Whales with a lot of money to spend have taken a noticeably bearish stance on Novo Nordisk.

Looking at options history for Novo Nordisk (NYSE:NVO) we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 66% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $187,270 and 4, calls, for a total amount of $298,402.

From the overall spotted trades, 5 are puts, for a total amount of $187,270 and 4, calls, for a total amount of $298,402.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $110.0 to $145.0 for Novo Nordisk over the last 3 months.

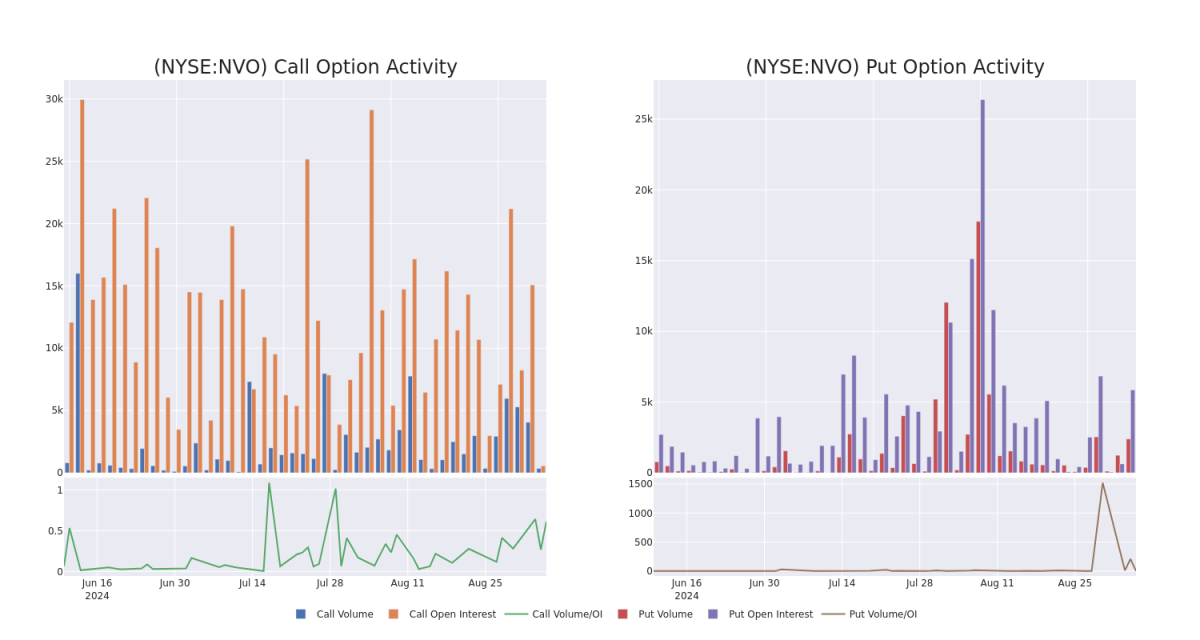

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Novo Nordisk's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Novo Nordisk's whale trades within a strike price range from $110.0 to $145.0 in the last 30 days.

Novo Nordisk Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| NVO | CALL | TRADE | BEARISH | 03/21/25 | $28.0 | $27.2 | $27.2 | $110.00 | $190.4K | 159 | 70 |

| NVO | CALL | SWEEP | BEARISH | 06/20/25 | $10.9 | $10.85 | $10.9 | $145.00 | $52.3K | 4 | 68 |

| NVO | PUT | SWEEP | BULLISH | 09/06/24 | $4.85 | $4.5 | $4.5 | $136.00 | $48.1K | 540 | 219 |

| NVO | PUT | SWEEP | BEARISH | 09/13/24 | $3.1 | $3.05 | $3.1 | $132.00 | $42.4K | 137 | 153 |

| NVO | PUT | SWEEP | BULLISH | 09/06/24 | $4.85 | $4.5 | $4.5 | $136.00 | $35.5K | 540 | 338 |

About Novo Nordisk

With roughly one third of the global branded diabetes treatment market, Novo Nordisk is the leading provider of diabetes-care products in the world. Based in Denmark, the company manufactures and markets a variety of human and modern insulins, injectable diabetes treatments such as GLP-1 therapy, oral antidiabetic agents, and obesity treatments. Novo also has a biopharmaceutical segment (constituting roughly 10% of revenue) that specializes in protein therapies for hemophilia and other disorders.

After a thorough review of the options trading surrounding Novo Nordisk, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Novo Nordisk

- Currently trading with a volume of 1,270,535, the NVO's price is down by -2.78%, now at $130.79.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 56 days.

What The Experts Say On Novo Nordisk

In the last month, 2 experts released ratings on this stock with an average target price of $160.0.

- An analyst from BMO Capital has decided to maintain their Outperform rating on Novo Nordisk, which currently sits at a price target of $160.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $160.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Novo Nordisk options trades with real-time alerts from Benzinga Pro.

有很多錢可以花的大戶對Novo Nordisk採取了明顯的看淡態度。

查看諾和諾德(NYSE:NVO)期權歷史數據,我們發現了9筆交易。

如果我們考慮每一次交易的具體情況,可以準確地說,33%的投資者持有看好預期,66%持有看淡預期。

從所有的交易中,有5筆是看跌期權,總金額爲187,270美元,4筆是看漲期權,總金額爲298,402美元。

從所有的交易中,有5筆是看跌期權,總金額爲187,270美元,4筆是看漲期權,總金額爲298,402美元。

預計價格目標

考慮到這些合約的成交量和持倉量,看來鯨魚們在過去的3個月裏將諾和諾德的價格區間定在了110.0美元至145.0美元之間。

成交量和未平倉量趨勢

在交易期權時,觀察成交量和持倉量是一個強大的舉措。這些數據可以幫助您追蹤給定行權價的諾和諾德期權的流動性和興趣。下面,我們可以觀察在過去30天內,110.0美元至145.0美元的價格區間內,所有諾和諾德鯨魚交易的看漲和看跌期權的成交量和持倉量的變化情況。

諾和諾德期權活動分析:最近30天

檢測到重大期權交易:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

NVO | CALL | TRADE | BEARISH | 03/21/25 | $28.0 | $27.2 | $27.2 | $110.00 | $190.4K | 159 | 70 |

NVO | CALL | SWEEP | BEARISH | 06/20/25 | $10.9 | $10.85 | $10.9 | $145.00 | $52.3K | 4 | 68 |

NVO | PUT | SWEEP | BULLISH | 09/06/24 | $4.85 | $4.5 | $4.5 | $136.00 | $48.1K | 540 | 219 |

NVO | PUT | SWEEP | BEARISH | 09/13/24 | $3.1 | $3.05 | $3.1 | $132.00 | $42.4K | 137 | 153 |

NVO | PUT | SWEEP | BULLISH | 09/06/24 | $4.85 | $4.5 | $4.5 | $136.00 | $35.5K | 540 | 338 |

諾和諾德是一家領先的全球醫療保健公司,致力於研發創新藥品,幫助患糖尿病的患者過上更長壽、更健康的生活,這一傳統已有100多年。這種傳統爲我們提供了經驗和能力,使我們能夠推動變革,幫助人們戰勝其他嚴重的慢性疾病,如肥胖症、罕見的血液和內分泌紊亂。我們始終堅信,持久的成功公式是保持專注,長遠思考,並以財務、社會和環境負責任的方式做生意。諾和諾德在新澤西州設有美國總部,在7個州加上華盛頓特區擁有商業、生產和研究設施,在全國約有8000名員工。有關更多信息,訪問novonordisk-us.com,Facebook、Instagram和X。

作爲全球治療糖尿病品牌市場三分之一的領先者,丹麥的Novo Nordisk公司是世界上提供糖尿病護理產品的主要製造商和市場推廣者。該公司製造和銷售各種人體和現代胰島素、GLP-1療法等可注射糖尿病治療藥物、口服降糖藥以及肥胖症治療藥物。Novo Nordisk還有一個生物製藥部門(約佔營收的10%),專門從事血友病和其他疾病的蛋白質療法。

經過對諾和諾德期權交易的全面審查,我們將進一步對該公司進行詳細審查。 這包括對其當前市場地位和業績的評估。

Novo Nordisk的現有市場地位

目前成交量爲1,270,535,NVO的價格下跌-2.78%,目前爲$130.79。

RSI讀數表明該股票目前處於中立狀態,處於超買和超賣之間。

預計的盈利發佈還有56天。

專家對諾和諾德的評價

在過去一個月中,有2位專家發佈了這支股票的評級,平均目標價爲160.0美元。

期權交易具有更高的風險和潛在回報。精明的交易者通過不斷教育自己、調整策略、監控多種因子和密切關注市場動態來管理這些風險。通過Benzinga Pro實時警報了解最新的Novo Nordisk期權交易情況。

從所有的交易中,有5筆是看跌期權,總金額爲187,270美元,4筆是看漲期權,總金額爲298,402美元。

從所有的交易中,有5筆是看跌期權,總金額爲187,270美元,4筆是看漲期權,總金額爲298,402美元。

From the overall spotted trades, 5 are puts, for a total amount of $187,270 and 4, calls, for a total amount of $298,402.

From the overall spotted trades, 5 are puts, for a total amount of $187,270 and 4, calls, for a total amount of $298,402.