5 Behavioral Biases in Investing and How to Overcome Them

5 Behavioral Biases in Investing and How to Overcome Them

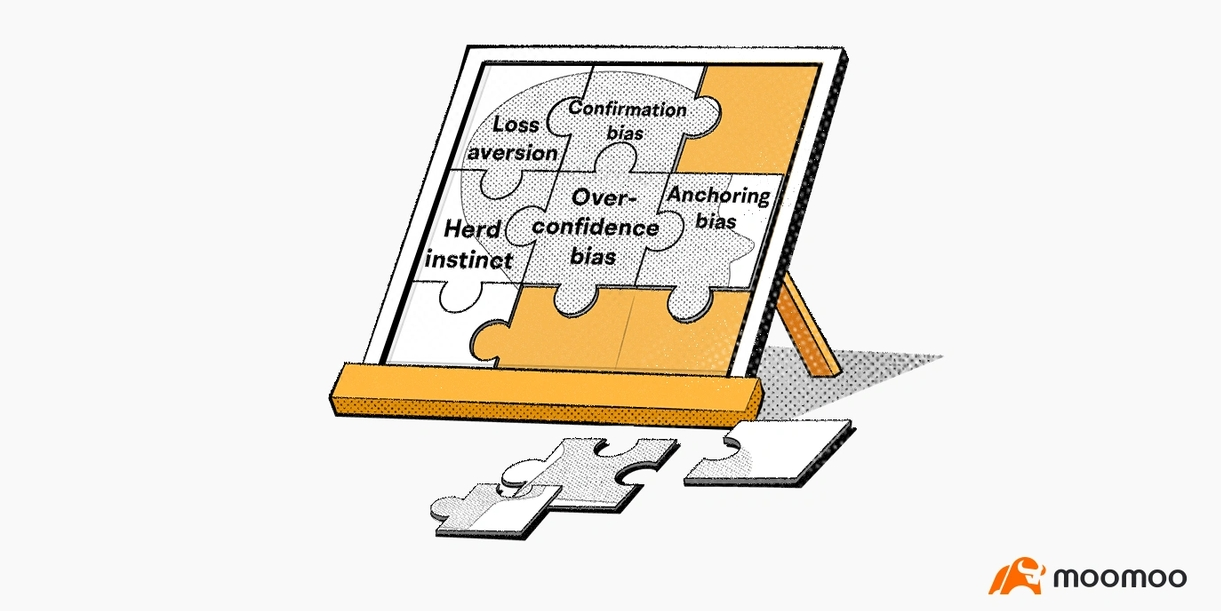

In the world of investing, emotions and cognitive biases often influence our decisions. Understanding these psychological factors can significantly enhance your investment strategy. Behavioral finance sheds light on how to identify and overcome these biases, helping you make smarter investment choices. Here are 5 common behavioral biases and how to overcome them.

在投資世界中,情緒和認知偏見常常影響我們的決策。了解這些心理因素可以顯著增強您的投資策略。行爲金融揭示瞭如何識別和克服這些偏見,幫助您做出更明智的投資選擇。以下是5種常見的行爲偏見以及如何克服它們。

1. Loss Aversion

1. 損失厭惡

What it is: Loss aversion occurs when the pain of losing money is stronger than the pleasure of gaining it. Investors often prefer avoiding losses over acquiring equivalent gains.

How to overcome it: Focus on a long-term investment strategy to mitigate the emotional impact of short-term losses. Diversify your portfolio to spread risk and reduce the urge to constantly monitor your investments. By checking your portfolio only once or twice a year, you can avoid emotional reactions that may lead to poor decisions.

什麼是:損失厭惡是指失去金錢的痛苦比獲得金錢的快樂更強烈。投資者通常更喜歡避免損失而不是獲得等值收益。

如何克服:專注於長期投資策略,以減輕短期損失的情緒影響。分散您的投資組合,以減少風險並減少不斷監控投資的衝動。每年只檢查一兩次您的投資組合,可以避免可能導致糟糕決策的情緒反應。

2. Home Bias

2. 地域偏好

What it is: Home bias is the tendency to favor investments from one's own country over those from foreign markets. This can lead to an overly concentrated portfolio.

How to overcome it: Aim for a globally diversified portfolio to spread risk and capture opportunities from different markets. Research international stocks, bonds, and other assets to ensure a balanced investment approach. Consider using global index funds or exchange-traded funds (ETFs) to easily diversify internationally.

什麼是:地域偏好是指傾向於偏愛自己國家的投資,而不是外國市場的投資。這可能導致投資組合過度集中。

如何克服:致力於全球多元化的投資組合,以分散風險並抓住不同市場的機會。研究國際股票、債券和其他資產,確保平衡的投資方式。考慮使用全球指數基金或交易所交易基金(ETF),輕鬆實現國際多元化。

3. Herd Instinct

3. 從衆心理

What it is: Herd instinct is the tendency to follow the actions of a larger group, often leading to buying or selling stocks based on what others are doing, rather than conducting your own analysis.

How to overcome it: Conduct independent research and rely on your own analysis. Trust your judgment and avoid making impulsive decisions based on market trends or rumors. Remember that following the crowd can often lead to buying overvalued stocks or selling undervalued ones, which can negatively impact your investment returns.

什麼是:群體效應是指趨向於跟隨一個較大群體的行動,通常會導致根據他人的行爲而買入或賣出股票,而不是依據自己的分析。

如何克服:進行獨立研究,依靠自己的分析。相信自己的判斷,避免基於市場趨勢或傳言做出衝動的決策。記住,跟隨群衆往往會導致購買高估的股票或賣出低估的股票,這可能對您的投資回報產生負面影響。

4. Overconfidence Bias

4. 過度自信偏見

What it is: Overconfidence bias is the tendency to overestimate one’s knowledge and abilities, leading to excessive risk-taking. This can result in poor investment choices and significant losses.

How to overcome it: Stay humble and recognize the limits of your knowledge. Diversify your portfolio to mitigate risk and consider seeking advice from financial professionals. Regularly review and adjust your investment strategy based on objective data and market conditions.

什麼是:過度自信偏見是指過高估計自己的知識和能力,從而導致過度冒險。這可能導致糟糕的投資選擇和重大虧損。

如何克服:保持謙虛,認識到自己的知識的侷限性。分散投資組合以減輕風險,並考慮尋求金融專業人士的建議。根據客觀數據和市場狀況定期審查和調整您的投資策略。

5. Confirmation Bias

5. 確認偏見

What it is: Confirmation bias is the tendency to favor information that supports your existing beliefs and ignore information that contradicts them. This can lead to a skewed perception of reality and poor investment decisions.

How to overcome it: Actively seek out diverse perspectives and consider information that challenges your views. Evaluate your investments objectively and be open to changing your strategy based on new information. By considering different viewpoints, you can make more informed and balanced investment decisions.

什麼是:確認偏見是指傾向於支持您現有信念的信息,並忽視與之相矛盾的信息。這可能導致對現實的扭曲認知和糟糕的投資決策。

如何克服:積極尋求不同的觀點,並考慮挑戰您的觀點的信息。客觀評估您的投資,並願意根據新的信息調整您的策略。通過考慮不同的觀點,您可以做出更明智和平衡的投資決策。

Recognizing and understanding these common behavioral biases is the first step towards making more rational and informed investment decisions. By being aware of these psychological traps, you can develop strategies to minimize their impact and improve your long-term financial outcomes.

認識和理解這些常見的行爲偏見是朝着更理性和明智的投資決策邁出的第一步。通過意識到這些心理陷阱,您可以制定策略,減少它們的影響,改善您的長期財務結果。