Decoding Qualcomm's Options Activity: What's the Big Picture?

Decoding Qualcomm's Options Activity: What's the Big Picture?

Deep-pocketed investors have adopted a bullish approach towards Qualcomm (NASDAQ:QCOM), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in QCOM usually suggests something big is about to happen.

財力雄厚的投資者對高通(納斯達克股票代碼:QCOM)採取了看漲態度,這是市場參與者不容忽視的。我們對本辛加公開期權記錄的追蹤今天揭示了這一重大舉措。這些投資者的身份仍然未知,但是QCOM的如此重大變動通常表明即將發生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 32 extraordinary options activities for Qualcomm. This level of activity is out of the ordinary.

我們今天從觀察中收集了這些信息,當時Benzinga的期權掃描儀重點介紹了高通公司的32項非同尋常的期權活動。這種活動水平與衆不同。

The general mood among these heavyweight investors is divided, with 43% leaning bullish and 37% bearish. Among these notable options, 23 are puts, totaling $2,056,485, and 9 are calls, amounting to $457,310.

這些重量級投資者的總體情緒存在分歧,43%的人傾向於看漲,37%的人傾向於看跌。在這些值得注意的期權中,有23個是看跌期權,總額爲2,056,485美元,9個是看漲期權,總額爲457,310美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $125.0 to $210.0 for Qualcomm over the recent three months.

根據交易活動,看來主要投資者的目標是將高通最近三個月的價格區間從125.0美元擴大到210.0美元。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

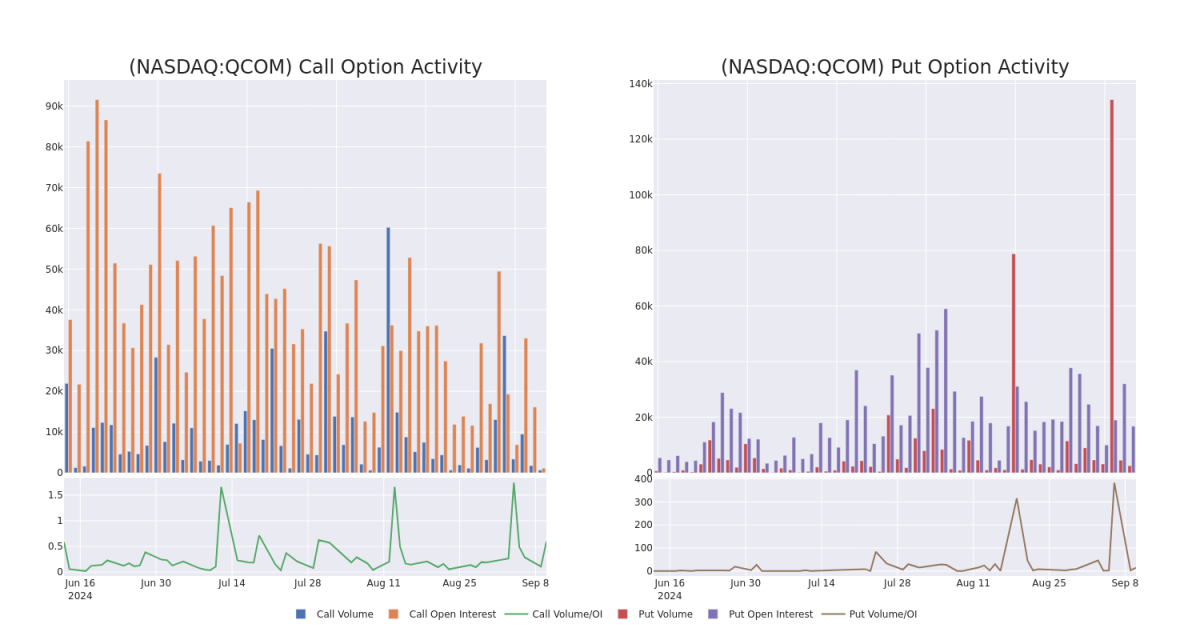

In today's trading context, the average open interest for options of Qualcomm stands at 715.72, with a total volume reaching 3,243.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Qualcomm, situated within the strike price corridor from $125.0 to $210.0, throughout the last 30 days.

在當今的交易背景下,高通期權的平均未平倉合約爲715.72,總交易量達到3,243.00。隨附的圖表描繪了過去30天內高通公司看漲期權和看跌期權交易量以及未平倉合約的變化,這些交易位於行使價走勢從125.0美元到210.0美元之間。

Qualcomm Option Volume And Open Interest Over Last 30 Days

過去30天的高通期權交易量和未平倉合約

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QCOM | PUT | SWEEP | BEARISH | 06/20/25 | $34.85 | $34.45 | $34.73 | $185.00 | $347.1K | 1.4K | 120 |

| QCOM | PUT | SWEEP | BULLISH | 01/17/25 | $29.55 | $29.0 | $29.02 | $185.00 | $290.2K | 2.0K | 120 |

| QCOM | PUT | SWEEP | BULLISH | 06/20/25 | $34.8 | $34.7 | $34.7 | $185.00 | $208.2K | 1.4K | 180 |

| QCOM | PUT | SWEEP | BEARISH | 09/20/24 | $3.95 | $3.9 | $3.9 | $157.50 | $158.3K | 679 | 430 |

| QCOM | PUT | SWEEP | NEUTRAL | 10/18/24 | $3.1 | $3.05 | $3.1 | $145.00 | $155.0K | 1.5K | 518 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QCOM | 放 | 掃 | 粗魯的 | 06/20/25 | 34.85 美元 | 34.45 美元 | 34.73 美元 | 185.00 美元 | 347.1 萬美元 | 1.4K | 120 |

| QCOM | 放 | 掃 | 看漲 | 01/17/25 | 29.55 美元 | 29.0 美元 | 29.02 美元 | 185.00 美元 | 290.2 萬美元 | 2.0K | 120 |

| QCOM | 放 | 掃 | 看漲 | 06/20/25 | 34.8 美元 | 34.7 美元 | 34.7 美元 | 185.00 美元 | 208.2 萬美元 | 1.4K | 180 |

| QCOM | 放 | 掃 | 粗魯的 | 09/20/24 | 3.95 美元 | 3.9 美元 | 3.9 美元 | 157.50 美元 | 158.3 萬美元 | 679 | 430 |

| QCOM | 放 | 掃 | 中立 | 10/18/24 | 3.1 美元 | 3.05 美元 | 3.1 美元 | 145.00 美元 | 155.0K | 1.5K | 518 |

About Qualcomm

關於高通

Qualcomm develops and licenses wireless technology and designs chips for smartphones. The company's key patents revolve around CDMA and OFDMA technologies, which are standards in wireless communications that are the backbone of all 3G, 4G, and 5G networks. Qualcomm's IP is licensed by virtually all wireless device makers. The firm is also the world's largest wireless chip vendor, supplying nearly every premier handset maker with leading-edge processors. Qualcomm also sells RF-front end modules into smartphones, as well as chips into automotive and Internet of Things markets.

高通開發和許可無線技術,併爲智能手機設計芯片。該公司的主要專利圍繞CDMA和OFDMA技術,這些技術是無線通信的標準,是所有3G、4G和5G網絡的支柱。高通公司的IP幾乎已獲得所有無線設備製造商的許可。該公司還是全球最大的無線芯片供應商,爲幾乎所有頂級手機制造商提供領先的處理器。高通公司還向智能手機銷售射頻前端模塊,並向汽車和物聯網市場銷售芯片。

Current Position of Qualcomm

高通公司目前的位置

- Currently trading with a volume of 4,834,298, the QCOM's price is up by 0.49%, now at $161.55.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 50 days.

- QCOM目前的交易量爲4,834,298美元,價格上漲了0.49%,目前爲161.55美元。

- RSI讀數表明,該股目前在超買和超賣之間處於中立狀態。

- 預計收益將在50天后發佈。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $125.0 to $210.0 for Qualcomm over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $125.0 to $210.0 for Qualcomm over the recent three months.