Carvana's Options: A Look at What the Big Money Is Thinking

Carvana's Options: A Look at What the Big Money Is Thinking

Whales with a lot of money to spend have taken a noticeably bullish stance on Carvana.

資金雄厚的鯨魚已經明顯地看好了Carvana。

Looking at options history for Carvana (NYSE:CVNA) we detected 51 trades.

查看Carvana (紐交所:CVNA)的期權歷史,我們發現了51筆交易。

If we consider the specifics of each trade, it is accurate to state that 43% of the investors opened trades with bullish expectations and 41% with bearish.

如果我們考慮每筆交易的特定情況,可以準確地說,43%的投資者以看好的預期開倉,41%爲看淡。

From the overall spotted trades, 41 are puts, for a total amount of $3,020,691 and 10, calls, for a total amount of $789,526.

在所有發現的交易中,有41只看跌,總金額爲$3,020,691,10只看漲,總金額爲$789,526。

Expected Price Movements

預期價格波動

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $70.0 and $160.0 for Carvana, spanning the last three months.

在評估交易量和持倉量後,顯然主要的市場推動者正在關注Carvana的價格區間,即$70.0到$160.0,跨越最近三個月。

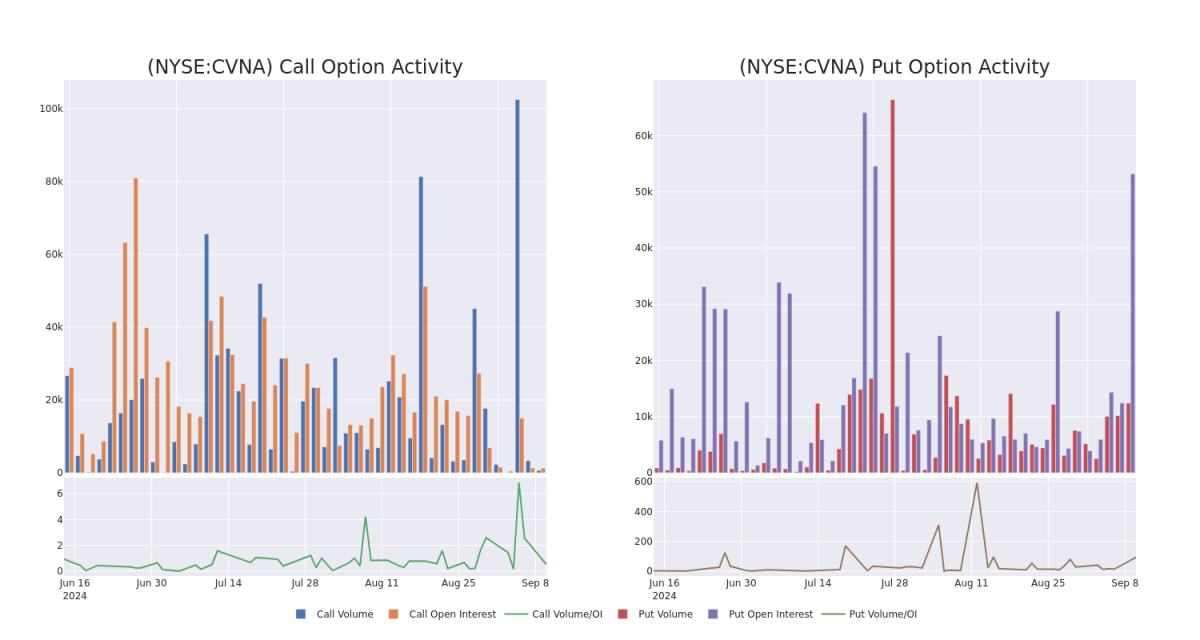

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Carvana's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Carvana's significant trades, within a strike price range of $70.0 to $160.0, over the past month.

檢查成交量和持倉量可以提供關於股票研究的重要見解。這些信息對於衡量特定執行價下Carvana期權的流動性和興趣水平至關重要。下面,我們將介紹過去一個月內在$70.0到$160.0執行價格範圍內Carvana重要交易中看漲和看跌的成交量和持倉量的趨勢快照。

Carvana Call and Put Volume: 30-Day Overview

Carvana看漲期權和看跌期權成交量:30天概覽

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVNA | CALL | SWEEP | BULLISH | 03/21/25 | $31.0 | $30.6 | $31.0 | $125.00 | $496.0K | 212 | 130 |

| CVNA | PUT | TRADE | BULLISH | 09/20/24 | $7.3 | $7.1 | $7.1 | $130.00 | $319.5K | 4.1K | 842 |

| CVNA | PUT | SWEEP | NEUTRAL | 03/21/25 | $6.05 | $5.6 | $5.9 | $75.00 | $295.0K | 15 | 500 |

| CVNA | PUT | TRADE | BULLISH | 01/17/25 | $4.6 | $4.4 | $4.4 | $80.00 | $264.0K | 824 | 624 |

| CVNA | PUT | TRADE | NEUTRAL | 10/18/24 | $8.2 | $7.9 | $8.05 | $125.00 | $180.3K | 1.1K | 246 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| carvana | 看漲 | SWEEP | 看好 | 03/21/25 | $31.0 | $30.6 | $31.0 | $125.00 | 496.0千美元 | 212 | Dated: September 3, 2024 |

| carvana | 看跌 | 交易 | 看好 | 09/20/24 | $7.3 | $7.1 | $7.1 | $130.00 | 319.5千美元 | 4.1K | 842 |

| carvana | 看跌 | SWEEP | 中立 | 03/21/25 | $6.05 | $5.6 | $5.9 | $75.00 | $295,000 | 15 | 500 |

| carvana | 看跌 | 交易 | 看好 | 01/17/25 | $4.6 | $4.4 | $4.4 | $80.00 | $264.0K | 824 | 624 |

| carvana | 看跌 | 交易 | 中立 | 10/18/24 | $8.2 | $7.9 | $8.05 | $125.00 | 180.3千美元 | 1.1千 | 246 |

About Carvana

關於Carvana

Carvana Co is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues. The other sales and revenues include sales of loans originated and sold in securitization transactions or to financing partners, commissions received on VSCs and sales of GAP waiver coverage. The foundation of the business is retail vehicle unit sales. This drives the majority of the revenue and allows the company to capture additional revenue streams associated with financing, VSCs, auto insurance and GAP waiver coverage, as well as trade-in vehicles.

Carvana Co是一家用於購買和銷售二手車的電子商務平台。公司的營業收入來自二手車銷售、批發車輛銷售和其他銷售和收入。其他銷售和收入包括在證券化交易中發起並出售的貸款銷售以及向融資合作伙伴的銷售、收到的VSC佣金以及GAP豁免保險的銷售。業務的基石是零售車輛銷售。這推動了大部分收入,並允許公司捕獲與融資、VSC、汽車保險、GAP豁免保險以及以舊車換新車的相關收入流相關的額外收入。

Following our analysis of the options activities associated with Carvana, we pivot to a closer look at the company's own performance.

在分析與Carvana相關的期權活動之後,我們轉向更仔細地審視該公司的業績。

Where Is Carvana Standing Right Now?

Carvana現在的處境如何?

- With a volume of 3,208,214, the price of CVNA is down -5.43% at $128.12.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 51 days.

- CVNA的成交量爲3,208,214,價格下跌了5.43%,爲128.12美元。

- RSI指標暗示基礎股票可能接近超賣。

- 預計將在51天內發佈下一次季度收益。

Professional Analyst Ratings for Carvana

Carvana的專業分析師評級

1 market experts have recently issued ratings for this stock, with a consensus target price of $200.0.

1位市場專家最近爲這支股票發出了評級,目標價爲200.0美元。

- Reflecting concerns, an analyst from JMP Securities lowers its rating to Market Outperform with a new price target of $200.

- 反映市場擔憂,JMP Securities將其評級下調爲Market Outperform,並將其新的價格目標定爲200美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Carvana options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在回報。精明的交易者通過不斷地學習,調整策略,監控多種因子,密切關注市場動態來管理這些風險。使用 Benzinga Pro 的實時警報及時了解最新的 Carvana 期權交易。

From the overall spotted trades, 41 are puts, for a total amount of $3,020,691 and 10, calls, for a total amount of $789,526.

From the overall spotted trades, 41 are puts, for a total amount of $3,020,691 and 10, calls, for a total amount of $789,526.