Top 3 Defensive Stocks That Could Lead To Your Biggest Gains In September

Top 3 Defensive Stocks That Could Lead To Your Biggest Gains In September

9月份可能帶來最大收益的前3只防御性股票

The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

消費板塊中最被過度拋售的股票爲買入低估公司提供了機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指標是一種動量指標,它比較了股票在價格上漲時的強度與在價格下跌時的強度。與股票的價格走勢進行比較,可以給交易者更好的了解股票短期內表現的良好程度。當RSI低於30時,資產通常被認爲是超賣的,根據Benzinga Pro的數據。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行業板塊最近的主要超賣股票列表,RSI接近或低於30。

Walgreens Boots Alliance Inc (NASDAQ:WBA)

沃爾格林-聯合博姿公司(納斯達克股票代碼:WBA)

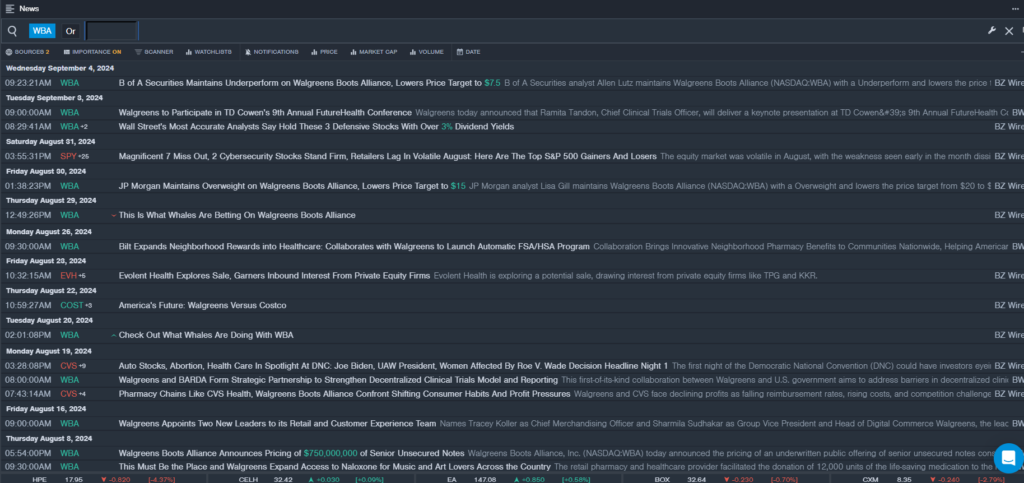

- On Sept. 4, B of A Securities analyst Allen Lutz maintained Walgreens Boots Alliance with an Underperform and lowered the price target from $11 to $7.5. The company's stock fell around 19% over the past month and has a 52-week low of $8.62.

- RSI Value: 25.14

- WBA Price Action: Shares of Walgreens fell 3.6% to close at $8.65 on Wednesday.

- Benzinga Pro's real-time newsfeed alerted to latest WBA news.

- 在9月,A證券分析師艾倫·盧茲給沃爾格林-聯合博姿股票維持了一個弱買入的評級,並將目標股價從11美元下調至7.5美元。該公司股票在過去一個月內下跌了約19%,並創下了52周的低點8.62美元。

- RSI值:25.14

- 沃爾格林的股價行動:沃爾格林的股票在週三下跌3.6%,收盤價爲8.65美元。

- Benzinga Pro的實時新聞提供了最新的沃爾格林-聯合博姿股票新聞。

Dollar General Corp (NYSE:DG)

美國達樂公司 (紐交所:DG)

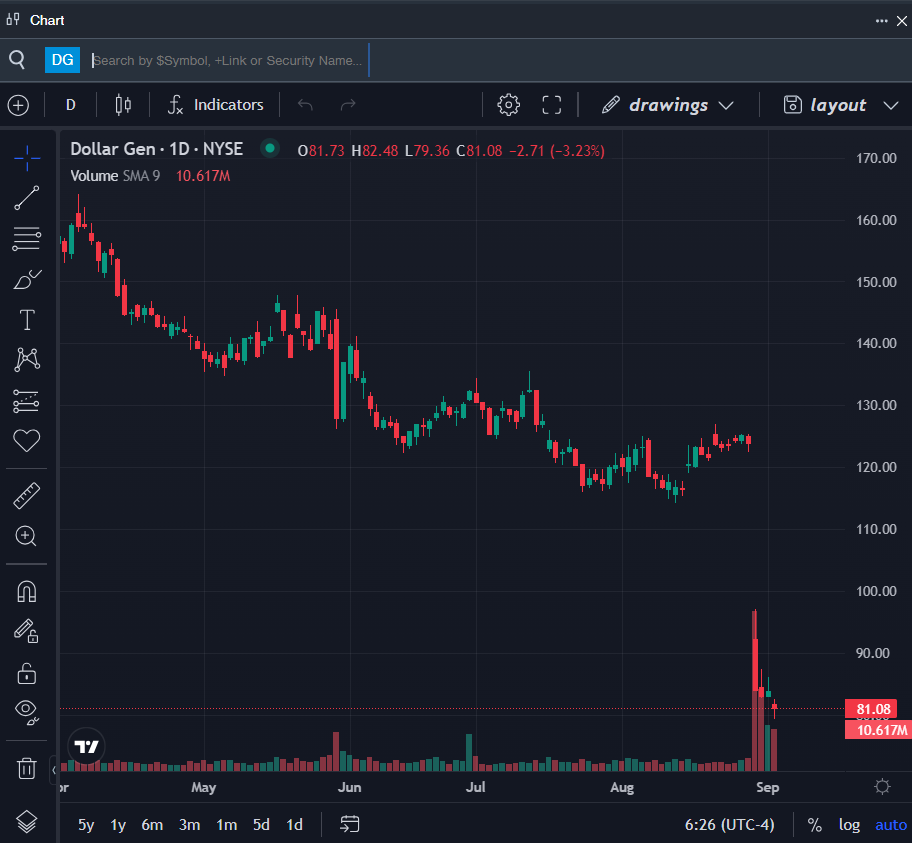

- On Aug. 29, Dollar General reported worse-than-expected second-quarter results and lowered its 2024 guidance. The retail behemoth reported second-quarter earnings per share of $1.70, missing the analyst consensus of $1.78. Quarterly sales of $10.21 billion (+4.2% year over year) missed the street view of $10.368 billion.. The company's stock fell around 35% over the past five days. It has a 52-week low of $79.36.

- RSI Value: 16.90

- DG Price Action: Shares of Dollar General fell 3.2% to close at $81.08 on Wednesday.

- Benzinga Pro's charting tool helped identify the trend in DG stock.

- 8月29日,美國達樂公司發佈了遜於預期的第二季度業績,並下調了2024年的指引。這家零售巨頭報告了每股收益1.70美元,低於分析師預期的1.78美元。季度銷售額爲102.1億美元(同比增長4.2%),低於市場預期的103.68億美元。公司股價在過去五天下跌了約35%。最低點爲52周79.36美元。

- RSI指數爲16.90

- 美國達樂公司的股票下跌了3.2%,收盤價爲81.08美元。

- Benzinga Pro的圖表工具幫助識別了美國達樂公司股票的趨勢。

Dollar Tree Inc (NASDAQ:DLTR)

美元樹公司 (納斯達克: DLTR)

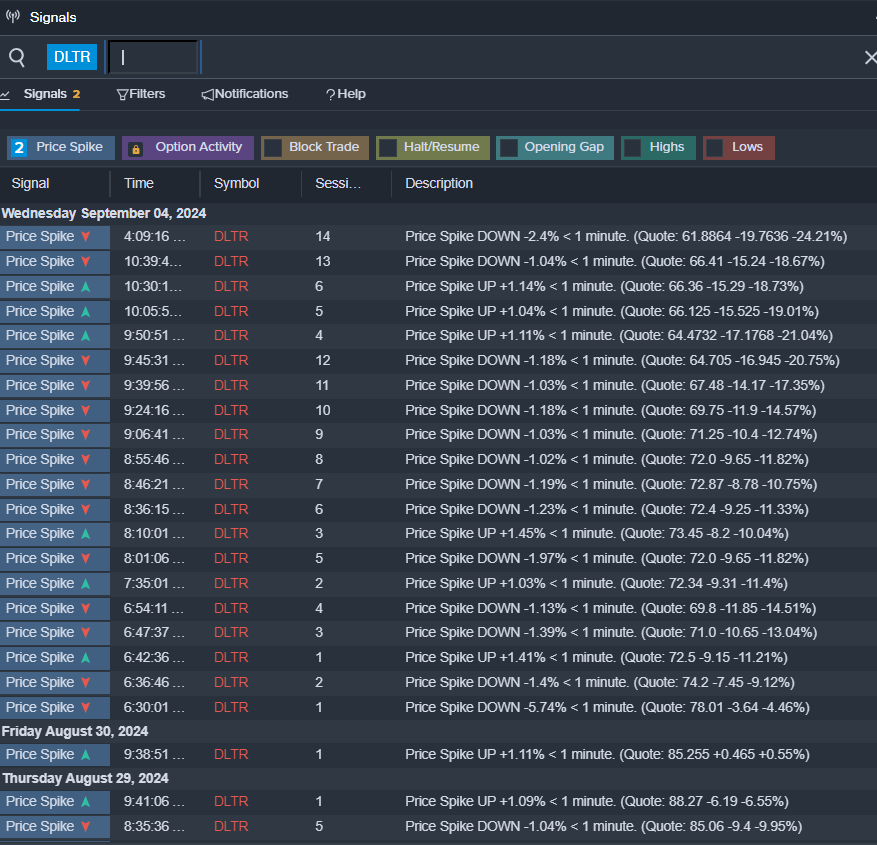

- On Sept. 4, Dollar Tree reported worse-than-expected second-quarter 2024 earnings. The discount variety stores chain reported an adjusted EPS of $0.67, missing the consensus of $1.04, and down 26.4% year over year. Chief Financial Officer Jeff Davis added, "Our adjusted EPS of $0.67 was $0.38 below the midpoint of our previous outlook range. While the vast majority of this variance was attributable to an adjustment of our general liability accrual, a portion was attributable to a comp shortfall, which reflected the increasing effect of macro pressures on the purchasing behavior of Dollar Tree's middle- and higher-income customers.". The company's shares fell around 34% over the past five days and has a 52-week low of $60.82.

- RSI Value: 11.87

- DLTR Price Action: Shares of Dollar Tree dipped 22.2% to close at $63.56 on Wednesday.

- Benzinga Pro's signals feature notified of a potential breakout in DLTR shares.

- 9月4日,美元樹公司公佈了2024年第二季度的業績,結果低於預期。該折扣雜貨店連鎖店報告了每股調整後的收益爲0.67美元,低於預期的1.04美元,同比下降26.4%。首席財務官Jeff Davis補充道:「我們的每股收益爲0.67美元,比我們之前的預期區間中點低了0.38美元。雖然其中絕大部分差異歸因於我們的總責任準備金的調整,但部分歸因於公司的銷售額不足,反映了宏觀壓力對美元樹中高收入客戶購買行爲的不斷影響。」該公司股價在過去五天下跌了約34%,並且創下了52周的低點60.82美元。

- RSI值:11.87

- 美元樹公司股票走勢:週三,美元樹公司股價下跌22.2%,收於63.56美元。

- Benzinga Pro的信號功能提示了美元樹公司股票有潛在突破的可能性。

- Wall Street's Most Accurate Analysts Weigh In On 3 Energy Stocks With Over 7% Dividend Yields

- 華爾街最準確的分析師們對3家能源股的股息率超過7%進行了評估。