This Is What Whales Are Betting On Unity Software

This Is What Whales Are Betting On Unity Software

Whales with a lot of money to spend have taken a noticeably bullish stance on Unity Software.

有大量資金的鯨魚顯然看好 Unity Software。

Looking at options history for Unity Software (NYSE:U) we detected 12 trades.

查看Unity Software (紐交所:U)的期權歷史,我們發現了12筆交易。

If we consider the specifics of each trade, it is accurate to state that 66% of the investors opened trades with bullish expectations and 33% with bearish.

如果我們考慮到每一筆交易的具體情況,可以準確地說有66%的投資者持看好預期開倉,33%的投資者持看淡預期開倉。

From the overall spotted trades, 3 are puts, for a total amount of $108,369 and 9, calls, for a total amount of $477,110.

從所有交易中,有3筆看跌期權交易,總金額爲108,369美元,以及9筆看漲期權交易,總金額爲477,110美元。

Predicted Price Range

預測價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.0 to $31.0 for Unity Software over the last 3 months.

根據這些合約的成交量和持倉量,大型投資者在過去3個月裏一直將Unity Software的目標價區間設定爲10.0美元至31.0美元。

Volume & Open Interest Trends

成交量和未平倉量趨勢

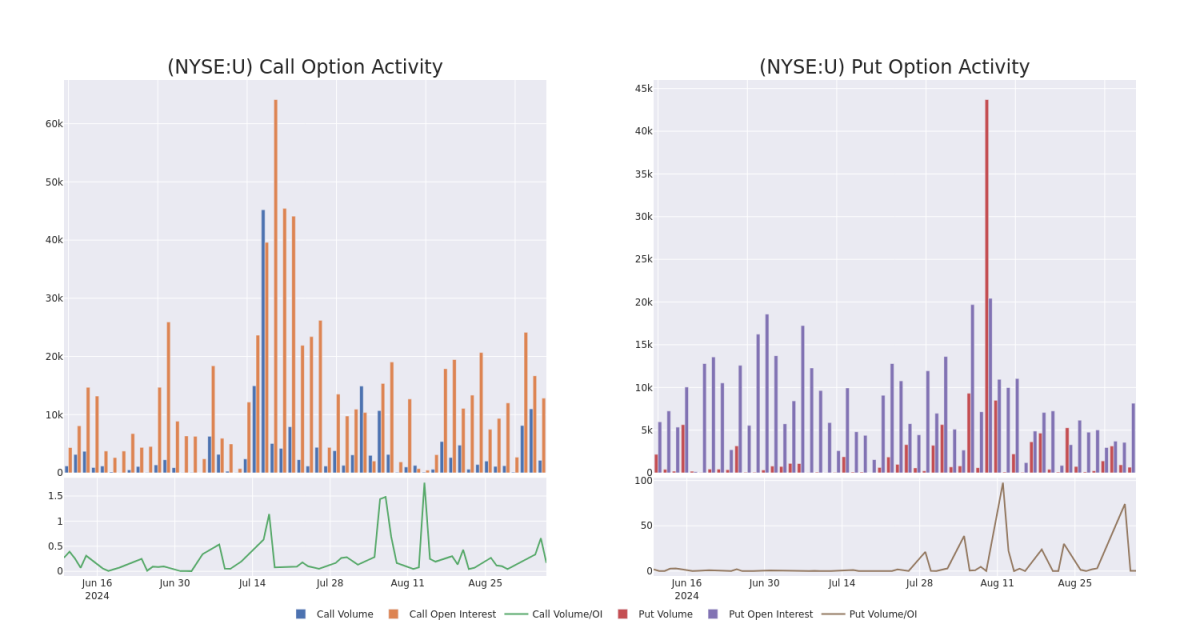

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Unity Software's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Unity Software's substantial trades, within a strike price spectrum from $10.0 to $31.0 over the preceding 30 days.

評估成交量和持倉量是期權交易的一個戰略步驟。這些指標揭示了特定行權價格下Unity Software期權的流動性和投資者興趣。下面的數據可視化顯示了過去30天內與Unity Software大手交易相關的看漲和看跌期權的成交量和持倉量的波動,行權價格區間爲10.0美元至31.0美元。

Unity Software Option Activity Analysis: Last 30 Days

Unity Software Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| U | CALL | SWEEP | BULLISH | 01/17/25 | $2.47 | $2.43 | $2.46 | $17.50 | $95.0K | 3.6K | 464 |

| U | CALL | SWEEP | BEARISH | 01/16/26 | $5.95 | $5.8 | $5.8 | $15.00 | $80.7K | 2.8K | 147 |

| U | CALL | TRADE | BEARISH | 11/15/24 | $6.7 | $6.65 | $6.65 | $10.00 | $66.5K | 619 | 100 |

| U | CALL | SWEEP | BULLISH | 01/17/25 | $2.57 | $2.55 | $2.57 | $17.50 | $51.4K | 3.6K | 772 |

| U | CALL | SWEEP | BULLISH | 11/15/24 | $1.8 | $1.77 | $1.8 | $17.00 | $45.0K | 1.6K | 12 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| U | 看漲 | SWEEP | 看好 | 01/17/25 | $2.47 | $2.43 | $2.46 | $17.50 | 95.0千美元 | 3.6千 | 464 |

| U | 看漲 | SWEEP | 看淡 | 01/16/26 | $5.95 | $5.8 | $5.8 | 15.00美元 | $80.7K | 2.8K | 147 |

| U | 看漲 | 交易 | 看淡 | 11/15/24 | $6.7 | $6.65 | $6.65 | $10.00 | $66.5K | 619 | 100 |

| U | 看漲 | SWEEP | 看好 | 01/17/25 | $2.57 | $2.55 | $2.57 | $17.50 | $51.4K | 3.6千 | 772 |

| U | 看漲 | SWEEP | 看好 | 11/15/24 | $1.8 | $1.77 | $1.8 | $17.00 | $45.0K | 1.6K | 12 |

About Unity Software

關於 Unity Software

Unity Software Inc provides a software platform for creating and operating interactive, real-time 3D content. The platform can be used to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The business is spread across the United States, Greater China, EMEA, APAC, and Other Americas, of which key revenue is derived from the EMEA region. The products are used in the gaming industry, architecture and construction sector, animation industry, and designing sector.

Unity Software Inc提供了一個用於創建和操作交互式、實時3D內容的軟件平台。該平台可用於爲手機、平板電腦、個人電腦、遊戲機以及增強和虛擬現實設備創建、運行和貨幣化交互式、實時2D和3D內容。該業務遍佈美國、大中華、歐洲、中東、非洲、亞太和其他美洲,其中主要營業收入來自歐洲、中東和非洲地區。這些產品在遊戲行業、建築和施工行業、動畫行業和設計行業中使用。

Following our analysis of the options activities associated with Unity Software, we pivot to a closer look at the company's own performance.

在分析與 Unity Software 相關的期權活動後,我們將目光轉向公司的表現。

Unity Software's Current Market Status

Unity Software的當前市場狀況

- With a volume of 10,373,253, the price of U is up 6.65% at $17.0.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 63 days.

- 成交量爲10,373,253,U的價格上漲了6.65%,達到17.0美元。

- RSI指標暗示該股票可能要超買了。

- 下一次業績預計在63天發佈。

Professional Analyst Ratings for Unity Software

Unity Software的專業分析師評級

5 market experts have recently issued ratings for this stock, with a consensus target price of $16.9.

有5位市場專家最近對該股票發表了評級意見,一致認爲目標價是16.9美元。

- An analyst from Benchmark persists with their Sell rating on Unity Software, maintaining a target price of $10.

- An analyst from Needham persists with their Buy rating on Unity Software, maintaining a target price of $23.

- An analyst from Goldman Sachs has decided to maintain their Neutral rating on Unity Software, which currently sits at a price target of $22.

- Maintaining their stance, an analyst from Macquarie continues to hold a Underperform rating for Unity Software, targeting a price of $12.

- Reflecting concerns, an analyst from Piper Sandler lowers its rating to Neutral with a new price target of $17.

- Benchmark的一位分析師繼續給Unity Software標註爲賣出,目標價維持在10美元。

- Needham的一位分析師繼續給Unity Software標註爲買入,目標價維持在23美元。

- 高盛的一位分析師決定維持對Unity Software的中立評級,並將目標價設定在22美元。

- 麥格理的一位分析師繼續保持對Unity Software的弱表現評級,目標價爲12美元。

- 受到擔憂的影響,派傑投資的分析師將其評級下調至中立,目標價爲$17。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Unity Software with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易員通過持續教育、戰略性交易調整、利用各種指標以及保持對市場動態的關注來減輕這些風險。通過Benzinga Pro實時警報及時了解Unity Software的最新期權交易。