Check Out What Whales Are Doing With PANW

Check Out What Whales Are Doing With PANW

Deep-pocketed investors have adopted a bearish approach towards Palo Alto Networks (NASDAQ:PANW), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PANW usually suggests something big is about to happen.

資金雄厚的投資者對Palo Alto Networks(納斯達克:PANW)採取了看淡的態度,市場參與者不應忽視這一點。我們在Benzinga的公開期權記錄中發現了這一重要動向。這些投資者的身份尚不爲人所知,但在PANW方面進行如此大規模的操作通常意味着有重大事件即將發生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 15 extraordinary options activities for Palo Alto Networks. This level of activity is out of the ordinary.

我們從今天本花日的觀察中獲得了這些信息,當財經新聞網的期權掃描器突出了 Palo Alto Networks 的15個非同尋常期權活動時。這種活動水平是超出尋常的。

The general mood among these heavyweight investors is divided, with 40% leaning bullish and 53% bearish. Among these notable options, 7 are puts, totaling $328,937, and 8 are calls, amounting to $548,107.

這些重量級投資者之間的一般情緒是分散的,40%傾向於看漲,53%看淡。在這些值得注意的期權中,有7個看跌,總計328,937美元,而有8個看漲,總計548,107美元。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $320.0 and $370.0 for Palo Alto Networks, spanning the last three months.

在評估交易量和未平倉量之後,可以明顯看出主要的市場推動者正在關注 Palo Alto Networks 的價格區間,介於320.0美元和370.0美元之間,跨過了過去三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

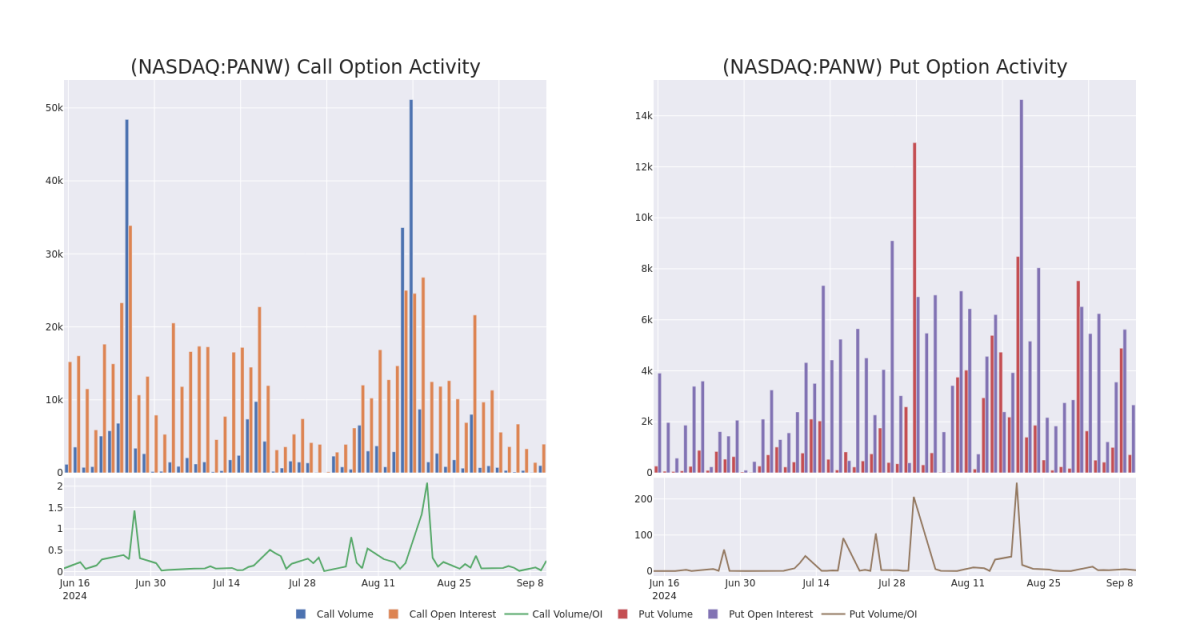

In today's trading context, the average open interest for options of Palo Alto Networks stands at 598.82, with a total volume reaching 1,700.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Palo Alto Networks, situated within the strike price corridor from $320.0 to $370.0, throughout the last 30 days.

在今天的交易背景下,Palo Alto Networks 的期權平均未平倉量爲598.82,總成交量達到1,700.00。隨附的圖表描述了過去30天內,在Palo Alto Networks 的高價值交易中,從320.0美元到370.0美元的行權價格走廊中,看漲和看跌期權的成交量和未平倉量的變化。

Palo Alto Networks Call and Put Volume: 30-Day Overview

Palo Alto Networks的看漲和看跌成交量:30天概述

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | CALL | SWEEP | BEARISH | 09/13/24 | $9.5 | $7.5 | $7.5 | $335.00 | $150.0K | 610 | 0 |

| PANW | CALL | SWEEP | BULLISH | 12/20/24 | $27.4 | $27.05 | $27.4 | $340.00 | $137.0K | 532 | 64 |

| PANW | PUT | SWEEP | BEARISH | 11/15/24 | $27.65 | $27.35 | $27.65 | $350.00 | $60.8K | 361 | 30 |

| PANW | PUT | TRADE | NEUTRAL | 09/20/24 | $36.6 | $34.9 | $35.7 | $370.00 | $60.6K | 250 | 17 |

| PANW | PUT | SWEEP | BULLISH | 09/20/24 | $4.55 | $4.45 | $4.5 | $332.50 | $59.9K | 69 | 133 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | 看漲 | SWEEP | 看淡 | 09/13/24 | $9.5 | $7.5 | $7.5 | 335.00美元 | $150.0K | 610 | 0 |

| PANW | 看漲 | SWEEP | 看好 | 12/20/24 | $27.4 | $27.05 | $27.4 | $340.00 | $137.0K | 532 | 64 |

| PANW | 看跌 | SWEEP | 看淡 | 11/15/24 | $27.65 | 公司治理 | $27.65 | $350.00 | $60.8K | 361 | 30 |

| PANW | 看跌 | 交易 | 中立 | 09/20/24 | $ 36.6 | $34.9 | $35.7 | $370.00 | $60.6K | 250 | 17 |

| PANW | 看跌 | SWEEP | 看好 | 09/20/24 | 4.55 | $4.45 | $4.5 | $332.50 | $59.9千美元 | 69 | 133 |

About Palo Alto Networks

關於Palo Alto Networks

Palo Alto Networks is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, and security operations. The California-based firm has more than 80,000 enterprise customers across the world, including more than three fourths of the Global 2000.

Palo Alto Networks是一個基於平台的網絡安全供應商,其產品涵蓋網絡安全、雲安全和安全運營。這家總部位於加利福尼亞的公司在全球擁有超過80,000家企業客戶,其中包括全球2000強的四分之三以上。

Where Is Palo Alto Networks Standing Right Now?

Palo Alto Networks現在的情況如何?

- Trading volume stands at 1,459,658, with PANW's price down by -3.08%, positioned at $336.89.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 63 days.

- 交易量爲1,459,658股,PANW的價格下跌了-3.08%,定位在336.89美元。

- RSI指標顯示該股票目前處於超買和超賣之間的中立狀態。

- 預計還有63天就要公佈收益。

What Analysts Are Saying About Palo Alto Networks

分析師對Palo Alto Networks的評價

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $380.0.

過去30天裏,共有5位專業分析師對這支股票發表了看法,給出了平均目標價格爲$380.0。

- Maintaining their stance, an analyst from Bernstein continues to hold a Outperform rating for Palo Alto Networks, targeting a price of $399.

- Maintaining their stance, an analyst from Rosenblatt continues to hold a Neutral rating for Palo Alto Networks, targeting a price of $345.

- Consistent in their evaluation, an analyst from Rosenblatt keeps a Neutral rating on Palo Alto Networks with a target price of $345.

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Palo Alto Networks with a target price of $416.

- Consistent in their evaluation, an analyst from BTIG keeps a Buy rating on Palo Alto Networks with a target price of $395.

- 伯恩斯坦的一位分析師保持了他們的觀點,繼續對Palo Alto Networks持有超級表現評級,目標價位爲$399。

- 羅森布拉特的一位分析師保持了他們的觀點,繼續對Palo Alto Networks持有中立評級,目標價位爲$345。

- 羅森布拉特的一位分析師堅持對Palo Alto Networks持有中立評級,目標價位爲$345。

- 富國銀行的一位分析師堅持對Palo Alto Networks持有超配評級,目標價位爲$416。

- BTIG的一位分析師堅持對Palo Alto Networks持有買入評級,目標價位爲$395。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Palo Alto Networks options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在回報。精明的交易者通過不斷學習、調整策略、監控多種因子並密切關注市場行情來管理這些風險。通過Benzinga Pro的實時提醒保持對Palo Alto Networks期權交易的最新動態了解。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $320.0 and $370.0 for Palo Alto Networks, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $320.0 and $370.0 for Palo Alto Networks, spanning the last three months.