Even After Rising 21% This Past Week, Hainan RuiZe New Building MaterialLtd (SZSE:002596) Shareholders Are Still Down 73% Over the Past Five Years

Even After Rising 21% This Past Week, Hainan RuiZe New Building MaterialLtd (SZSE:002596) Shareholders Are Still Down 73% Over the Past Five Years

While not a mind-blowing move, it is good to see that the Hainan RuiZe New Building Material Co.,Ltd (SZSE:002596) share price has gained 27% in the last three months. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Like a ship taking on water, the share price has sunk 73% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The fundamental business performance will ultimately determine if the turnaround can be sustained.

雖然不是一個令人興奮的舉動,但很高興看到海南瑞澤新建材有限公司, Ltd(深圳證券交易所:002596)的股價在過去三個月中上漲了27%。但這並不能改變這樣一個事實,即過去五年的回報一直令人震驚。就像船隻上水一樣,股價在那段時間下跌了73%。的確,最近的反彈可能預示着該公司正在翻開新的一頁,但我們不太確定。基本業務績效最終將決定這種轉變能否持續下去。

While the last five years has been tough for Hainan RuiZe New Building MaterialLtd shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

儘管過去五年對海南瑞澤新建材有限公司的股東來說是艱難的,但過去一週顯示出希望的跡象。因此,讓我們來看看長期基本面,看看它們是否是負回報的驅動力。

Hainan RuiZe New Building MaterialLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

海南瑞澤新建材有限公司在過去十二個月中沒有盈利,我們不太可能看到其股價與每股收益(EPS)之間存在很強的相關性。可以說,收入是我們的下一個最佳選擇。一般而言,沒有利潤的公司預計每年收入將增長,而且速度很快。可以想象,收入的快速增長如果持續下去,通常會帶來利潤的快速增長。

Over half a decade Hainan RuiZe New Building MaterialLtd reduced its trailing twelve month revenue by 10% for each year. That's definitely a weaker result than most pre-profit companies report. So it's not that strange that the share price dropped 12% per year in that period. This kind of price performance makes us very wary, especially when combined with falling revenue. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

在過去的五年中,海南瑞澤新建材有限公司過去十二個月的收入每年減少10%。這絕對比大多數盈利前公司報告的結果要差。因此,在此期間,股價每年下跌12%也就不足爲奇了。這種價格表現使我們非常警惕,尤其是在收入下降的情況下。當然,表現不佳可能意味着市場的拋售過於嚴重。這有可能發生。

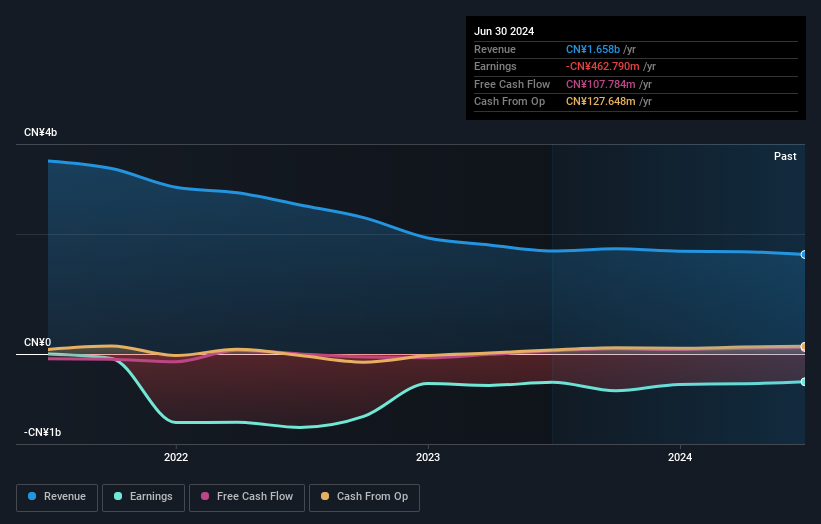

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

公司的收入和收益(隨着時間的推移)如下圖所示(點擊查看確切數字)。

Take a more thorough look at Hainan RuiZe New Building MaterialLtd's financial health with this free report on its balance sheet.

通過這份免費的資產負債表報告,更全面地了解海南瑞澤新建材有限公司的財務狀況。

A Different Perspective

不同的視角

We regret to report that Hainan RuiZe New Building MaterialLtd shareholders are down 33% for the year. Unfortunately, that's worse than the broader market decline of 18%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Hainan RuiZe New Building MaterialLtd better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Hainan RuiZe New Building MaterialLtd you should be aware of.

我們遺憾地報告,海南瑞澤新建材有限公司的股東今年下跌了33%。不幸的是,這比整個市場18%的跌幅還要嚴重。話雖如此,在下跌的市場中,一些股票不可避免地會被超賣。關鍵是要密切關注基本發展。遺憾的是,去年的業績結束了糟糕的表現,股東在五年內每年面臨12%的總虧損。我們意識到羅斯柴爾德男爵曾說過,投資者應該 「在街頭流血時買入」,但我們警告說,投資者應首先確保他們購買的是高質量的企業。長期跟蹤股價表現總是很有意思的。但是,要更好地了解海南瑞澤新建材有限公司,我們需要考慮許多其他因素。一個很好的例子:我們已經發現了兩個你應該注意的海南瑞澤新建材有限公司的警告標誌。

Of course Hainan RuiZe New Building MaterialLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

當然,海南瑞澤新建材有限公司可能不是最好的買入股票。因此,您可能希望看到這批免費的成長股。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

請注意,本文引用的市場回報反映了目前在中國交易所交易的股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接聯繫我們。或者,也可以發送電子郵件至編輯團隊 (at) simplywallst.com。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。