Monolithic Power Systems Unusual Options Activity

Monolithic Power Systems Unusual Options Activity

Financial giants have made a conspicuous bearish move on Monolithic Power Systems. Our analysis of options history for Monolithic Power Systems (NASDAQ:MPWR) revealed 11 unusual trades.

金融巨頭對monolithic power systems採取了明顯的看淡策略。我們對納斯達克代碼爲MPWR的期權歷史進行分析,發現了11筆異常交易。

Delving into the details, we found 0% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $59,670, and 9 were calls, valued at $306,839.

深入細節後,我們發現0%的交易者持看漲意願,而45%顯示了看淡傾向。在我們發現的所有交易中,有2筆看跌期權,價值59670美元,以及9筆買入期權,價值306839美元。

Projected Price Targets

預計價格目標

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $450.0 to $840.0 for Monolithic Power Systems over the last 3 months.

考慮到這些合約的成交量和未平倉合約數,似乎大鱷們一直將monolithic power systems的目標價範圍定在450.0至840.0美元之間,持續三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Monolithic Power Systems's options for a given strike price.

這些數據可以幫助您跟蹤Monolithic Power Systems在給定執行價格的期權的流動性和興趣。

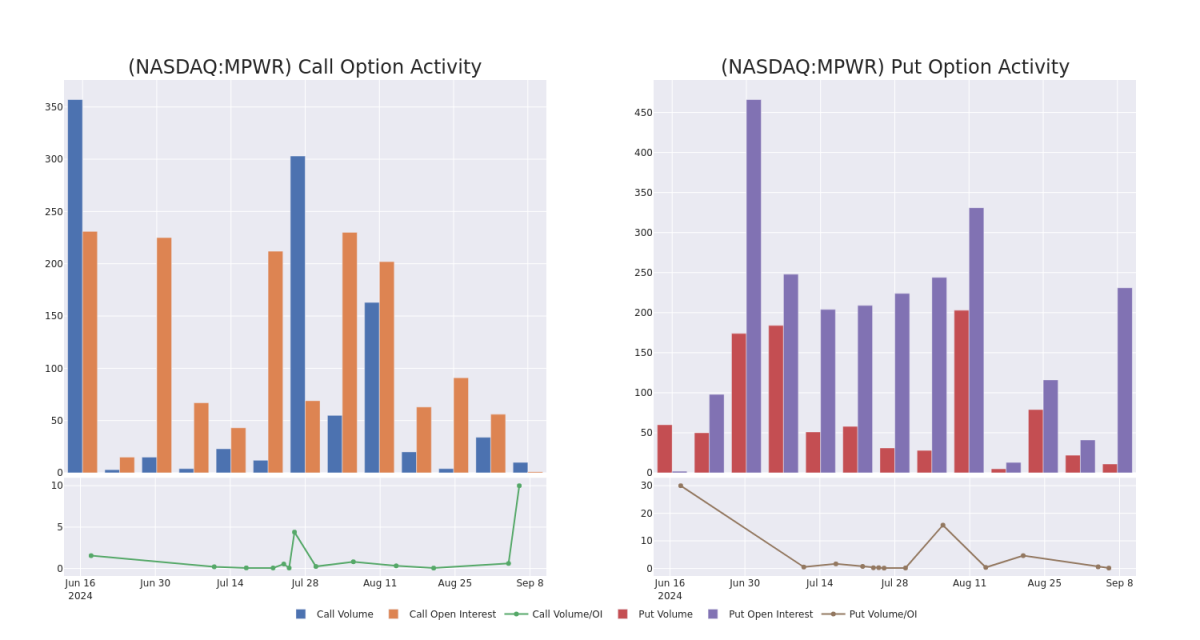

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Monolithic Power Systems's whale activity within a strike price range from $450.0 to $840.0 in the last 30 days.

下面,我們可以觀察過去30天內所有monolithic power systems大鱷活動所涉及的看漲期權和看跌期權的成交量和未平倉合約數的變化。這些活動的執行價範圍從450.0至840.0美元。

Monolithic Power Systems Option Volume And Open Interest Over Last 30 Days

在過去的30天內,Monolithic Power Systems的期權成交量和持倉量變化

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MPWR | CALL | TRADE | NEUTRAL | 09/20/24 | $268.5 | $253.5 | $260.42 | $550.00 | $52.0K | 1 | 0 |

| MPWR | CALL | TRADE | NEUTRAL | 09/20/24 | $369.5 | $355.7 | $362.6 | $450.00 | $36.2K | 0 | 2 |

| MPWR | CALL | TRADE | NEUTRAL | 09/20/24 | $369.6 | $355.6 | $361.93 | $450.00 | $36.1K | 0 | 1 |

| MPWR | CALL | TRADE | NEUTRAL | 09/20/24 | $349.4 | $335.7 | $341.58 | $470.00 | $34.1K | 0 | 1 |

| MPWR | CALL | TRADE | BEARISH | 09/20/24 | $349.4 | $335.7 | $341.03 | $470.00 | $34.1K | 0 | 2 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MPWR | 看漲 | 交易 | 中立 | 09/20/24 | 目標價268.5美元 | 目標價253.5美元 | 目標價260.42美元 | $550.00 | $52000 | 1 | 0 |

| MPWR | 看漲 | 交易 | 中立 | 09/20/24 | 369.5美元 | 355.7美元 | 362.6美元 | $450.00 | 36200美元 | 0 | 2 |

| MPWR | 看漲 | 交易 | 中立 | 09/20/24 | 369.6美元 | 355.6美元 | 361.93美元 | $450.00 | $36.1K | 0 | 1 |

| MPWR | 看漲 | 交易 | 中立 | 09/20/24 | 349.4美元 | 335.7美元 | $341.58 | $470.00 | $34.1K | 0 | 1 |

| MPWR | 看漲 | 交易 | 看淡 | 09/20/24 | 349.4美元 | 335.7美元 | 341.03美元 | $470.00 | $34.1K | 0 | 2 |

About Monolithic Power Systems

關於Monolithic Power Systems,Inc.(「MPS」)MPS是一家提供高性能基於半導體的電力電子解決方案的全球無廠商公司。MPS的使命是減少能源和材料的消耗,提高生活品質的各個方面,並創造一個可持續的未來。MPS由我們的首席執行官邢國民於1997年創立,具有系統水平的深入知識、強大的半導體設計專業知識,以及半導體工藝、系統集成和封裝領域的創新專有技術等三種核心優勢。這些優勢的結合使MPS能夠提供可靠、緊湊和單片解決方案,具有高效節能、經濟實用和環境負責的特點,同時爲我們的股東提供一致的投資回報。MPS可以透過其網站或全球的支持辦事處聯繫。

Monolithic Power Systems is an analog and mixed-signal chipmaker, specializing in power management solutions. The firm's mission is to reduce total energy consumption in end systems, and it serves the computing, automotive, industrial, communications, and consumer end markets. MPS uses a fabless manufacturing model, partnering with third-party chip foundries to host its proprietary BCD process technology.

Monolithic Power Systems是一家模擬和混合信號芯片製造商,專注於電源管理解決方案。該公司的使命是降低終端系統的總能耗,爲計算機、汽車、工業、通信和消費者終端市場提供服務。MPS採用無晶圓廠造模式,與第三方芯片代工廠合作,託管其專有的BCD工藝技術。

Following our analysis of the options activities associated with Monolithic Power Systems, we pivot to a closer look at the company's own performance.

在分析與monolithic power systems相關的期權活動後,我們轉而更仔細地觀察該公司自身的表現。

Present Market Standing of Monolithic Power Systems

Monolithic Power Systems目前的市場地位

- Currently trading with a volume of 308,618, the MPWR's price is down by -5.17%, now at $798.01.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 52 days.

- 目前交易量爲308,618的MPWR價格下跌了-5.17%,目前爲798.01美元。

- RSI讀數表明該股票目前處於中立狀態,處於超買和超賣之間。

- 預計將於52天后公佈收益。

Professional Analyst Ratings for Monolithic Power Systems

Monolithic Power Systems的專業分析師評級

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $1100.0.

在過去30天裏,共有1位專業分析師對這支股票發表了自己的看法,設定了一個平均目標價爲$1100.0。

- An analyst from TD Cowen persists with their Buy rating on Monolithic Power Systems, maintaining a target price of $1100.

- TD Cowen的一位分析師堅持對Monolithic Power Systems給予買入評級,並維持目標價爲$1100。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Monolithic Power Systems with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高的利潤潛力。精明的交易者通過持續的教育、戰略性交易調整、利用各種指標以及保持對市場動態的關注來減輕這些風險。通過Benzinga Pro獲取Monolithic Power Systems的最新期權交易,以獲得實時提醒。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.