BlackRock Strategist On Market Jitters: Expect Volatility, But Stay Positive On US Equities And This Emerging Market

BlackRock Strategist On Market Jitters: Expect Volatility, But Stay Positive On US Equities And This Emerging Market

Investors, brace yourselves for the rollercoaster that is September and October. But before hitting the panic button, BlackRock managing director Gargi Pal Chaudhuri offers reassurance, urging that investors not be alarmed by near-term volatility in U.S. equity markets.

投資者們,爲即將到來的九月和十月的過山車式市場做好準備。但在按下恐慌鍵之前,貝萊德董事總經理加爾吉·帕爾·喬杜裏(Gargi Pal Chaudhuri)提供了安慰,敦促投資者不要被美國股市的短期波動所驚慌。

In a recent CNBC interview, Chaudhuri — Head of BlackRock's iShares Investment Strategy-Americas — emphasized that whether it's small-cap stocks, large-caps, or the tech sector, "these months tend to be seasonally volatile, a trend observed over the past decade."

在最近的CNBC採訪中,喬杜裏,貝萊德iShares投資策略-美洲區的負責人,強調無論是小盤股、大盤股還是科技板塊,「這幾個月往往是季節性波動的,這是過去十年觀察到的趨勢。」

We looked into the past trend for validation.

我們調查了過去的趨勢以進行驗證。

Seasonal Market Swings: A Recurring Phenomenon

季節性市場波動:一種經常出現的現象

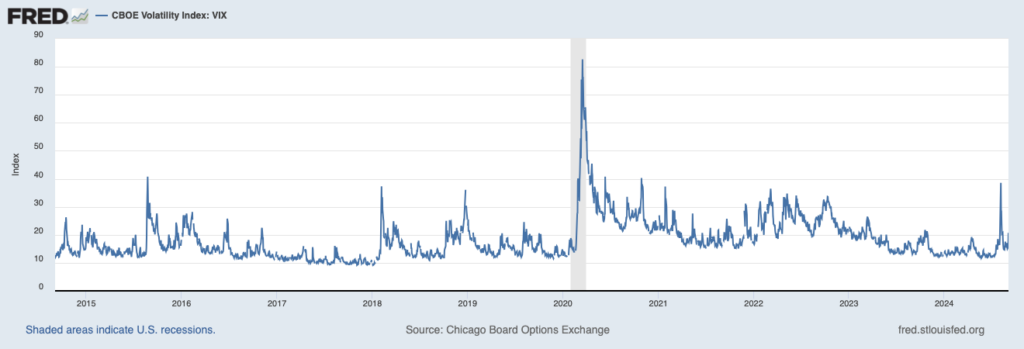

Above is the graph of the CBOE Volatility Index, also known as, VIX — over the past decade. It can be observed, that the index tends to gain strength during these two months Chaudhuri mentioned (taking into account that the extremely high wave in 2020 is accountable to Covid).

上圖是CBOE波動指數,也稱爲VIX,過去十年的走勢。可以觀察到,在喬杜裏所提到的這兩個月中,指數往往會增強(考慮到2020年的極高波動是由Covid引起的)。

Investors who track market volatility often tend to book gains through its swings via ETFs such as the iPath Series B S&P 500 VIX Short-Term Futures ETN (NYSE:VXX) or the ProShares VIX Short-Term Futures ETF (NYSE:VIXY)

經常跟蹤市場波動的投資者通常會通過etf(如iPath S&P 500 VIX短期期貨etn(紐交所:VXX)或ProShares波動率指數短期期貨etf(紐交所:VIXY))鎖定收益。

Chaudhuri also mentioned that this year, the uncertainty around the upcoming U.S. election adds to the already jittery markets, creating more potential for fluctuations.

喬杜裏還提到,今年,圍繞即將到來的美國大選的不確定性加劇了已經焦慮的市場,進一步增加了波動的潛力。

Read Also: Institutional Investors Buy The Dip After August Volatility Spike: Wall Street Analyst

閱讀更多:華爾街分析師表示,8月波動激增後,機構投資者買入低點。

Medium- To Long-Term? Still Bright

中長期?依然光明

Despite the near-term uncertainty, Chaudhuri remains upbeat about the medium- to long-term outlook for U.S. equities. She believes high-quality stocks are poised to perform well over the next six to twelve months, especially as the Federal Reserve is expected to begin cutting interest rates.

儘管存在短期不確定性,Chaudhuri對美國股票的中長期前景仍然持樂觀態度。她認爲,高質量股票在未來六至十二個月內有望表現良好,尤其是隨着聯儲局預計將開始減息,情況將更加樂觀。

Chaudhuri stated, "Historically, rate cuts have benefited both stocks and bonds," adding that she expects the Fed to start normalizing interest rates later this month with a 25-basis point cut.

Chaudhuri表示:「從歷史上看,減息對股票和債券都有利。她補充說,她預計聯儲局將在本月晚些時候開始通過25個點子的減息來開始利率的正常化。」

India: The Emerging Market Opportunity

印度:新興市場機遇

But Chaudhuri's focus isn't solely on the U.S. With India's growing influence on the global stage, she believes foreign investors should reconsider their current underweight positions.

但Chaudhuri的重點不僅僅是美國。隨着印度在全球舞臺上日益影響力的增長,她認爲外國投資者應重新考慮其目前的輕倉頭寸。

"I think investors need to at least get back to benchmark weights with respect to emerging markets (EMs) and with respect to India specifically. And I think that is the opportunity," she said.

「我認爲投資者至少需要回到新興市場(EMs)和特定於印度的基準權重。我認爲這就是機會,」她說。

While India's market valuations are on the higher end, Chaudhuri noted that "this is not just about valuations." India's economic potential and its increasing importance make it a key area for future growth.

儘管印度的市場估值偏高,Chaudhuri指出「這不僅僅是關於估值。」印度的經濟潛力和其日益增長的重要性使其成爲未來增長的關鍵領域。

Popular ETFs tracking Indian equity include the iShares MSCI India ETF (NYSE:INDA), the WisdomTree India Earnings Fund (NYSE:EPI) and the Franklin FTSE India ETF (NYSE:FLIN)

追蹤印度股票的熱門etf包括iShares MSCI India ETF(紐交所:INDA)、WisdomTree India Earnings Fund(紐交所:EPI)和Franklin FTSE India ETF(紐交所:FLIN)

Overall, Chaudhuri's message is clear: ride out the short-term volatility and stay focused on the long-term opportunities.

總體而言,喬杜裏的信息很明確:堅持短期波動,專注於長期機會。

- From Stocks To Bonds: CBOE's VIXTLT Index Adds New Twist To Volatility

- 從股票到債券: CBOE的VIXTLt指數爲波動率增添了新的曲折

Above is the graph of the CBOE Volatility Index, also known as,

Above is the graph of the CBOE Volatility Index, also known as,