Concerns Surrounding Baimtec MaterialLtd's (SHSE:688563) Performance

Concerns Surrounding Baimtec MaterialLtd's (SHSE:688563) Performance

Baimtec Material Co.,Ltd.'s (SHSE:688563) healthy profit numbers didn't contain any surprises for investors. We think this is due to investors looking beyond the statutory profits and being concerned with what they see.

Baimtec 材料有限公司, Ltd. 's(上海證券交易所代碼:688563)健康的利潤數字並沒有讓投資者感到意外。我們認爲這是由於投資者將目光投向了法定利潤之外並關注他們所看到的情況。

Zooming In On Baimtec MaterialLtd's Earnings

放大Baimtec MaterialLTD的收益

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

用於衡量公司將其利潤轉換爲自由現金流(FCF)的情況的一個關鍵財務比率是應計比率。簡而言之,該比率從淨利潤中減去FCF,然後將該數字除以該時期公司的平均運營資產。這個比率告訴我們,一家公司的利潤中有多少沒有自由現金流的支持。

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

因此,當公司的應計比率爲負時,這實際上被認爲是一件好事,但如果其應計比率爲正,則是一件壞事。雖然應計比率高於零並不令人擔憂,但我們確實認爲,當公司的應計比率相對較高時,值得注意。值得注意的是,有一些學術證據表明,總的來說,高應計率對短期利潤來說是個壞兆頭。

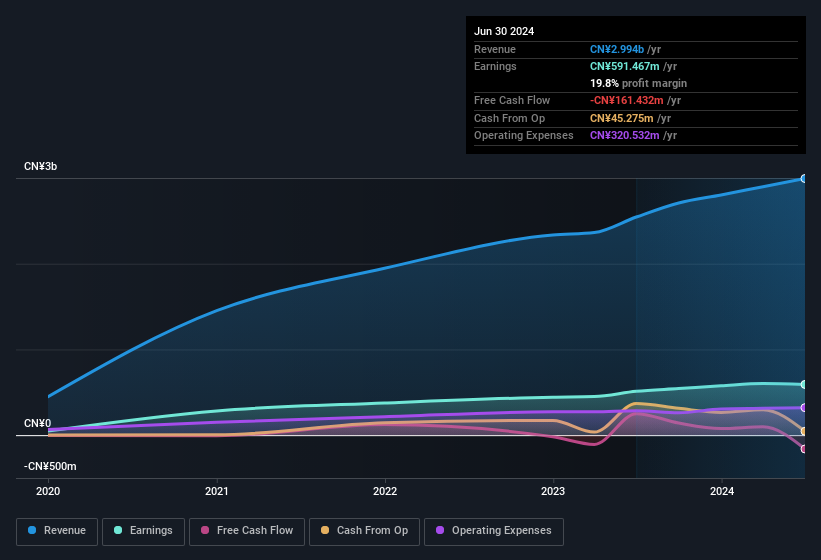

Baimtec MaterialLtd has an accrual ratio of 0.27 for the year to June 2024. Unfortunately, that means its free cash flow fell significantly short of its reported profits. Over the last year it actually had negative free cash flow of CN¥161m, in contrast to the aforementioned profit of CN¥591.5m. It's worth noting that Baimtec MaterialLtd generated positive FCF of CN¥250m a year ago, so at least they've done it in the past. Having said that, there is more to the story. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

截至2024年6月的一年中,Baimtec MaterialLTD的應計比率爲0.27。不幸的是,這意味着其自由現金流遠低於其報告的利潤。去年,它的自由現金流實際上爲負16100萬元人民幣,而上述利潤爲59150萬元人民幣。值得注意的是,Baimtec MaterialLTD在一年前創造了25000萬元人民幣的正FCF,因此至少他們過去曾這樣做過。話雖如此,故事還有更多。我們可以看到,不尋常的項目影響了其法定利潤,從而影響了應計比率。

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

這可能會讓你想知道分析師對未來盈利能力的預測。幸運的是,您可以單擊此處查看根據他們的估計描繪未來盈利能力的交互式圖表。

The Impact Of Unusual Items On Profit

不尋常物品對利潤的影響

Given the accrual ratio, it's not overly surprising that Baimtec MaterialLtd's profit was boosted by unusual items worth CN¥48m in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

考慮到應計比率,在過去的十二個月中,Baimtec MaterialLTD的利潤因價值4800萬元人民幣的不尋常物品而提振也就不足爲奇了。我們不能否認更高的利潤通常會讓我們感到樂觀,但如果利潤是可持續的,我們更願意這樣做。當我們計算數千家上市公司的數字時,我們發現,特定年份中不尋常的項目所帶來的提振通常不會在第二年重演。考慮到這個名字,這並不奇怪。假設這些不尋常的項目在本年度不會再次出現,因此我們預計明年的利潤將疲軟(也就是說,在業務沒有增長的情況下)。

Our Take On Baimtec MaterialLtd's Profit Performance

我們對Baimtec MaterialLTD利潤表現的看法

Summing up, Baimtec MaterialLtd received a nice boost to profit from unusual items, but could not match its paper profit with free cash flow. For the reasons mentioned above, we think that a perfunctory glance at Baimtec MaterialLtd's statutory profits might make it look better than it really is on an underlying level. If you'd like to know more about Baimtec MaterialLtd as a business, it's important to be aware of any risks it's facing. To that end, you should learn about the 2 warning signs we've spotted with Baimtec MaterialLtd (including 1 which is significant).

總而言之,Baimtec MaterialLTD從不尋常的物品中獲得了不錯的利潤提振,但其紙面利潤無法與自由現金流相提並論。出於上述原因,我們認爲,敷衍地看一眼Baimtec MaterialLTD的法定利潤可能會使其看起來比實際水平要好。如果您想進一步了解Baimtec MaterialLTD作爲一家企業,請務必了解其面臨的任何風險。爲此,你應該了解我們在Baimtec MaterialLTD中發現的兩個警告信號(包括一個重要的警告信號)。

Our examination of Baimtec MaterialLtd has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

我們對Baimtec MaterialLTD的審查側重於某些可能使其收益看起來好於實際的因素。而且,在此基礎上,我們有些懷疑。但是,還有很多其他方法可以讓你對公司的看法。有些人認爲高股本回報率是優質業務的好兆頭。雖然可能需要你進行一些研究,但你可能會發現這份免費收集的擁有高股本回報率的公司,或者這份擁有大量內幕持股的股票清單很有用。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接聯繫我們。或者,也可以發送電子郵件至編輯團隊 (at) simplywallst.com。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

Baimtec MaterialLtd has an accrual ratio of 0.27 for the year to June 2024. Unfortunately, that means its free cash flow fell significantly short of its reported profits. Over the last year it actually had

Baimtec MaterialLtd has an accrual ratio of 0.27 for the year to June 2024. Unfortunately, that means its free cash flow fell significantly short of its reported profits. Over the last year it actually had