Occidental Petroleum Options Trading: A Deep Dive Into Market Sentiment

Occidental Petroleum Options Trading: A Deep Dive Into Market Sentiment

Deep-pocketed investors have adopted a bearish approach towards Occidental Petroleum (NYSE:OXY), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in OXY usually suggests something big is about to happen.

財力雄厚的投資者對西方石油公司(紐約證券交易所代碼:OXY)採取了看跌態度,這是市場參與者不容忽視的。我們對本辛加公開期權記錄的追蹤今天揭示了這一重大舉措。這些投資者的身份仍然未知,但是OXY的如此實質性的變動通常表明大事即將發生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 22 extraordinary options activities for Occidental Petroleum. This level of activity is out of the ordinary.

我們今天從觀察中收集了這些信息,當時Benzinga的期權掃描儀重點介紹了西方石油的22項非同尋常的期權活動。這種活動水平與衆不同。

The general mood among these heavyweight investors is divided, with 31% leaning bullish and 59% bearish. Among these notable options, 11 are puts, totaling $615,605, and 11 are calls, amounting to $478,964.

這些重量級投資者的總體情緒存在分歧,31%的人傾向於看漲,59%的人傾向於看跌。在這些值得注意的期權中,有11個是看跌期權,總額爲615,605美元,11個是看漲期權,總額爲478,964美元。

Predicted Price Range

預測的價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $30.0 to $60.0 for Occidental Petroleum over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將西方石油的價格定在30.0美元至60.0美元之間。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

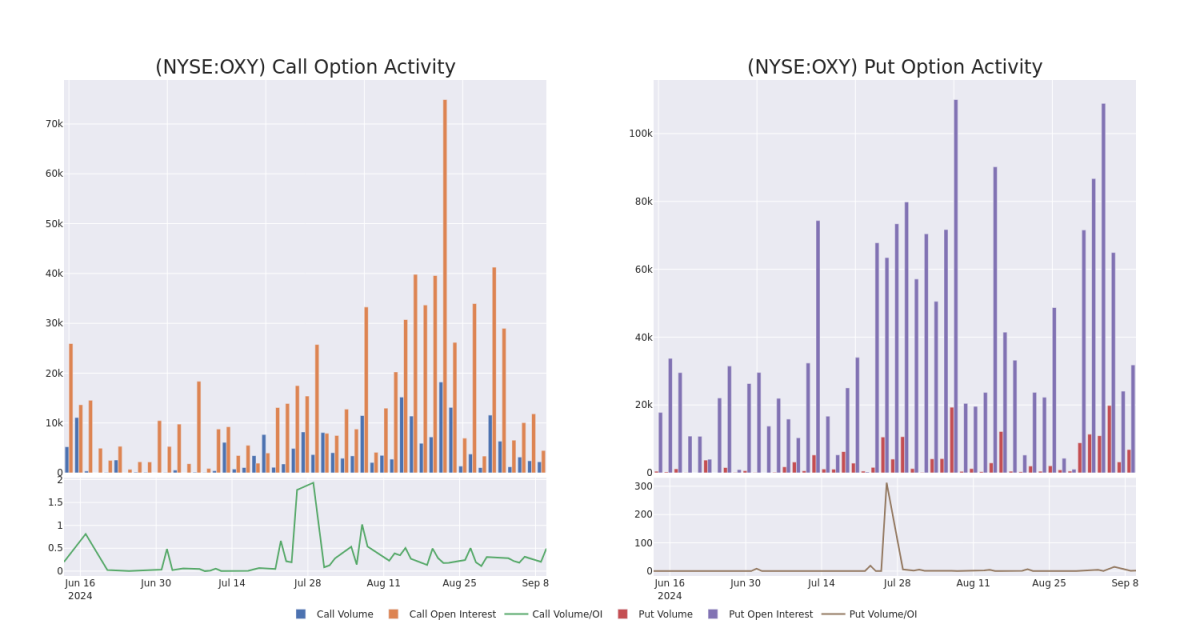

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Occidental Petroleum's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Occidental Petroleum's whale trades within a strike price range from $30.0 to $60.0 in the last 30 days.

交易期權時,查看交易量和未平倉合約是一個強有力的舉動。這些數據可以幫助您跟蹤給定行使價下西方石油期權的流動性和利息。下面,我們可以觀察到過去30天中西方石油公司所有鯨魚交易的看漲和看跌期權交易量和未平倉合約的變化,其行使價在30.0美元至60.0美元之間。

Occidental Petroleum Option Volume And Open Interest Over Last 30 Days

過去30天西方石油期權交易量和未平倉合約

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OXY | PUT | TRADE | BEARISH | 01/16/26 | $11.15 | $10.85 | $11.15 | $60.00 | $111.5K | 6.4K | 101 |

| OXY | PUT | SWEEP | BULLISH | 01/16/26 | $10.95 | $10.85 | $10.93 | $60.00 | $109.3K | 6.4K | 201 |

| OXY | PUT | TRADE | BEARISH | 12/20/24 | $2.38 | $2.33 | $2.36 | $50.00 | $80.7K | 3.9K | 401 |

| OXY | CALL | TRADE | BEARISH | 10/11/24 | $7.5 | $7.2 | $7.2 | $45.00 | $72.0K | 1 | 0 |

| OXY | CALL | TRADE | BEARISH | 12/18/26 | $6.15 | $6.0 | $6.0 | $60.00 | $60.0K | 668 | 105 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OXY | 放 | 貿易 | 粗魯的 | 01/16/26 | 11.15 美元 | 10.85 美元 | 11.15 美元 | 60.00 美元 | 111.5 萬美元 | 6.4K | 101 |

| OXY | 放 | 掃 | 看漲 | 01/16/26 | 10.95 美元 | 10.85 美元 | 10.93 美元 | 60.00 美元 | 109.3 萬美元 | 6.4K | 201 |

| OXY | 放 | 貿易 | 粗魯的 | 12/20/24 | 2.38 美元 | 2.33 美元 | 2.36 美元 | 50.00 美元 | 80.7 萬美元 | 3.9K | 401 |

| OXY | 打電話 | 貿易 | 粗魯的 | 10/11/24 | 7.5 美元 | 7.2 美元 | 7.2 美元 | 45.00 美元 | 72.0 萬美元 | 1 | 0 |

| OXY | 打電話 | 貿易 | 粗魯的 | 12/18/26 | 6.15 美元 | 6.0 美元 | 6.0 美元 | 60.00 美元 | 60.0 萬美元 | 668 | 105 |

About Occidental Petroleum

關於西方石油公司

Occidental Petroleum is an independent exploration and production company with operations in the United States, Latin America, and the Middle East. At the end of 2023, the company reported net proved reserves of nearly 4 billion barrels of oil equivalent. Net production averaged 1,234 thousand barrels of oil equivalent per day in 2023 at a ratio of roughly 50% oil and natural gas liquids and 50% natural gas.

西方石油公司是一家獨立的勘探和生產公司,業務遍及美國、拉丁美洲和中東。截至2023年底,該公司報告的淨探明儲量爲近40億桶石油當量。2023 年日均淨產量爲 12.4 萬桶石油當量,比例約爲 50% 的液化石油和天然氣以及 50% 的天然氣。

In light of the recent options history for Occidental Petroleum, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於西方石油公司最近的期權歷史,現在應該將重點放在公司本身上。我們的目標是探索其目前的表現。

Current Position of Occidental Petroleum

西方石油公司的現狀

- Currently trading with a volume of 7,555,937, the OXY's price is down by -1.74%, now at $51.05.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 56 days.

- OXY目前的交易量爲7,555,937美元,價格下跌了-1.74%,目前爲51.05美元。

- RSI讀數表明該股目前可能已超賣。

- 預計業績將在56天后發佈。

What Analysts Are Saying About Occidental Petroleum

分析師對西方石油的看法

3 market experts have recently issued ratings for this stock, with a consensus target price of $71.0.

3位市場專家最近發佈了該股的評級,共識目標價爲71.0美元。

- An analyst from Susquehanna persists with their Positive rating on Occidental Petroleum, maintaining a target price of $78.

- Maintaining their stance, an analyst from Truist Securities continues to hold a Hold rating for Occidental Petroleum, targeting a price of $65.

- An analyst from UBS has decided to maintain their Neutral rating on Occidental Petroleum, which currently sits at a price target of $70.

- 薩斯奎哈納的一位分析師堅持對西方石油的正面評級,維持78美元的目標價。

- Truist Securities的一位分析師保持立場,繼續對西方石油公司維持持有評級,目標價格爲65美元。

- 瑞銀的一位分析師已決定維持對西方石油的中性評級,目前的目標股價爲70美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $30.0 to $60.0 for Occidental Petroleum over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $30.0 to $60.0 for Occidental Petroleum over the last 3 months.