A Closer Look at Snap's Options Market Dynamics

A Closer Look at Snap's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bullish stance on Snap.

資本雄厚的鯨魚們對Snap採取了明顯看好的立場。

Looking at options history for Snap (NYSE:SNAP) we detected 13 trades.

查看Snap(紐交所:SNAP)的期權歷史,我們發現了13筆交易。

If we consider the specifics of each trade, it is accurate to state that 53% of the investors opened trades with bullish expectations and 46% with bearish.

如果我們考慮每項交易的細節,可以說53%的投資者持看漲期權而46%持看跌期權。

From the overall spotted trades, 10 are puts, for a total amount of $1,698,787 and 3, calls, for a total amount of $140,775.

從所有被發現的交易中,有10筆看跌,總金額爲$1,698,787,和3筆看漲,總金額爲$140,775。

What's The Price Target?

目標價是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $5.0 and $8.0 for Snap, spanning the last three months.

在評估交易量和未平倉合約後,顯然主要的市場推動者正專注於Snap的價格區間,該價格區間是在過去三個月內從$5.0到$8.0。

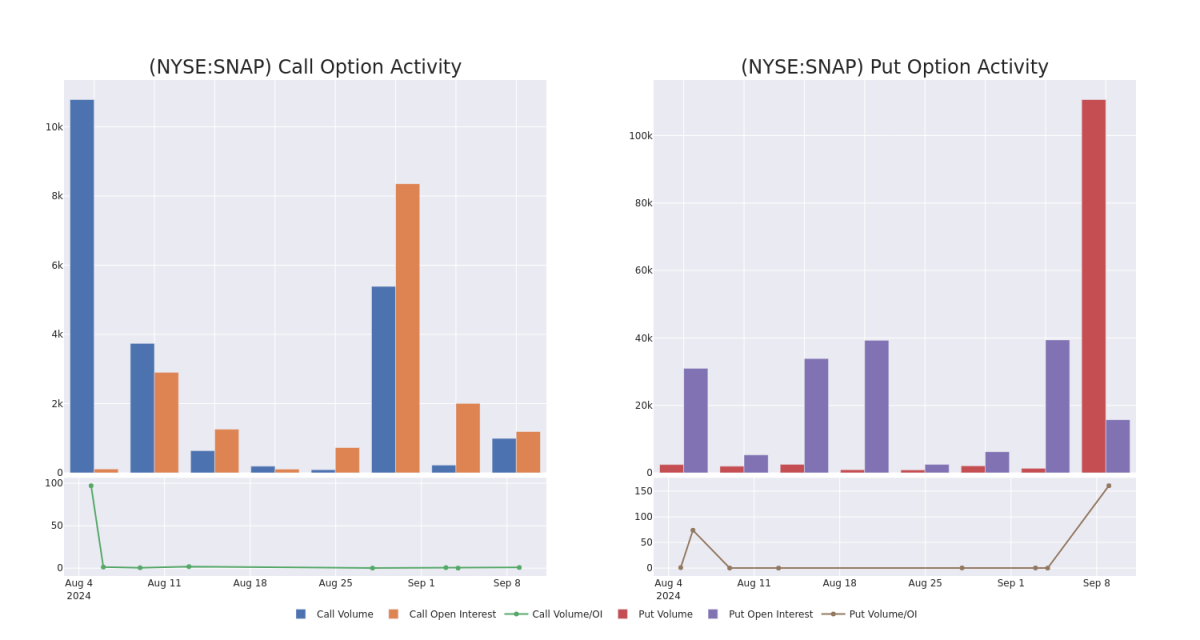

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Snap's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Snap's whale trades within a strike price range from $5.0 to $8.0 in the last 30 days.

在交易期權時,查看成交量和未平倉合約是一個有力的舉措。這些數據可以幫助您跟蹤Snap特定行權價的期權的流動性和興趣。在過去30天內,我們可以觀察到Snap所有大宗交易中看漲和看跌的成交量和未平倉合約的演變,分別在行權價區間從$5.0到$8.0。

Snap Call and Put Volume: 30-Day Overview

Snap看漲和看跌期權成交量概覽:30天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNAP | PUT | SWEEP | BEARISH | 12/20/24 | $0.91 | $0.89 | $0.91 | $8.00 | $364.0K | 8.1K | 16.0K |

| SNAP | PUT | TRADE | BEARISH | 12/20/24 | $0.89 | $0.84 | $0.88 | $8.00 | $318.3K | 8.1K | 4.0K |

| SNAP | PUT | SWEEP | BEARISH | 12/20/24 | $0.88 | $0.87 | $0.88 | $8.00 | $303.8K | 8.1K | 7.4K |

| SNAP | PUT | SWEEP | BULLISH | 11/15/24 | $0.19 | $0.16 | $0.17 | $6.00 | $226.8K | 406 | 13.1K |

| SNAP | PUT | SWEEP | BULLISH | 11/15/24 | $0.18 | $0.17 | $0.17 | $6.00 | $160.2K | 406 | 29.4K |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNAP | 看跌 | SWEEP | 看淡 | 12/20/24 | 0.91美元 | $0.89 | 0.91美元 | 8.00美元 | 364.0K美元 | 8.1千 | 16.0K |

| SNAP | 看跌 | 交易 | 看淡 | 12/20/24 | $0.89 | $0.84 | $0.88 | 8.00美元 | 318.3千美元 | 8.1千 | 4.0K |

| SNAP | 看跌 | SWEEP | 看淡 | 12/20/24 | $0.88 | $0.87 | $0.88 | 8.00美元 | 303.8千美元 | 8.1千 | 7.4K |

| SNAP | 看跌 | SWEEP | 看好 | 11/15/24 | $0.19 | $0.16 | 0.17美元 | $6.00 | $226.8K | 406 | 13.1K |

| SNAP | 看跌 | SWEEP | 看好 | 11/15/24 | 0.18美元 | 0.17美元 | 0.17美元 | $6.00 | 標的爲160.2千美元 | 406 | 29.4千 |

About Snap

關於Snap

Snap owns one of the most popular social networking apps, Snapchat, claiming more than 400 million daily active users as of the end of 2023. Snap generates nearly all its revenue from advertising. While only about one quarter of users are in North America, the region accounts for about 65% of sales.

Snap擁有頗受歡迎的社交網絡應用程序Snapchat,截至2023年底,每天活躍用戶數超過4億。Snap幾乎全部收入來自廣告。雖然僅約四分之一的用戶位於北美地區,但該地區佔銷售額的約65%。

Having examined the options trading patterns of Snap, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在檢查了Snap的期權交易模式之後,我們現在將目光直接轉向該公司。這種轉變使我們能夠深入了解其當前的市場地位和表現。

Where Is Snap Standing Right Now?

Snap目前所處的地位在哪裏?

- With a volume of 16,783,265, the price of SNAP is down -1.68% at $8.47.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 43 days.

- SNAP的成交量爲16,783,265,價格下跌-1.68%,報8.47美元。

- RSI指標暗示基礎股票可能接近超賣。

- 預計將在43天內發佈下一份收益報告。

Expert Opinions on Snap

Snap的專家意見

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $9.5.

在過去的30天裏,共有2名專業分析師對該股票發表了他們的看法,設定了9.5美元的平均目標價。

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Neutral, setting a price target of $8.

- Consistent in their evaluation, an analyst from Citigroup keeps a Neutral rating on Snap with a target price of $11.

- 慎重地,Cantor Fitzgerald的一名分析師下調了評級,設定了8美元的目標價。

- 始終如一地,花旗集團的一名分析師維持對Snap的中立評級,目標價爲11美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Snap with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高的利潤潛力。精明的交易者通過持續的教育、戰略性的交易調整、利用各種因子以及保持市場動態的關注來降低這些風險。通過Benzinga Pro獲取Snap的最新期權交易,獲得實時提示。

From the overall spotted trades, 10 are puts, for a total amount of $1,698,787 and 3, calls, for a total amount of $140,775.

From the overall spotted trades, 10 are puts, for a total amount of $1,698,787 and 3, calls, for a total amount of $140,775.