Top 3 Industrials Stocks That May Rocket Higher In Q3

Top 3 Industrials Stocks That May Rocket Higher In Q3

第三季度可能大幅上漲的前三個工業股票

The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

工業板塊中超賣次數最多的股票爲買入被低估的公司提供了機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI是一個動量指標,它比較股票在價格上漲的日子裏的走強與價格下跌的日子的走強。與股票的價格走勢相比,它可以讓交易者更好地了解股票在短期內的表現。根據Benzinga Pro的數據,當相對強弱指數低於30時,資產通常被視爲超賣。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是該行業主要超賣參與者的最新名單,RSI接近或低於30。

Core & Main Inc (NYSE:CNM)

Core & Main Inc(紐約證券交易所代碼:CNM)

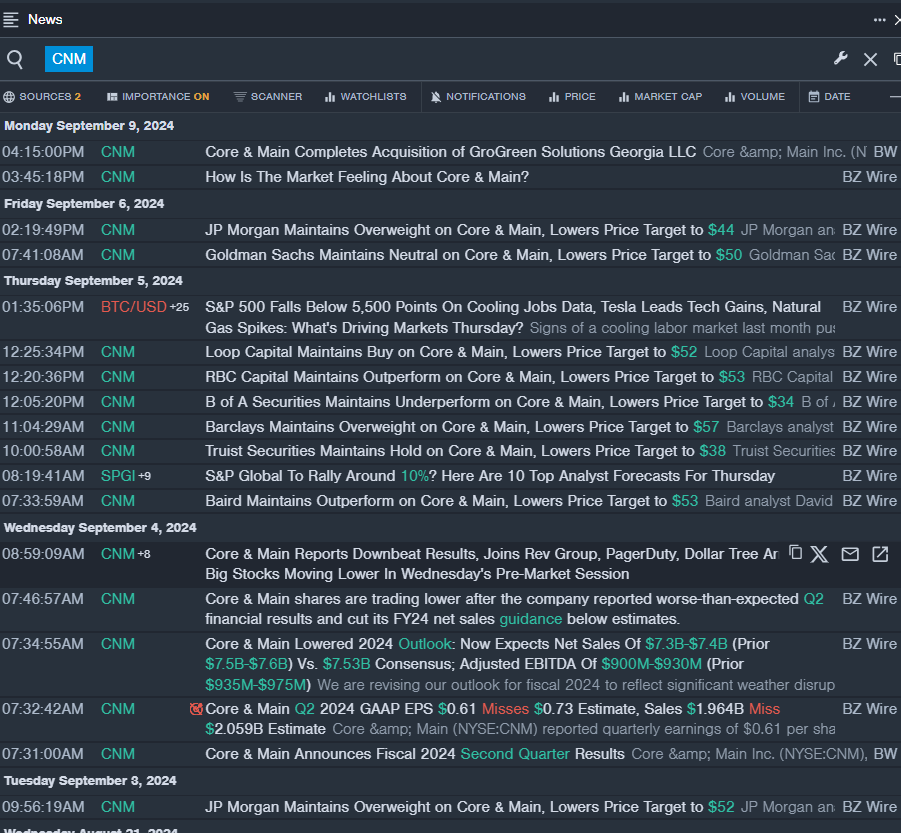

- On Sept. 4, Core & Main reported worse-than-expected second-quarter financial results and cut its FY24 net sales guidance below estimates. Core & Main reported quarterly earnings of 61 cents per share which missed the analyst consensus estimate of 73 cents per share. The company reported quarterly sales of $1.964 billion which missed the analyst consensus estimate of $2.059 billion.. The company's stock fell around 22% over the past month and has a 52-week low of $27.75.

- RSI Value: 25.50

- CNM Price Action: Shares of Core & Main fell 0.5% to close at $38.12 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest CNM news.

- 9月4日,Core & Main公佈的第二季度財務業績低於預期,並將24財年的淨銷售預期下調至低於預期。Core & Main公佈的季度收益爲每股61美分,未達到分析師普遍預期的每股73美分。該公司公佈的季度銷售額爲19.64億美元,未達到分析師共識估計的20.59億美元。該公司的股票在過去一個月中下跌了約22%,跌至52周低點27.75美元。

- RSI 值:25.50

- cNM價格走勢:週二,核心和主要股價下跌0.5%,收於38.12美元。

- Benzinga Pro的實時新聞提醒了最新的cNM新聞。

Avis Budget Group Inc (NASDAQ:CAR)

安飛士預算集團公司(納斯達克股票代碼:CAR)

- On Sept. 10, Avis Budget Group announced the pricing of $700 million of senior notes. The company's stock fell around 19% over the past month It has a 52-week low of $65.73.

- RSI Value: 26.27

- CAR Price Action: Shares of Avis Budget fell 3.2% to close at $67.43 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in CAR stock.

- 9月10日,安飛士預算集團宣佈了7億美元優先票據的定價。該公司的股價在過去一個月中下跌了約19%,爲52周低點65.73美元。

- RSI 值:26.27

- 汽車價格走勢:週二,安飛士預算股價下跌3.2%,收於67.43美元。

- Benzinga Pro的圖表工具幫助確定了汽車股票的走勢。

Golden Ocean Group Ltd (NASDAQ:GOGL)

金海集團有限公司(納斯達克股票代碼:GOGL)

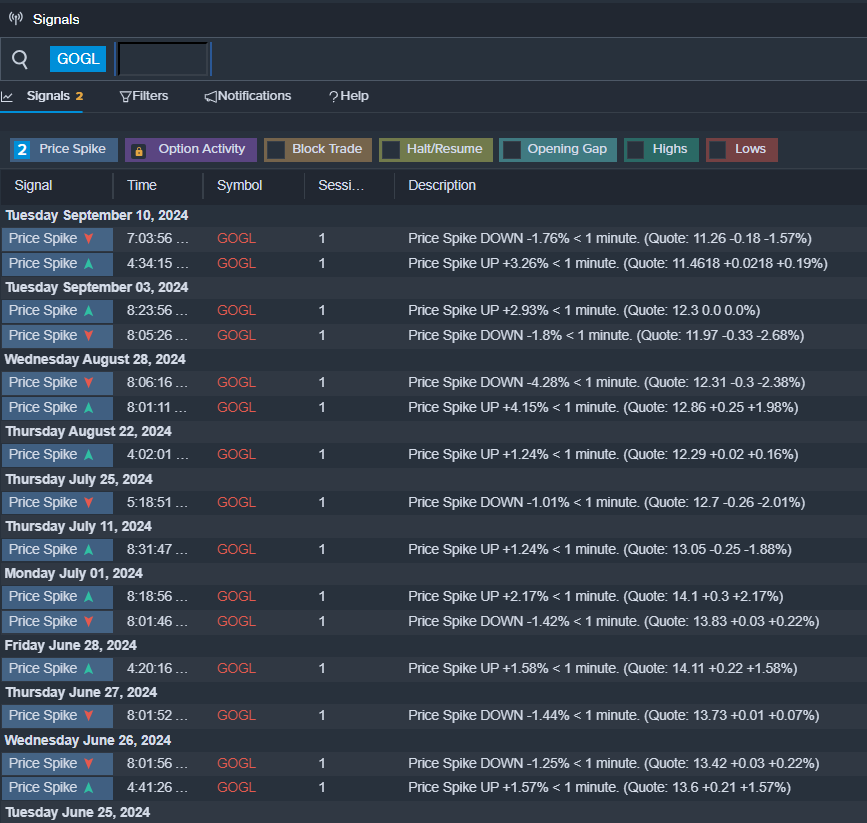

- On Aug. 28, Golden Ocean Group posted better-than-expected quarterly earnings. Peder Simonsen, Interim Chief Executive Officer and Chief Financial Officer, commented, "Despite a volatile macro and geopolitical backdrop, the dry bulk shipping market remains healthy, and Golden Ocean continues to deliver above-market performance. This is attributable to the quality of our modern, fuel-efficient fleet as well as our strong commercial capabilities. While we continue to opportunistically secure charter coverage, we retain significant exposure to a market we believe will strengthen as the year progresses." The company's shares fell around 7% over the past month and has a 52-week low of $7.09.

- RSI Value: 29.58

- GOGL Price Action: Shares of Golden Ocean Group fell 3.3% to close at $11.06 on Tuesday.

- Benzinga Pro's signals feature notified of a potential breakout in GOGL shares.

- 8月28日,金海集團公佈的季度收益好於預期。臨時首席執行官兼首席財務官佩德·西蒙森評論說:「儘管宏觀和地緣政治背景動盪不定,但幹散貨航運市場仍然健康,金海繼續保持高於市場的表現。這要歸功於我們現代化、節油機隊的質量以及我們強大的商業能力。在我們繼續機會性地確保包機保險的同時,我們仍保留了大量的市場敞口,我們認爲隨着今年的推移將得到加強。」該公司的股價在過去一個月中下跌了約7%,爲52周低點7.09美元。

- RSI 值:29.58

- GOGL價格走勢:週二,金海集團股價下跌3.3%,收於11.06美元。

- Benzinga Pro的信號功能被告知GOGL股票可能出現突破。

Read Next:

繼續閱讀:

- Jim Cramer Says AES Is 'Very Inexpensive', Recommends Buying This Industrial Stock

- 吉姆·克萊默說AES 「非常便宜」,建議買入這隻工業股