Financial giants have made a conspicuous bullish move on Adobe. Our analysis of options history for Adobe (NASDAQ:ADBE) revealed 15 unusual trades.

Delving into the details, we found 46% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $389,519, and 6 were calls, valued at $236,561.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $500.0 to $620.0 for Adobe during the past quarter.

Analyzing Volume & Open Interest

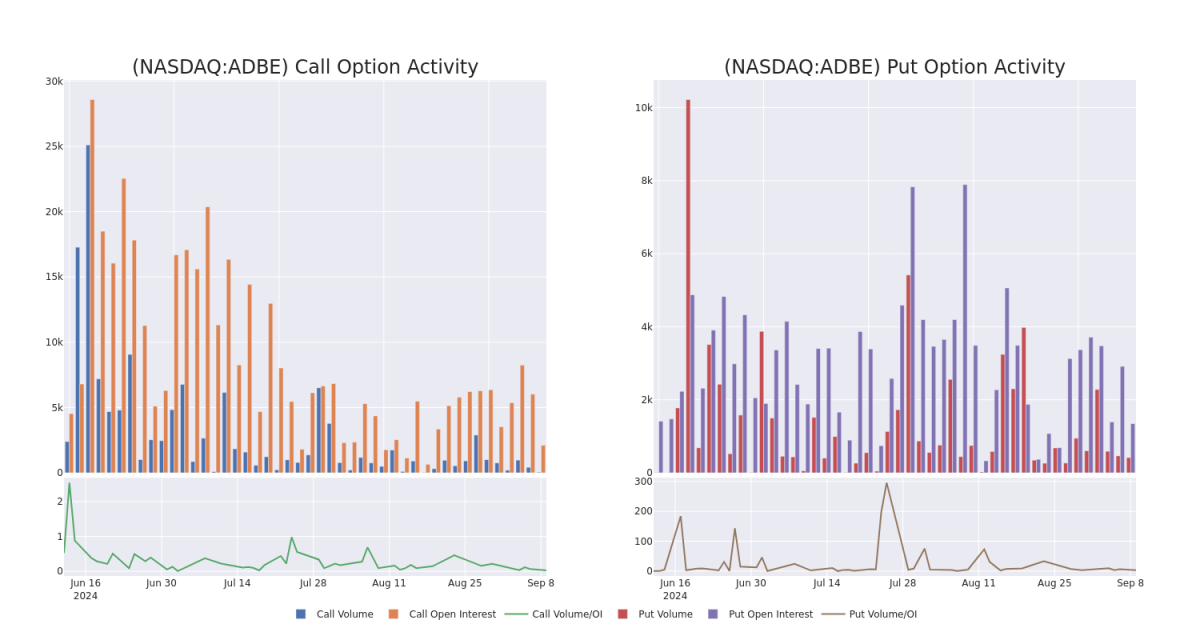

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Adobe's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Adobe's whale trades within a strike price range from $500.0 to $620.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Adobe's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Adobe's whale trades within a strike price range from $500.0 to $620.0 in the last 30 days.

Adobe 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

ADBE | PUT | SWEEP | BULLISH | 09/20/24 | $25.2 | $24.7 | $24.85 | $570.00 | $104.3K | 412 | 45 |

ADBE | CALL | SWEEP | BULLISH | 12/20/24 | $95.35 | $92.9 | $94.0 | $500.00 | $65.8K | 319 | 0 |

ADBE | PUT | SWEEP | BEARISH | 09/13/24 | $11.05 | $10.6 | $11.05 | $540.00 | $61.8K | 136 | 149 |

ADBE | PUT | TRADE | BULLISH | 10/18/24 | $10.95 | $8.3 | $8.8 | $500.00 | $44.0K | 404 | 0 |

ADBE | CALL | TRADE | BEARISH | 09/20/24 | $62.8 | $60.0 | $60.0 | $515.00 | $42.0K | 150 | 7 |

About Adobe

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizing, and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

Having examined the options trading patterns of Adobe, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Adobe Standing Right Now?

Trading volume stands at 160,491, with ADBE's price up by 0.92%, positioned at $568.57.

RSI indicators show the stock to be may be approaching overbought.

Earnings announcement expected in 3 days.

What The Experts Say On Adobe

3 market experts have recently issued ratings for this stock, with a consensus target price of $650.0.

In a cautious move, an analyst from Oppenheimer downgraded its rating to Outperform, setting a price target of $625.

Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for Adobe, targeting a price of $650.

An analyst from Barclays has decided to maintain their Overweight rating on Adobe, which currently sits at a price target of $675.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Adobe with Benzinga Pro for real-time alerts.

金融巨頭對Adobe採取了明顯的看漲舉動。我們對Adobe(納斯達克股票代碼:ADBE)期權歷史的分析顯示了15筆不尋常的交易。

深入研究細節,我們發現46%的交易者看漲,而40%的交易者表現出看跌的趨勢。在我們發現的所有交易中,有9筆是看跌期權,價值爲389,519美元,6筆是看漲期權,價值236,561美元。

預期的價格走勢

分析這些合約的交易量和未平倉合約,看來大型企業一直在關注Adobe在過去一個季度的價格範圍從500.0美元到620.0美元不等。

分析交易量和未平倉合約

交易期權時,查看交易量和未平倉合約是一個強有力的舉動。這些數據可以幫助您跟蹤給定行使價下Adobe期權的流動性和利息。下面,我們可以觀察過去30天內,Adobe所有鯨魚交易的看漲期權和看跌期權交易量和未平倉合約的分別變化,其行使價在500.0美元至620.0美元之間。

交易期權時,查看交易量和未平倉合約是一個強有力的舉動。這些數據可以幫助您跟蹤給定行使價下Adobe期權的流動性和利息。下面,我們可以觀察過去30天內,Adobe所有鯨魚交易的看漲期權和看跌期權交易量和未平倉合約的分別變化,其行使價在500.0美元至620.0美元之間。

Adobe 30 天期權交易量和利息快照

檢測到的重要期權交易:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

ADBE | PUT | SWEEP | BULLISH | 09/20/24 | $25.2 | $24.7 | $24.85 | $570.00 | $104.3K | 412 | 45 |

ADBE | CALL | SWEEP | BULLISH | 12/20/24 | $95.35 | $92.9 | $94.0 | $500.00 | $65.8K | 319 | 0 |

ADBE | PUT | SWEEP | BEARISH | 09/13/24 | $11.05 | $10.6 | $11.05 | $540.00 | $61.8K | 136 | 149 |

ADBE | PUT | TRADE | BULLISH | 10/18/24 | $10.95 | $8.3 | $8.8 | $500.00 | $44.0K | 404 | 0 |

ADBE | CALL | TRADE | BEARISH | 09/20/24 | $62.8 | $60.0 | $60.0 | $515.00 | $42.0K | 150 | 7 |

Adobe

Adobe 爲創意專業人士和營銷人員提供內容創作、文檔管理以及數字營銷和廣告軟件和服務,用於在多個操作系統、設備和媒體上創建、管理、交付、測量、優化和參與引人入勝的內容。該公司分爲三個部門:數字媒體內容創作、營銷解決方案的數字體驗和傳統產品的出版(不到收入的5%)。

在研究了Adobe的期權交易模式之後,我們的注意力現在直接轉向了該公司。這種轉變使我們能夠深入研究其目前的市場地位和表現

Adobe 現在的立場在哪裏?

專家對Adobe的看法

3位市場專家最近發佈了該股的評級,共識目標價爲650.0美元。

奧本海默的一位分析師謹慎地將其評級下調至跑贏大盤,將目標股價定爲625美元。

Stifel的一位分析師保持立場,繼續維持Adobe的買入評級,目標價格爲650美元。

巴克萊銀行的一位分析師已決定維持對Adobe的增持評級,目前的目標股價爲675美元。

交易期權涉及更大的風險,但也提供了獲得更高利潤的可能性。精明的交易者通過持續的教育、戰略交易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解Adobe的最新期權交易信息,獲取實時提醒。

交易期權時,查看交易量和未平倉合約是一個強有力的舉動。這些數據可以幫助您跟蹤給定行使價下Adobe期權的流動性和利息。下面,我們可以觀察過去30天內,Adobe所有鯨魚交易的看漲期權和看跌期權交易量和未平倉合約的分別變化,其行使價在500.0美元至620.0美元之間。

交易期權時,查看交易量和未平倉合約是一個強有力的舉動。這些數據可以幫助您跟蹤給定行使價下Adobe期權的流動性和利息。下面,我們可以觀察過去30天內,Adobe所有鯨魚交易的看漲期權和看跌期權交易量和未平倉合約的分別變化,其行使價在500.0美元至620.0美元之間。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Adobe's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Adobe's whale trades within a strike price range from $500.0 to $620.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Adobe's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Adobe's whale trades within a strike price range from $500.0 to $620.0 in the last 30 days.