Looking At Coca-Cola's Recent Unusual Options Activity

Looking At Coca-Cola's Recent Unusual Options Activity

High-rolling investors have positioned themselves bearish on Coca-Cola (NYSE:KO), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in KO often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 13 options trades for Coca-Cola. This is not a typical pattern.

The sentiment among these major traders is split, with 38% bullish and 53% bearish. Among all the options we identified, there was one put, amounting to $93,125, and 12 calls, totaling $959,708.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $65.0 to $77.5 for Coca-Cola over the recent three months.

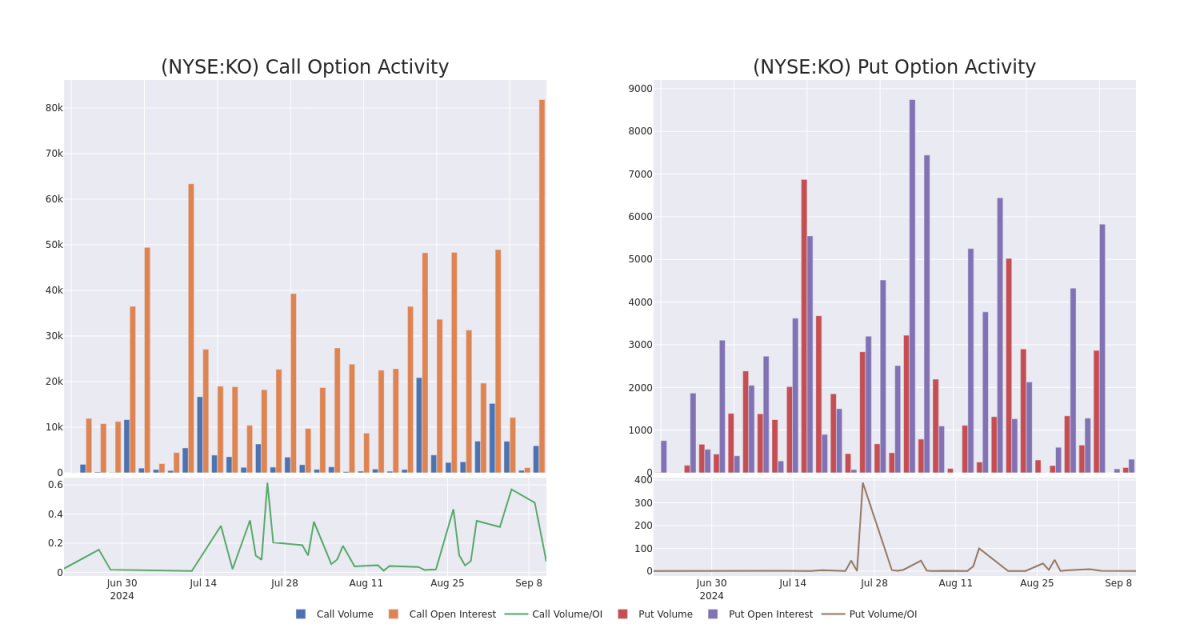

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Coca-Cola's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Coca-Cola's substantial trades, within a strike price spectrum from $65.0 to $77.5 over the preceding 30 days.

Coca-Cola Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KO | CALL | SWEEP | BULLISH | 09/20/24 | $3.4 | $3.3 | $3.39 | $67.50 | $256.8K | 9.7K | 1.0K |

| KO | CALL | TRADE | BEARISH | 01/17/25 | $3.35 | $3.25 | $3.25 | $70.00 | $245.7K | 9.0K | 811 |

| KO | PUT | SWEEP | BEARISH | 02/21/25 | $7.45 | $7.35 | $7.45 | $77.50 | $93.1K | 319 | 125 |

| KO | CALL | SWEEP | BULLISH | 09/20/24 | $0.47 | $0.42 | $0.47 | $71.00 | $69.0K | 6.9K | 1.6K |

| KO | CALL | SWEEP | BULLISH | 10/04/24 | $1.45 | $1.25 | $1.45 | $70.00 | $65.2K | 73 | 181 |

About Coca-Cola

Founded in 1886, Atlanta-headquartered Coca-Cola is the world's largest nonalcoholic beverage company, with a strong portfolio of 200 brands covering key categories including carbonated soft drinks, water, sports, energy, juice, and coffee. Together with bottlers and distribution partners, the company sells finished beverage products bearing Coca-Cola and licensed brands through retailers and food-service locations in more than 200 countries and regions globally. Coca-Cola generates around two thirds of its total revenue overseas, with a significant portion from emerging economies in Latin America and Asia-Pacific.

Following our analysis of the options activities associated with Coca-Cola, we pivot to a closer look at the company's own performance.

Coca-Cola's Current Market Status

- With a trading volume of 5,775,299, the price of KO is down by -0.94%, reaching $70.88.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 41 days from now.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Coca-Cola with Benzinga Pro for real-time alerts.