Intuit's Options: A Look at What the Big Money Is Thinking

Intuit's Options: A Look at What the Big Money Is Thinking

Whales with a lot of money to spend have taken a noticeably bearish stance on Intuit.

Looking at options history for Intuit (NASDAQ:INTU) we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 18% of the investors opened trades with bullish expectations and 27% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $55,200 and 9, calls, for a total amount of $258,250.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $590.0 to $640.0 for Intuit during the past quarter.

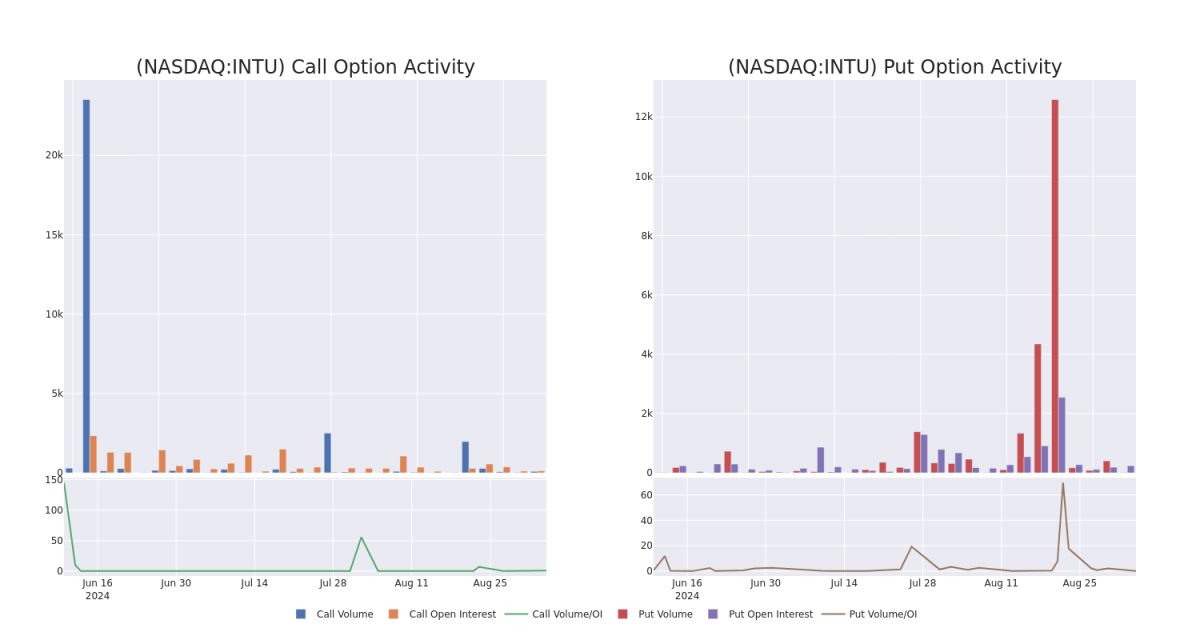

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Intuit's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Intuit's substantial trades, within a strike price spectrum from $590.0 to $640.0 over the preceding 30 days.

Intuit Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTU | CALL | TRADE | NEUTRAL | 06/20/25 | $68.4 | $65.4 | $66.7 | $640.00 | $33.3K | 852 | 28 |

| INTU | CALL | TRADE | NEUTRAL | 06/20/25 | $69.7 | $63.2 | $66.2 | $640.00 | $33.1K | 852 | 5 |

| INTU | CALL | TRADE | NEUTRAL | 06/20/25 | $68.3 | $63.6 | $65.6 | $640.00 | $32.8K | 852 | 43 |

| INTU | PUT | TRADE | NEUTRAL | 12/20/24 | $30.6 | $29.4 | $30.0 | $600.00 | $30.0K | 204 | 11 |

| INTU | CALL | TRADE | NEUTRAL | 06/20/25 | $68.9 | $65.3 | $66.9 | $640.00 | $26.7K | 852 | 23 |

About Intuit

Intuit is a provider of small-business accounting software (QuickBooks), personal tax solutions (TurboTax), and professional tax offerings (Lacerte). Founded in the mid-1980s, Intuit controls the majority of US market share for small-business accounting and do-it-yourself tax-filing software.

Having examined the options trading patterns of Intuit, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Intuit

- Currently trading with a volume of 980,452, the INTU's price is down by -0.99%, now at $615.33.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 81 days.

What The Experts Say On Intuit

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $734.4.

- An analyst from Barclays has decided to maintain their Overweight rating on Intuit, which currently sits at a price target of $740.

- An analyst from JP Morgan has decided to maintain their Neutral rating on Intuit, which currently sits at a price target of $600.

- An analyst from Susquehanna has decided to maintain their Positive rating on Intuit, which currently sits at a price target of $757.

- Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for Intuit, targeting a price of $795.

- Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Intuit with a target price of $780.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Intuit options trades with real-time alerts from Benzinga Pro.