FuboTV Inc. (NYSE:FUBO) Stock Rockets 33% But Many Are Still Ignoring The Company

FuboTV Inc. (NYSE:FUBO) Stock Rockets 33% But Many Are Still Ignoring The Company

The fuboTV Inc. (NYSE:FUBO) share price has done very well over the last month, posting an excellent gain of 33%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 45% over that time.

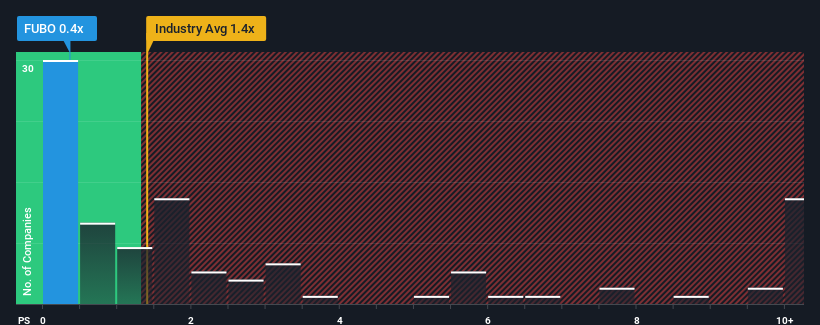

Although its price has surged higher, fuboTV may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Interactive Media and Services industry in the United States have P/S ratios greater than 1.4x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How fuboTV Has Been Performing

fuboTV certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think fuboTV's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

fuboTV's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 29% last year. The strong recent performance means it was also able to grow revenue by 266% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 13% as estimated by the nine analysts watching the company. That's shaping up to be similar to the 13% growth forecast for the broader industry.

In light of this, it's peculiar that fuboTV's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift fuboTV's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that fuboTV currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for fuboTV that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.