What the Options Market Tells Us About AbbVie

What the Options Market Tells Us About AbbVie

Investors with a lot of money to spend have taken a bullish stance on AbbVie (NYSE:ABBV).

有大量資金可以花的投資者對艾伯維(紐約證券交易所代碼:ABBV)採取了看漲立場。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

今天,當我們在本辛加追蹤的公開期權歷史記錄中出現頭寸時,我們注意到了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ABBV, it often means somebody knows something is about to happen.

無論這些是機構還是僅僅是富人,我們都不知道。但是,當ABBV發生這麼大的事情時,通常意味着有人知道某件事即將發生。

Today, Benzinga's options scanner spotted 13 options trades for AbbVie.

今天,本辛加的期權掃描儀發現了艾伯維的13筆期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 46% bullish and 46%, bearish.

這些大資金交易者的整體情緒在46%的看漲和46%的看跌之間。

Out of all of the options we uncovered, there was 1 put, for a total amount of $33,000, and 12, calls, for a total amount of $817,396.

在我們發現的所有期權中,有1份看跌期權,總額爲33,000美元,還有12份看漲期權,總額爲817,396美元。

Expected Price Movements

預期的價格走勢

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $155.0 to $200.0 for AbbVie over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將AbbVie的價格定在155.0美元至200.0美元之間。

Volume & Open Interest Development

交易量和未平倉合約的發展

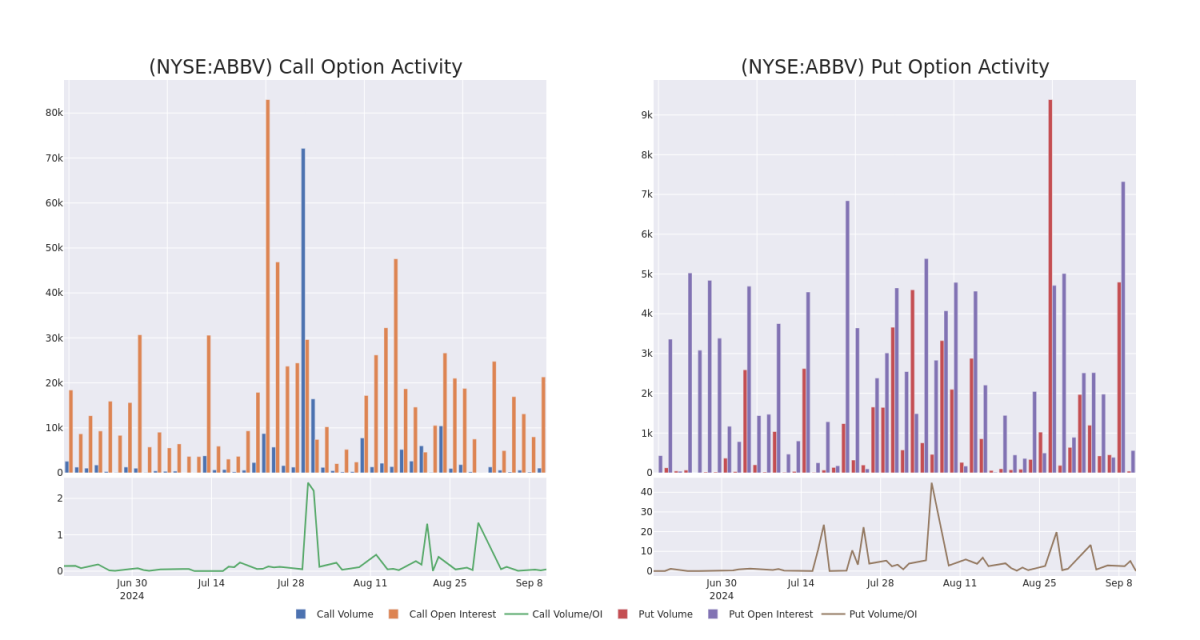

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in AbbVie's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to AbbVie's substantial trades, within a strike price spectrum from $155.0 to $200.0 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了艾伯維在指定行使價下期權的流動性和投資者對艾伯維期權的興趣。即將發佈的數據可視化了與艾伯維的大量交易相關的看漲期權和看跌期權的交易量和未平倉合約的波動,在過去30天內,行使價範圍從155.0美元到200.0美元不等。

AbbVie Option Activity Analysis: Last 30 Days

AbbVie 期權活動分析:過去 30 天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABBV | CALL | TRADE | BEARISH | 10/18/24 | $16.9 | $16.85 | $16.85 | $180.00 | $337.0K | 676 | 200 |

| ABBV | CALL | SWEEP | NEUTRAL | 10/18/24 | $3.3 | $3.25 | $3.25 | $200.00 | $109.1K | 2.4K | 520 |

| ABBV | CALL | SWEEP | BULLISH | 09/20/24 | $21.9 | $20.75 | $21.95 | $175.00 | $52.6K | 2.9K | 111 |

| ABBV | CALL | SWEEP | BEARISH | 10/18/24 | $21.95 | $21.6 | $21.72 | $175.00 | $52.1K | 287 | 0 |

| ABBV | CALL | TRADE | BULLISH | 11/15/24 | $15.1 | $15.05 | $15.1 | $185.00 | $37.7K | 3.1K | 88 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABBV | 打電話 | 貿易 | 粗魯的 | 10/18/24 | 16.9 美元 | 16.85 美元 | 16.85 美元 | 180.00 美元 | 337.0 萬美元 | 676 | 200 |

| ABBV | 打電話 | 掃 | 中立 | 10/18/24 | 3.3 美元 | 3.25 | 3.25 | 200.00 美元 | 109.1 萬美元 | 2.4K | 520 |

| ABBV | 打電話 | 掃 | 看漲 | 09/20/24 | 21.9 美元 | 20.75 美元 | 21.95 美元 | 175.00 美元 | 52.6 萬美元 | 2.9K | 111 |

| ABBV | 打電話 | 掃 | 粗魯的 | 10/18/24 | 21.95 美元 | 21.6 美元 | 21.72 美元 | 175.00 美元 | 52.1 萬美元 | 287 | 0 |

| ABBV | 打電話 | 貿易 | 看漲 | 11/15/24 | 15.1 美元 | 15.05 美元 | 15.1 美元 | 185.00 美元 | 37.7 萬美元 | 3.1K | 88 |

About AbbVie

關於 AbbVie

AbbVie is a pharmaceutical firm with a strong exposure to immunology (with Humira, Skyrizi, and Rinvoq) and oncology (with Imbruvica and Venclexta). The company was spun off from Abbott in early 2013. The 2020 acquisition of Allergan added several new products and drugs in aesthetics (including Botox).

艾伯維是一家制藥公司,在免疫學(與Humira、Skyrizi和Rinvoq合作)和腫瘤學(與Imbruvica和Venclexta合作)方面有着豐富的經驗。該公司於2013年初從雅培分拆出來。2020年對Allergan的收購增加了幾種美容領域的新產品和藥物(包括肉毒桿菌毒素)。

Present Market Standing of AbbVie

艾伯維目前的市場地位

- Currently trading with a volume of 1,562,326, the ABBV's price is down by -1.93%, now at $195.5.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 44 days.

- ABBV目前的交易量爲1,562,326美元,其價格下跌了-1.93%,目前爲195.5美元。

- RSI讀數表明,該股目前可能接近超買。

- 預計業績將在44天后發佈。

Professional Analyst Ratings for AbbVie

AbbVie的專業分析師評級

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $209.0.

在過去的一個月中,1位行業分析師分享了他們對該股的見解,提出平均目標價爲209.0美元。

- An analyst from Piper Sandler has decided to maintain their Overweight rating on AbbVie, which currently sits at a price target of $209.

- 派珀·桑德勒的一位分析師已決定維持對艾伯維的增持評級,目前的目標股價爲209美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for AbbVie with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro獲取實時提醒,隨時了解AbbVie的最新期權交易。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ABBV, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ABBV, it often means somebody knows something is about to happen.