A Closer Look at PDD Holdings's Options Market Dynamics

A Closer Look at PDD Holdings's Options Market Dynamics

Deep-pocketed investors have adopted a bearish approach towards PDD Holdings (NASDAQ:PDD), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PDD usually suggests something big is about to happen.

財力雄厚的投資者對PDD Holdings(納斯達克股票代碼:PDD)採取了看跌的態度,這是市場參與者不容忽視的。我們對本辛加公開期權記錄的追蹤今天揭示了這一重大舉措。這些投資者的身份仍然未知,但PDD的如此實質性變動通常表明重大事件即將發生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 38 extraordinary options activities for PDD Holdings. This level of activity is out of the ordinary.

我們從今天的觀察中收集了這些信息,當時Benzinga的期權掃描儀重點介紹了PDD Holdings的38項非同尋常的期權活動。這種活動水平與衆不同。

The general mood among these heavyweight investors is divided, with 34% leaning bullish and 52% bearish. Among these notable options, 14 are puts, totaling $1,007,385, and 24 are calls, amounting to $1,476,402.

這些重量級投資者的總體情緒存在分歧,34%的人傾向於看漲,52%的人傾向於看跌。在這些值得注意的期權中,有14個是看跌期權,總額爲1,007,385美元,24個是看漲期權,總額爲1,476,402美元。

What's The Price Target?

目標價格是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $150.0 for PDD Holdings, spanning the last three months.

在評估了交易量和未平倉合約之後,很明顯,主要市場走勢者正在關注過去三個月中PDD Holdings在50.0美元至150.0美元之間的價格區間。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

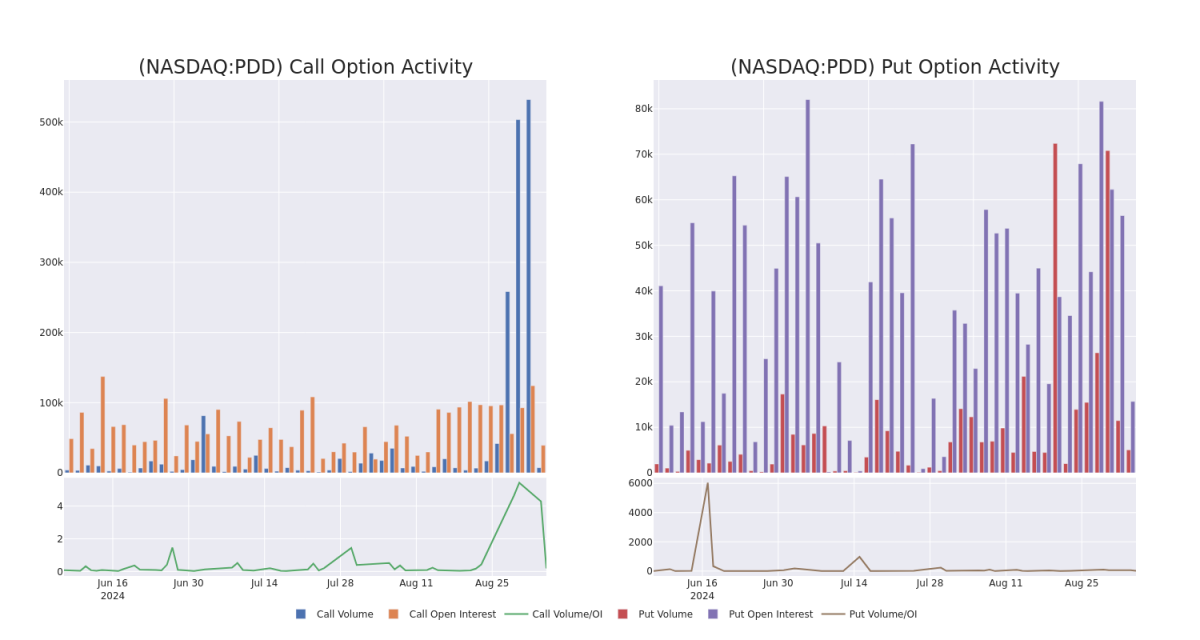

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for PDD Holdings's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across PDD Holdings's significant trades, within a strike price range of $50.0 to $150.0, over the past month.

檢查交易量和未平倉合約爲股票研究提供了至關重要的見解。這些信息是衡量PDD Holdings期權在特定行使價下的流動性和利息水平的關鍵。下面,我們簡要介紹了過去一個月PDD Holdings重大交易的看漲期權和未平倉合約的趨勢,行使價區間爲50.0美元至150.0美元。

PDD Holdings Option Volume And Open Interest Over Last 30 Days

PDD Holdings 過去 30 天的期權交易量和未平倉合約

Significant Options Trades Detected:

檢測到的重要期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | PUT | TRADE | BULLISH | 02/21/25 | $4.5 | $4.3 | $4.3 | $80.00 | $387.0K | 2.3K | 0 |

| PDD | CALL | SWEEP | BEARISH | 01/17/25 | $19.3 | $19.05 | $19.05 | $80.00 | $190.5K | 872 | 154 |

| PDD | PUT | SWEEP | BEARISH | 09/13/24 | $7.85 | $7.65 | $7.78 | $101.00 | $156.8K | 250 | 204 |

| PDD | CALL | TRADE | BEARISH | 11/15/24 | $16.25 | $15.0 | $15.0 | $85.00 | $144.0K | 23 | 100 |

| PDD | CALL | SWEEP | BEARISH | 11/15/24 | $12.8 | $12.7 | $12.7 | $85.00 | $116.8K | 23 | 313 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | 放 | 貿易 | 看漲 | 02/21/25 | 4.5 美元 | 4.3 美元 | 4.3 美元 | 80.00 美元 | 387.0 萬美元 | 2.3K | 0 |

| PDD | 打電話 | 掃 | 粗魯的 | 01/17/25 | 19.3 美元 | 19.05 美元 | 19.05 美元 | 80.00 美元 | 190.5 萬美元 | 872 | 154 |

| PDD | 放 | 掃 | 粗魯的 | 09/13/24 | 7.85 美元 | 7.65 美元 | 7.78 美元 | 101.00 美元 | 156.8 萬美元 | 250 | 204 |

| PDD | 打電話 | 貿易 | 粗魯的 | 11/15/24 | 16.25 美元 | 15.0 美元 | 15.0 美元 | 85.00 美元 | 144.0 萬美元 | 23 | 100 |

| PDD | 打電話 | 掃 | 粗魯的 | 11/15/24 | 12.8 美元 | 12.7 美元 | 12.7 美元 | 85.00 美元 | 116.8 萬美元 | 23 | 313 |

About PDD Holdings

關於 PDD Holdings

PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. PDD aims to bring more businesses and people into the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD has built a network of sourcing, logistics, and fulfillment capabilities that support its underlying businesses.

PDD Holdings是一家跨國商業集團,擁有並經營業務組合。PDD旨在將更多的企業和人員帶入數字經濟,使當地社區和小型企業能夠從生產力的提高和新的機遇中受益。PDD 已經建立了一個採購、物流和配送能力網絡,爲其基礎業務提供支持。

In light of the recent options history for PDD Holdings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於PDD Holdings最近的期權歷史,現在應該將重點放在公司本身上。我們的目標是探索其目前的表現。

Present Market Standing of PDD Holdings

PDD Holdings目前的市場地位

- Currently trading with a volume of 10,247,226, the PDD's price is down by -5.23%, now at $92.64.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 83 days.

- PDD目前的交易量爲10,247,226美元,價格下跌了-5.23%,目前爲92.64美元。

- RSI讀數表明,該股目前可能已接近超賣。

- 預計業績將在83天后發佈。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。