What the Options Market Tells Us About PayPal Holdings

What the Options Market Tells Us About PayPal Holdings

Investors with a lot of money to spend have taken a bearish stance on PayPal Holdings (NASDAQ:PYPL).

有很多錢可以花的投資者對paypal(納斯達克:pypl)持懷疑態度。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄中發現,今天這些頭寸已經出現了。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with PYPL, it often means somebody knows something is about to happen.

無論這些機構還是富人,我們都不知道。但是當pypl發生這麼大的事情時,通常意味着有人知道即將發生的事情。

Today, Benzinga's options scanner spotted 21 options trades for PayPal Holdings.

今天,Benzinga的期權掃描器發現了21筆paypal控股的期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 19% bullish and 76%, bearish.

這些大手交易者的整體情緒分爲19%看漲和76%看淡。

Out of all of the options we uncovered, there was 1 put, for a total amount of $27,000, and 20, calls, for a total amount of $2,295,167.

在我們發現的所有期權中有1個看跌期權,總金額爲27,000美元,還有20個看漲期權,總金額爲2,295,167美元。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $30.0 to $105.0 for PayPal Holdings over the last 3 months.

考慮到這些合約的成交量和持倉量,過去三個月來,鯨魚們一直在將paypal控股的價格區間定在30.0至105.0美元之間。

Insights into Volume & Open Interest

成交量和持倉量分析

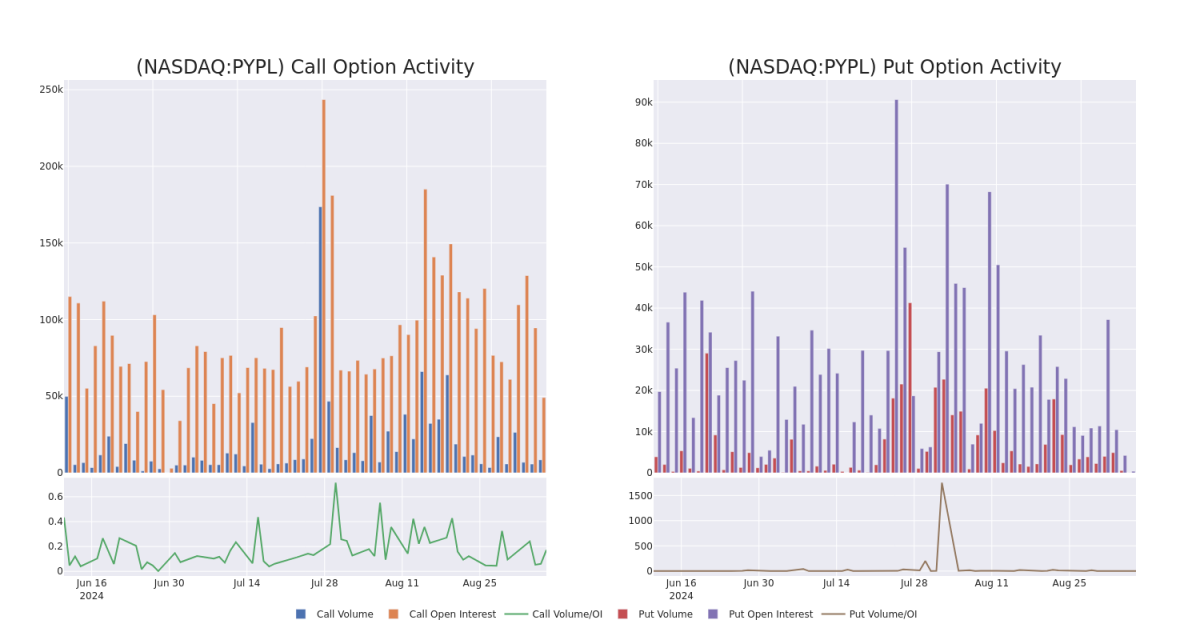

In terms of liquidity and interest, the mean open interest for PayPal Holdings options trades today is 3299.67 with a total volume of 8,473.00.

就流動性和興趣而言,今天paypal控股期權交易的平均持倉量爲3299.67手,總成交量爲8,473.00手。

In the following chart, we are able to follow the development of volume and open interest of call and put options for PayPal Holdings's big money trades within a strike price range of $30.0 to $105.0 over the last 30 days.

在接下來的圖表中,我們可以對過去30天內paypal控股看漲和看跌期權的成交量和持倉量的發展進行跟蹤,它們的行使價範圍是30.0至105.0美元。

PayPal Holdings 30-Day Option Volume & Interest Snapshot

PayPal Holdings 30天期權成交量及持倉快照

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | CALL | SWEEP | BEARISH | 01/17/25 | $18.05 | $18.0 | $18.0 | $55.00 | $340.2K | 5.2K | 200 |

| PYPL | CALL | SWEEP | BEARISH | 01/17/25 | $18.1 | $18.0 | $18.0 | $55.00 | $275.4K | 5.2K | 400 |

| PYPL | CALL | TRADE | BEARISH | 12/20/24 | $10.65 | $10.5 | $10.54 | $62.50 | $263.5K | 2.5K | 4 |

| PYPL | CALL | SWEEP | BEARISH | 12/20/24 | $10.65 | $10.5 | $10.54 | $62.50 | $263.2K | 2.5K | 504 |

| PYPL | CALL | SWEEP | BEARISH | 12/20/24 | $10.65 | $10.5 | $10.53 | $62.50 | $210.4K | 2.5K | 704 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | 看漲 | SWEEP | 看淡 | 01/17/25 | $18.05 | $18.0 | $18.0 | $55.00 | 340.2K美元 | 5.2K | 200 |

| PYPL | 看漲 | SWEEP | 看淡 | 01/17/25 | $18.1 | $18.0 | $18.0 | $55.00 | 275.4千美元 | 5.2K | 400 |

| PYPL | 看漲 | 交易 | 看淡 | 12/20/24 | $10.65 | $10.5 | $10.54 | $62.50 | $263.5K | 2.5千 | 4 |

| PYPL | 看漲 | SWEEP | 看淡 | 12/20/24 | $10.65 | $10.5 | $10.54 | $62.50 | 263.2千美元 | 2.5千 | 504 |

| PYPL | 看漲 | SWEEP | 看淡 | 12/20/24 | $10.65 | $10.5 | 10.53美元 | $62.50 | $210.4K | 2.5千 | 704 |

About PayPal Holdings

關於paypal控股

PayPal was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform.

paypal控股於2015年從ebay分拆出來,爲商家和消費者提供電子支付解決方案,重點放在在線交易方面。該公司在2023年末擁有4.26億活躍帳戶。該公司還擁有Venmo,這是一個人對人的支付平台。

In light of the recent options history for PayPal Holdings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考慮到paypal控股權的最近期權歷史,現在適合關注公司本身。我們旨在探討其當前表現。

Present Market Standing of PayPal Holdings

paypal控股的當前市場地位

- Trading volume stands at 7,005,173, with PYPL's price down by -3.8%, positioned at $69.3.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 54 days.

- 交易量爲7,005,173,PYPL的價格下跌了-3.8%,位於$69.3。

- RSI指標顯示該股票可能接近超買。

- 預計將在54天內宣佈盈利。

Expert Opinions on PayPal Holdings

關於PayPal Holdings的專家意見

3 market experts have recently issued ratings for this stock, with a consensus target price of $80.66666666666667.

3位市場專家最近對這隻股票發佈了評級,一致目標價爲80.66666666666667美元。

- Maintaining their stance, an analyst from Mizuho continues to hold a Outperform rating for PayPal Holdings, targeting a price of $90.

- An analyst from JP Morgan has decided to maintain their Overweight rating on PayPal Holdings, which currently sits at a price target of $80.

- An analyst from Daiwa Capital has elevated its stance to Outperform, setting a new price target at $72.

- 保持立場,瑞穗銀行的分析師繼續持有PayPal Holdings的跑贏市場評級,目標價爲90美元。

- 摩根大通的分析師決定維持對PayPal Holdings的超配評級,目標價目前爲80美元。

- 大和資本的分析師將其立場提升至跑贏市場,並設定了新的目標價爲72美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest PayPal Holdings options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。精明的交易者通過不斷地自我教育、調整策略、監控多個因子以及密切關注市場動向來管理這些風險。通過Benzinga Pro的實時提醒了解最新的paypal控股期權交易動態。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with PYPL, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with PYPL, it often means somebody knows something is about to happen.