Nvidia Plunges In Thursday's Premarket: What's Behind Stock's Incessant Sell-Off?

Nvidia Plunges In Thursday's Premarket: What's Behind Stock's Incessant Sell-Off?

Nvidia Corp. (NASDAQ:NVDA) stock appears on track to fall yet again on Thursday as macroeconomic concerns sap the risk appetite of traders.

由於宏觀經濟擔憂削弱了交易者的風險偏好,英偉達公司(納斯達克股票代碼:NVDA)的股票似乎有望在週四再次下跌。

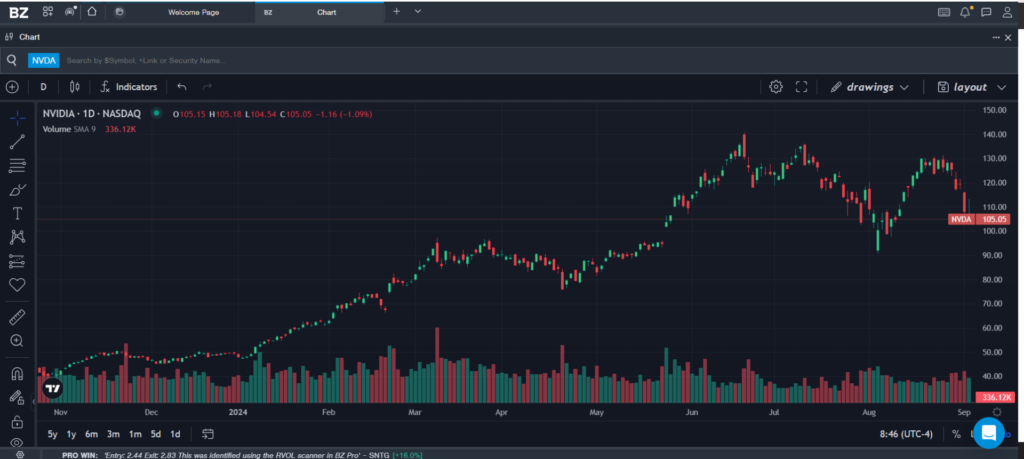

Nvidia Woes: Despite Nvidia's earnings getting high praise from sell-side analysts, investors have been incessantly selling the stock on fears that the Jensen Huang-led company can't keep on delivering superlative financial performance. The stock peaked at $140.76 on an intraday basis on June 20, shortly after the stock split took effect and the ex-dividend date. The record closing high is $135.58 reached on June 18.

英偉達的困境:儘管英偉達的收益獲得了賣方分析師的高度讚揚,但由於擔心黃延森領導的公司無法繼續提供最佳的財務業績,投資者一直在拋售該股。在股票拆分生效和除息日後不久,該股於6月20日盤中達到140.76美元的峯值。創紀錄的收盤高點是6月18日創下的135.58美元。

Nvidia shares were on a broad consolidation move since then before the yen carry trade unwinding wrecked the global markets and the artificial intelligence stalwart's stock came down with them.

自那時以來,英偉達的股價一直在廣泛盤整,之後日元套戥交易的平倉破壞了全球市場,而這家人工智能巨頭的股票也隨之下跌。

On the day of the Aug. 5 global sell-off, the stock hit a low of $90.69 and bottomed at $98.91 on a closing basis two sessions later. Even as it staged a comeback, the second-quarter earnings report served as a downside trigger despite the company reporting year-over-year and sequential earnings and revenue growth. Revenue from data center revenue, a segment that includes hardware, especially AI accelerators sold to cloud service providers, reached a record. The third-quarter revenue guidance, though upbeat, was panned by some as marking the smallest increase relative to the consensus in several quarters.

在8月5日全球拋售當天,該股觸及90.69美元的低點,並在兩個交易日後收盤時觸底至98.91美元。儘管該公司報告了同比和連續的收益和收入增長,但第二季度收益報告仍是下行觸發因素。數據中心收入創歷史新高,該細分市場包括硬件,尤其是出售給雲服務提供商的人工智能加速器。第三季度的收入指引雖然樂觀,但被一些人批評爲幾個季度以來相對於共識的最小增幅。

A lack of resolution regarding the Blackwell 200 shipment timing also exerted downward pressure.

對Blackwell 200的發貨時間缺乏解決也帶來了下行壓力。

Macro Shock: The stock's struggles aggravated further as soft economic data stirred recession concerns and this heavily impacted growth stocks. To make matters worse, reports of a Department of Justice subpoena regarding monopoly in AI chips did the rounds although the company denied it.

宏觀衝擊:由於疲軟的經濟數據引發了對衰退的擔憂,這嚴重影響了成長型股票,該股的困境進一步加劇。更糟糕的是,司法部關於人工智能芯片壟斷的傳票的報道四處流傳,儘管該公司予以否認。

After the recent weakness, the stock trades at a forward price/earnings multiple of 37.88. Most analysts, convinced of its AI supremacy, recommend buying the stock on its weakness.

在最近的疲軟之後,該股的遠期市盈率爲37.88。大多數分析師堅信其人工智能的霸主地位,建議買入該股,理由是其疲軟。

Immediate support is around $103.6 and a break below the level could take the stock to $101.50, the level to which it gapped up in late May. On the further downside, it could drop to the psychological resistance of $100. The next support is around the $95 level.

直接支撐位在103.6美元左右,跌破該水平可能會使該股跌至101.50美元,該股在5月下旬跌至該水平。不利的一面是,它可能會跌至100美元的心理阻力位。下一個支撐位在95美元附近。

On the upside, overhead resistance is around $106.5 and around the $115 level.

從好的方面來看,上方阻力位在106.5美元左右和115美元附近。

Source: Benzinga Pro

資料來源:Benzinga Pro

In premarket trading, the stock fell 0.89% to $105.26, according to Benzinga Pro data, with the weakness aggravating after a very weak ADP payrolls report.

根據Benzinga Pro的數據,在盤前交易中,該股下跌0.89%,至105.26美元,在ADP就業報告非常疲軟之後,疲軟加劇。

Nvidia Stock Loses The Value Of McDonald's, Disney, Coinbase Combined Since Q2 Earnings: AI Darling's Decline Continues Tuesday

英偉達股票自第二季度業績以來麥當勞、迪士尼和Coinbase的總價值下跌:AI Darling週二繼續下跌

Image via Shutterstock

圖片來自 Shutterstock

On the day of the Aug. 5 global sell-off, the stock hit a low of $90.69 and bottomed at $98.91 on a closing basis two sessions later. Even as it staged a comeback, the second-quarter earnings report served as a downside trigger despite the company reporting year-over-year and sequential earnings and revenue growth. Revenue from data center revenue, a segment that includes hardware, especially AI accelerators sold to cloud service providers, reached a record. The third-quarter revenue guidance, though upbeat, was panned by some as marking the smallest increase relative to the consensus in several quarters.

On the day of the Aug. 5 global sell-off, the stock hit a low of $90.69 and bottomed at $98.91 on a closing basis two sessions later. Even as it staged a comeback, the second-quarter earnings report served as a downside trigger despite the company reporting year-over-year and sequential earnings and revenue growth. Revenue from data center revenue, a segment that includes hardware, especially AI accelerators sold to cloud service providers, reached a record. The third-quarter revenue guidance, though upbeat, was panned by some as marking the smallest increase relative to the consensus in several quarters.