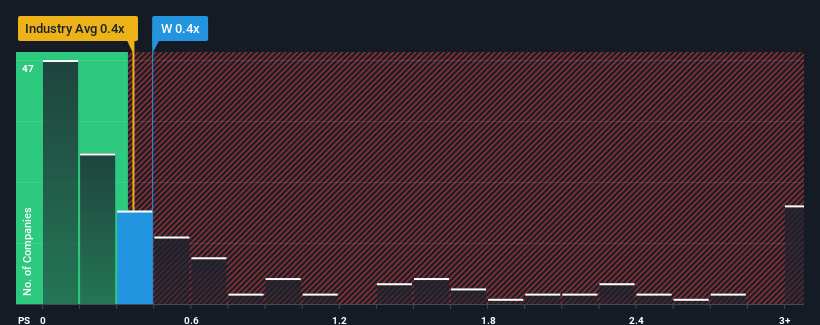

It's not a stretch to say that Wayfair Inc.'s (NYSE:W) price-to-sales (or "P/S") ratio of 0.4x seems quite "middle-of-the-road" for Specialty Retail companies in the United States, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Has Wayfair Performed Recently?

Recent times haven't been great for Wayfair as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Wayfair will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Wayfair's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 20% overall from three years ago. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 4.3% per year as estimated by the analysts watching the company. That's shaping up to be similar to the 5.7% per annum growth forecast for the broader industry.

With this in mind, it makes sense that Wayfair's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at Wayfair's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Wayfair (1 is a bit unpleasant!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Wayfair, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.