PayPal Holdings Options Trading: A Deep Dive Into Market Sentiment

PayPal Holdings Options Trading: A Deep Dive Into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bearish stance on PayPal Holdings.

有大量資金可以花的鯨魚對PayPal Holdings採取了明顯的看跌立場。

Looking at options history for PayPal Holdings (NASDAQ:PYPL) we detected 14 trades.

查看PayPal Holdings(納斯達克股票代碼:PYPL)的期權歷史記錄,我們發現了14筆交易。

If we consider the specifics of each trade, it is accurate to state that 42% of the investors opened trades with bullish expectations and 57% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,有42%的投資者以看漲的預期開盤,57%的投資者持看跌預期。

From the overall spotted trades, 2 are puts, for a total amount of $131,275 and 12, calls, for a total amount of $1,724,586.

在已發現的全部交易中,有2筆是看跌期權,總額爲131,275美元,12筆看漲期權,總額爲1,724,586美元。

Expected Price Movements

預期的價格走勢

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $30.0 and $110.0 for PayPal Holdings, spanning the last three months.

在評估了交易量和未平倉合約之後,很明顯,主要市場走勢者正在關注過去三個月的PayPal Holdings價格區間在30.0美元至110.0美元之間。

Volume & Open Interest Development

交易量和未平倉合約的發展

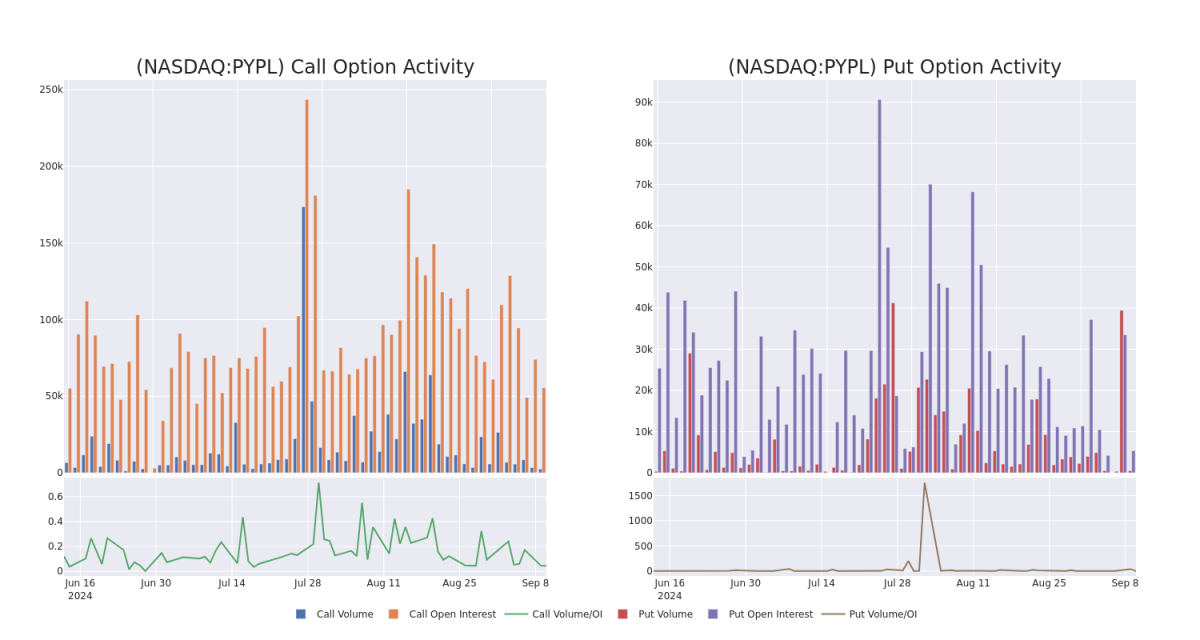

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for PayPal Holdings's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across PayPal Holdings's significant trades, within a strike price range of $30.0 to $110.0, over the past month.

檢查交易量和未平倉合約爲股票研究提供了至關重要的見解。這些信息是衡量PayPal Holdings期權在特定行使價下的流動性和利息水平的關鍵。下面,我們簡要介紹了過去一個月PayPal Holdings在30.0美元至110.0美元行使價區間內的重要交易的看漲期權和未平倉合約的交易量和未平倉合約的趨勢。

PayPal Holdings Call and Put Volume: 30-Day Overview

PayPal Holdings 看漲和看跌交易量:30 天概覽

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | CALL | SWEEP | BEARISH | 10/18/24 | $5.15 | $5.0 | $5.05 | $65.00 | $714.2K | 6.4K | 1.8K |

| PYPL | CALL | TRADE | BULLISH | 01/17/25 | $16.25 | $15.55 | $16.0 | $55.00 | $320.0K | 4.9K | 200 |

| PYPL | CALL | SWEEP | BEARISH | 01/17/25 | $15.6 | $15.5 | $15.5 | $55.00 | $310.0K | 4.9K | 200 |

| PYPL | PUT | SWEEP | BEARISH | 06/20/25 | $4.75 | $4.65 | $4.75 | $60.00 | $101.1K | 2.3K | 213 |

| PYPL | CALL | TRADE | BEARISH | 12/20/24 | $7.3 | $7.2 | $7.2 | $65.00 | $72.0K | 5.0K | 101 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | 打電話 | 掃 | 粗魯的 | 10/18/24 | 5.15 美元 | 5.0 美元 | 5.05 美元 | 65.00 美元 | 714.2 萬美元 | 6.4K | 1.8K |

| PYPL | 打電話 | 貿易 | 看漲 | 01/17/25 | 16.25 美元 | 15.55 美元 | 16.0 美元 | 55.00 美元 | 320.0 萬美元 | 4.9K | 200 |

| PYPL | 打電話 | 掃 | 粗魯的 | 01/17/25 | 15.6 美元 | 15.5 美元 | 15.5 美元 | 55.00 美元 | 310.0 萬美元 | 4.9K | 200 |

| PYPL | 放 | 掃 | 粗魯的 | 06/20/25 | 4.75 美元 | 4.65 美元 | 4.75 美元 | 60.00 美元 | 101.1 萬美元 | 2.3K | 213 |

| PYPL | 打電話 | 貿易 | 粗魯的 | 12/20/24 | 7.3 美元 | 7.2 美元 | 7.2 美元 | 65.00 美元 | 72.0 萬美元 | 5.0K | 101 |

About PayPal Holdings

關於 PayPal 控股

PayPal was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform.

PayPal於2015年從eBay分拆出來,爲商家和消費者提供電子支付解決方案,重點是在線交易。截至2023年底,該公司擁有4.26億個活躍帳戶。該公司還擁有人對人支付平台Venmo。

Where Is PayPal Holdings Standing Right Now?

PayPal Holdings現在處於什麼位置?

- With a volume of 2,155,243, the price of PYPL is down -2.65% at $67.52.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 50 days.

- PYPL的交易量爲2,155,243美元,價格下跌了-2.65%,至67.52美元。

- RSI指標暗示標的股票可能接近超買。

- 下一份業績預計將在50天后公佈。

What Analysts Are Saying About PayPal Holdings

分析師對PayPal控股的看法

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $85.0.

在過去的一個月中,兩位行業分析師分享了他們對該股的見解,提出平均目標價爲85.0美元。

- An analyst from Mizuho has decided to maintain their Outperform rating on PayPal Holdings, which currently sits at a price target of $90.

- An analyst from JP Morgan has decided to maintain their Overweight rating on PayPal Holdings, which currently sits at a price target of $80.

- 瑞穗的一位分析師已決定維持對PayPal Holdings的跑贏大盤評級,該評級目前的目標股價爲90美元。

- 摩根大通的一位分析師已決定維持對PayPal Holdings的增持評級,該評級目前的目標股價爲80美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for PayPal Holdings with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了獲得更高利潤的可能性。精明的交易者通過持續的教育、戰略交易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解PayPal Holdings的最新期權交易,獲取實時提醒。

From the overall spotted trades, 2 are puts, for a total amount of $131,275 and 12, calls, for a total amount of $1,724,586.

From the overall spotted trades, 2 are puts, for a total amount of $131,275 and 12, calls, for a total amount of $1,724,586.