3 Key factors driving gold surge and future outlook: Analyst expects $3000

3 Key factors driving gold surge and future outlook: Analyst expects $3000

Global stock market took a hit amid the "September effect," with $Nasdaq Composite Index (.IXIC.US)$ falling 3.26%, $S&P 500 Index (.SPX.US)$ down 2.12%, and $Dow Jones Industrial Average (.DJI.US)$ off 1.51% on Tuesday. Asian markets also dipped in the following trading day, with $Nikkei 225 (.N225.JP)$ down 4.24% and $S&P/ASX 200 (.XJO.AU)$ sliding 1.88%. The sell-off followed the weaker-than-expected US ISM manufacturing data, raising economic concerns but possibly boosting the odds of a Fed rate cut. In this context, gold, as a safe-haven asset, stands out, outperforming the broader market. Gold prices have risen approximately 21% this year, outpacing the S&P 500's year-to-date increase of 15.73%.

全球股市在"九月效應"下受到衝擊, $納斯達克綜合指數 (.IXIC.US)$ 下跌3.26%, $標普500指數 (.SPX.US)$ 下跌2.12%, $道瓊斯指數 (.DJI.US)$ 下跌1.51%。亞洲市場也在隨後的交易日中出現了下跌, $日經225 (.N225.JP)$ 下跌4.24%並 $S&P/ASX 200 (.XJO.AU)$ 滑落1.88%。這次拋售是由於美國ISM製造業數據不及預期,引發了經濟擔憂,但可能增加了聯儲局減息的可能性。在這種背景下,作爲避險資產的黃金顯得突出,表現優於整個市場。黃金價格今年已經上漲了約21%,超過了標普500指數年初至今的15.73%的增長。

Key factors driving gold prices this year

今年推動黃金價格上漲的關鍵因素

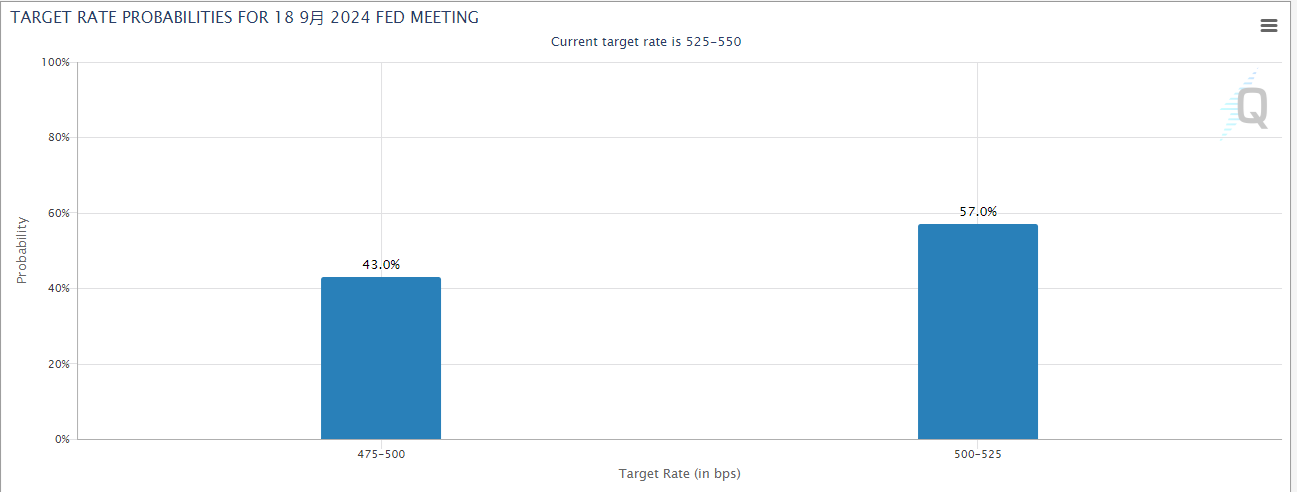

Fed's rate cut expectation. The Federal Reserve's monetary policy, particularly rate cuts, significantly influence gold prices. Typically, a Fed rate cut leads to a depreciation of the US dollar, consequently boosting the price of gold, which is priced in dollars. Additionally, rate reductions affect real interest rates, diminishing the opportunity cost for investors holding gold and thereby further stimulating demand and elevating gold prices. Currently, economic indicators and recent Fed communications indicate that a rate cut in September is increasingly likely, although the market remains divided on the extent of the cut. According to the CME Group's FedWatch tool, the probability of a rate cut of 25 basis points is 57%, while the probability of a 50 basis points cut is 43%.

聯儲局的減息預期。聯儲局的貨幣政策,特別是減息,對黃金價格產生了重大影響。通常情況下,聯儲局減息會導致美元貶值,從而提高黃金價格,因爲黃金是以美元計價的。此外,減息還會影響實際利率,減少持有黃金的投資者的機會成本,從而進一步刺激需求,推高黃金價格。目前,經濟指標和最近的聯儲局溝通顯示,9月減息的可能性越來越大,儘管市場對減息程度存在分歧。根據芝加哥商品交易所的FedWatch工具,25個點子減息的概率爲57%,50個點子減息的概率爲43%。

Rising geopolitical tensions. Geopolitical tensions are driving a surge in market risk aversion, prompting investors to seek sanctuary in safe-haven assets. Gold, with its storied history as a stable and reliable asset, is garnering favor amid volatility. This year has seen a steady climb in geopolitical risks, from Middle Eastern unrest to the ongoing conflict between Russia and Ukraine, bolstering demand for gold as a hedge against uncertainty.

地緣政治緊張局勢升高。地緣政治緊張局勢正在推動市場風險迴避措施的激增,促使投資者尋求安全避風港。黃金以其穩定可靠的性質而備受青睞,在波動中獲得了支撐。今年以來,地緣政治風險穩步上升,從中東動盪到俄羅斯和烏克蘭之間的持續衝突,推動了對黃金作爲不確定性對沖的需求。

Central banks around the world increase gold reserves. In recent years, as the US dollar's creditworthiness has been on the decline and the US fiscal deficit has been growing, the global demand for gold reserves has been steadily rising. The World Gold Council reports a significant uptick in holdings, jumping from 1,082 tons in 2022 to 1,030 tons in 2023, and a further 483 tons in the first half of this year, marking an all-time high for that period. This trend underscores central banks' robust confidence in gold as a reserve asset, indicating sustained demand.

全球各國的央行增加了黃金儲備。近年來,隨着美元的信譽下降和美國財政赤字的增長,全球對黃金儲備的需求穩步增長。世界黃金協會報告顯示,黃金儲備持有量顯著上升,從2022年的1,082噸增加到2023年的1,030噸,今年上半年再增加了483噸,創下該時期的歷史新高。這一趨勢凸顯了央行對黃金作爲儲備資產的強勁信心,表明需求持續增長。

Gold outlook: US labor market emerges as a key indicator

黃金前景:美國勞動力市場成爲關鍵指標

Gold investors are supposed to take a close look at this Friday's release of the US non-farm payrolls report for clues on future gold price movements. A resilient jobs market could signal the Federal Reserve's inclination towards a more moderate rate cut, potentially exerting downward pressure on gold prices and continuing the current correction trend. Conversely, a significant shortfall in employment data might increase the likelihood of deeper Fed rate cuts, propelling gold prices upwards and potentially driving a new rally to record highs.

黃金投資者應密切關注本週五發佈的美國非農就業報告,以獲取未來黃金價格走勢的線索。強勁的就業市場可能表明聯儲局對更溫和減息的偏好,可能對黃金價格施加下行壓力,延續當前的修正趨勢。相反,就業數據的明顯不足可能增加聯儲局進一步減息的可能性,推動黃金價格上漲,潛在推動新的漲勢創下歷史新高。

Bank of America's commodity strategy team reaffirms its forecast for gold to surpass the $3,000 per ounce milestone next year, consistent with its previous estimates. Despite gold prices reaching a record high above $2,500 per ounce this year, the team maintains its confidence in gold's potential to challenge the $3,000 threshold within the next 12 to 18 months, driven not by commercial buying but by non-commercial demand.

美國銀行的商品策略團隊重申了明年黃金超過每盎司3,000美元的預測,與之前的估計相一致。儘管今年黃金價格創下每盎司2,500美元的歷史新高,該團隊仍然對黃金挑戰每盎司3,000美元閾值的潛力保持信心,這不是由商業購買驅動,而是由非商業需求驅動。

Macquarie, on the other hand, anticipates the US Federal Reserve will enter a rate-cutting cycle, with recent weak economic data potentially leading to faster and more aggressive policy easing than expected. This outlook is expected to sustain the strength in gold prices, with Macquarie's commodities team forecasting gold to reach $2,277 per ounce this year and $2,425 per ounce next year, highlighting gold as a short-term winner.

另一方面,麥格理預計聯儲局將進入減息週期,最近的經濟數據疲軟可能導致政策寬鬆的速度和力度超出預期。這一前景預計將支撐黃金價格的強勁表現,麥格理的大宗商品團隊預測今年黃金價格將達到每盎司2,277美元,明年達到每盎司2,425美元,強調黃金是短期的贏家。

Goldman Sachs analyst Stephen Quinn forecasts in a report titled “Go for Gold” that gold has the highest potential for price increases among commodities, with a target of $2,700 per ounce by early 2025. Goldman Sachs’ bullish outlook for gold is underpinned by three key factors:

高盛分析師Stephen Quinn在一份名爲「Go for Gold」的報告中預計,黃金是商品中潛力最高的,目標是2025年初每盎司2700美元。高盛對黃金的看漲態度基於三個關鍵因素:

US Debt Crisis: We believe that due to concerns about US financial sanctions and US sovereign debt, global central bank gold purchases have doubled since mid-2022, which is structural, and this situation will continue regardless of whether the concerns materialize or not.

Fed Rate Cuts: Fed rate cuts will attract Western capital back to the gold market, and the momentum of a significant increase in gold prices over the past two years has not materialized.

Hedging Value: Gold provides important hedging value for portfolios to withstand geopolitical impacts such as tariffs, Fed subordination risks, and debt concerns.

美國債務危機:我們認爲,由於對美國金融制裁和美國主權債務的擔憂,全球央行購買黃金的數量自2022年中期以來翻了一番,這是結構性的,無論這些擔憂是否發生,這種情況都將持續下去。

聯儲局減息:聯儲局的減息將吸引西方資本回流黃金市場,然而,過去兩年黃金價格大幅上漲的勢頭並沒有實現。

對沖價值:黃金對於投資組合提供了重要的對沖價值,以抵禦地緣政治影響,如關稅、聯儲局的隸屬風險和債務擔憂。

How to seize opportunities for potentially rising gold prices?

如何抓住潛在上漲的黃金價格機會?

Gold ETFs:

黃金etf:

ETF offers a convenient way to invest in gold without the need for physical storage, making it accessible to a broad range of investors.

ETF提供了一種便捷的方式來投資黃金,無需實體儲存,適用於廣大投資者。

1. $SPDR黄金ETF(GLD.US)$, the gold ETF with the largest assets under management (AUM), aims to track the price of gold bullion. It has experienced a gain of over 21% this year and 62% over the past five years.

1。SPDR黃金ETF(GLD.US)黃金etf是資產管理規模最大的etf,旨在跟蹤黃金價格。今年已經經歷了超過21%的漲幅,過去五年增長了62%。

2. $ProShares两倍做多黄金ETF(UGL.US)$ seeks to provide double the daily return of the Bloomberg Gold Subindex, designed for investors looking for leveraged exposure to gold prices. This ETF has recorded gains of over 37% this year and 79% over the past five years.

2。$ProShares兩倍做多黃金etf(UGL.US) 旨在提供布倫特黃金子指數日收益翻倍的etf,旨在爲尋求黃金價格槓桿曝光的投資者而設計。該etf今年錄得超過37%的增長,過去五年錄得79%的增長。

Gold Mining Stocks:

黃金股:

Investing in gold mining companies can offer leveraged exposure to gold prices. However, it's important to note that these investments come with additional risks related to the mining industry, such as operational challenges and regulatory issues. Here are some prominent gold mining stocks:

投資黃金礦業公司可以爲投資者提供對黃金價格的槓桿曝光。但需要注意的是,這些投資伴隨着與礦業相關的額外風險,如運營挑戰和監管問題。以下是一些知名的黃金礦業股票:

1. $纽曼矿业(NEM.US)$, listed on AU, US and CA, is the world largest gold mining corporation with the market cap of about USD$60 billion and it has a diverse portfolio of gold mines around the globe. Last month, the company reported an profit of $834 million, or $0.74 per share, for the recent quarter, which is alomst three times higher than the same period last year.

1。$紐曼礦業(NEm.US)$, listed on AU, US and CA, is the world largest gold mining corporation with the market cap of about USD$600億 and it has a diverse portfolio of gold mines around the globe. Last month, the company reported an profit of $83400萬, or $0.74 per share, for the recent quarter, which is alomst three times higher than the same period last year.

2. $伊格尔矿业(AEM.US)$ : This Canadian-based company ranks as the third largest gold producer in the world with operations in Canada, Australia, Finlan and Mexico. It has significantly outperformed Gold price this year, surging over 51% YTD, and offers a 1.97% dividend yield, distributing $0.4 per share on a quarter basis.

2。$伊格爾礦業(AEm.US)$ : This Canadian-based company ranks as the third largest gold producer in the world with operations in Canada, Australia, Finlan and Mexico. It has significantly outperformed Gold price this year, surging over 51% YTD, and offers a 1.97% dividend yield, distributing $0.4 per share on a quarter basis.

3. $巴里克黄金(GOLD.US)$ : One of the world's largest gold mining companies, Barrick Gold operates mines and projects in various countries. Jon Mills, mining equity analyst from Morningstar, metioned that gold companies like Barrick tend not to follow general economic cycles, providing a hedge to inflation risk.

3. $巴里克黃金(GOLD.US)$ : One of the world's largest gold mining companies, Barrick Gold operates mines and projects in various countries. Jon Mills, mining equity analyst from Morningstar, metioned that gold companies like Barrick tend not to follow general economic cycles, providing a hedge to inflation risk.

Source: CME Group, Goldman Sachs, Macquarie, Bank of America, Bloomberg

來源:芝加哥商品交易所,高盛,麥格理,美國銀行,彭博