Spotlight on Thermo Fisher Scientific: Analyzing the Surge in Options Activity

Spotlight on Thermo Fisher Scientific: Analyzing the Surge in Options Activity

Deep-pocketed investors have adopted a bearish approach towards Thermo Fisher Scientific (NYSE:TMO), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in TMO usually suggests something big is about to happen.

深口袋的投資者對賽默飛世爾採取了看淡的態度,市場參與者不應忽視這一點。Benzinga跟蹤的公開期權記錄揭示了今天的重大舉動。這些投資者的身份還不清楚,但通常這樣重大的舉動意味着將要發生一些重大的事情。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for Thermo Fisher Scientific. This level of activity is out of the ordinary.

今天我們從Benzinga的期權掃描儀中獲得了這個信息,那裏突出了賽默飛世爾的8個非同尋常的期權活動。這種活動水平是不同尋常的。

The general mood among these heavyweight investors is divided, with 37% leaning bullish and 62% bearish. Among these notable options, 2 are puts, totaling $62,734, and 6 are calls, amounting to $487,222.

這些重要投資者中的普遍情緒存在分歧,37%傾向於看好,62%傾向於看淡。在這些引人注目的期權中,有2個看跌期權,總額爲62,734美元,有6個看漲期權,總額爲487,222美元。

Predicted Price Range

預測價格區間

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $530.0 to $710.0 for Thermo Fisher Scientific during the past quarter.

分析這些合同的成交量和持倉量,似乎這些大玩家在過去一個季度一直關注着賽默飛世爾的價格區間爲530.0到710.0美元。

Volume & Open Interest Trends

成交量和未平倉量趨勢

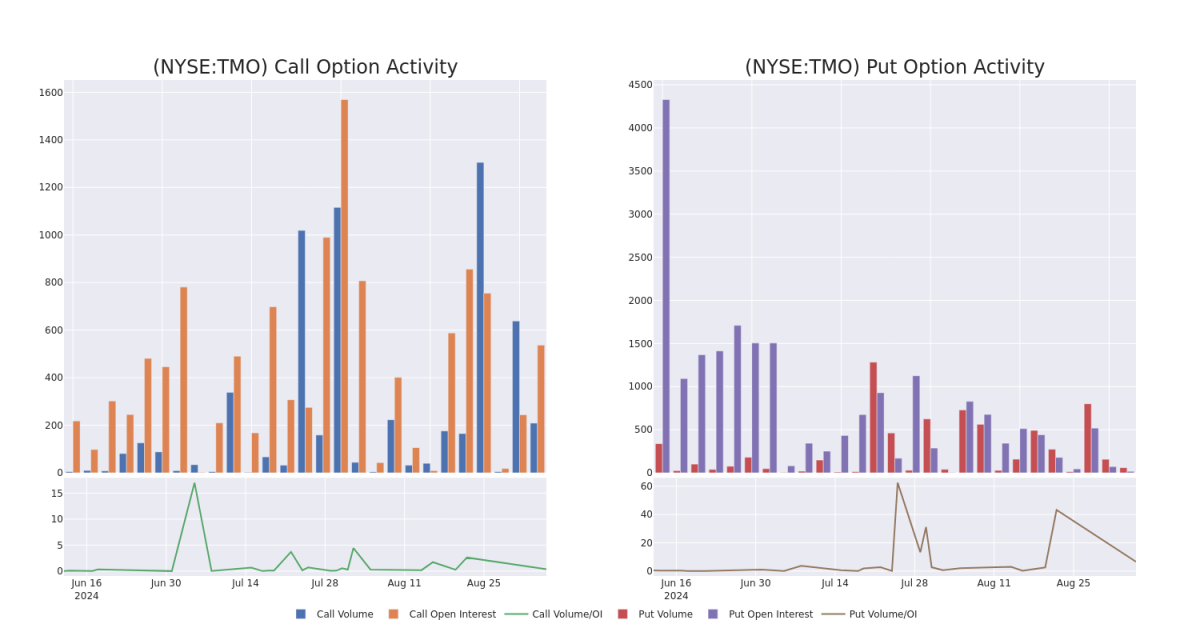

In today's trading context, the average open interest for options of Thermo Fisher Scientific stands at 69.25, with a total volume reaching 268.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Thermo Fisher Scientific, situated within the strike price corridor from $530.0 to $710.0, throughout the last 30 days.

在今天的交易背景下,賽默飛世爾的期權的平均持倉量爲69.25,總成交量達到268.00。隨附的圖表描述了在賽默飛世爾的530.0至710.0美元行權價格走廊內,過去30天內高價值交易的看漲和看跌期權的成交量和持倉量的變化。

Thermo Fisher Scientific Option Activity Analysis: Last 30 Days

賽默飛世爾期權活動分析:最近30天

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMO | CALL | TRADE | BEARISH | 01/17/25 | $96.6 | $90.8 | $93.0 | $530.00 | $167.4K | 172 | 18 |

| TMO | CALL | TRADE | BEARISH | 03/21/25 | $83.5 | $82.0 | $82.0 | $550.00 | $147.6K | 2 | 18 |

| TMO | CALL | TRADE | BULLISH | 12/20/24 | $43.4 | $41.6 | $43.2 | $590.00 | $69.1K | 59 | 37 |

| TMO | CALL | SWEEP | BULLISH | 10/18/24 | $4.1 | $4.0 | $4.1 | $650.00 | $37.7K | 73 | 112 |

| TMO | CALL | SWEEP | BULLISH | 01/16/26 | $37.5 | $34.8 | $36.39 | $710.00 | $36.5K | 54 | 32 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMO | 看漲 | 交易 | 看淡 | 01/17/25 | $96.6 | $90.8 | 93.0美元 | $530.00 | $167.4K | 172 | 18 |

| TMO | 看漲 | 交易 | 看淡 | 03/21/25 | $83.5 | $82.0 | $82.0 | $550.00 | $147.6K | 2 | 18 |

| TMO | 看漲 | 交易 | 看好 | 12/20/24 | $43.4 | $41.6 | $43.2 | 590.00美元 | $69.1K | 59 | 37 |

| TMO | 看漲 | SWEEP | 看好 | 10/18/24 | $4.1 | $4.0 | $4.1 | $650.00 | $37.7千美元 | 73 | 112 |

| TMO | 看漲 | SWEEP | 看好 | 01/16/26 | $37.5 | 34.8美元 | $36.39 | $710.00 | $36.5K | 54 | 32 |

About Thermo Fisher Scientific

關於賽默飛世爾科技(Thermo Fisher Scientific)

Thermo Fisher Scientific sells scientific instruments and laboratory equipment, diagnostics consumables, and life science reagents. The firm operates through four segments as of end-2023 (revenue figures include some cross-segment revenue): analytical technologies (17% of sales); specialty diagnostic products (10%); life science solutions (23%); and lab products and services, which includes CRO services (54%).

Thermo Fisher Scientific出售科學儀器和實驗室設備、診斷消耗品和生命科學試劑。截至2023年底,該公司通過四個板塊(營業收入包括某些跨板塊營業收入)運營:分析技術(銷售額的17%);專業診斷產品(10%);生命科學解決方案(23%);以及實驗室產品和服務,其中包括CRO服務(54%)。

Following our analysis of the options activities associated with Thermo Fisher Scientific, we pivot to a closer look at the company's own performance.

在對賽默飛世爾相關期權活動進行分析後,我們轉而更近距離地觀察公司自身的表現。

Where Is Thermo Fisher Scientific Standing Right Now?

賽默飛世爾當前處於什麼位置?

- Trading volume stands at 593,628, with TMO's price down by -0.01%, positioned at $611.84.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 48 days.

- 交易成交量爲593,628,TMO的價格下跌-0.01%,定位在611.84美元。

- RSI指標顯示該股票可能接近超買。

- 預計在48天內公佈盈利。

Professional Analyst Ratings for Thermo Fisher Scientific

賽默飛世爾的專業分析師評級

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $670.0.

過去30天,共有1位專業分析師對該股票給出了評級,設定了平均目標價格爲$670.0。

- An analyst from Wells Fargo downgraded its action to Overweight with a price target of $670.

- 富國銀行的分析師將其評級下調爲超重,目標價格爲$670。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $530.0 to $710.0 for Thermo Fisher Scientific during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $530.0 to $710.0 for Thermo Fisher Scientific during the past quarter.