Top 3 Tech Stocks You'll Regret Missing In September

Top 3 Tech Stocks You'll Regret Missing In September

The most oversold stocks in the information technology sector presents an opportunity to buy into undervalued companies.

信息技術領域超賣次數最多的股票爲買入被低估的公司提供了機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI是一個動量指標,它比較股票在價格上漲的日子裏的走強與價格下跌的日子的走強。與股票的價格走勢相比,它可以讓交易者更好地了解股票在短期內的表現。根據Benzinga Pro的數據,當相對強弱指數低於30時,資產通常被視爲超賣。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是該行業主要超賣參與者的最新名單,RSI接近或低於30。

eGain Corp (NASDAQ:EGAN)

eGain Corp(納斯達克股票代碼:EGAN)

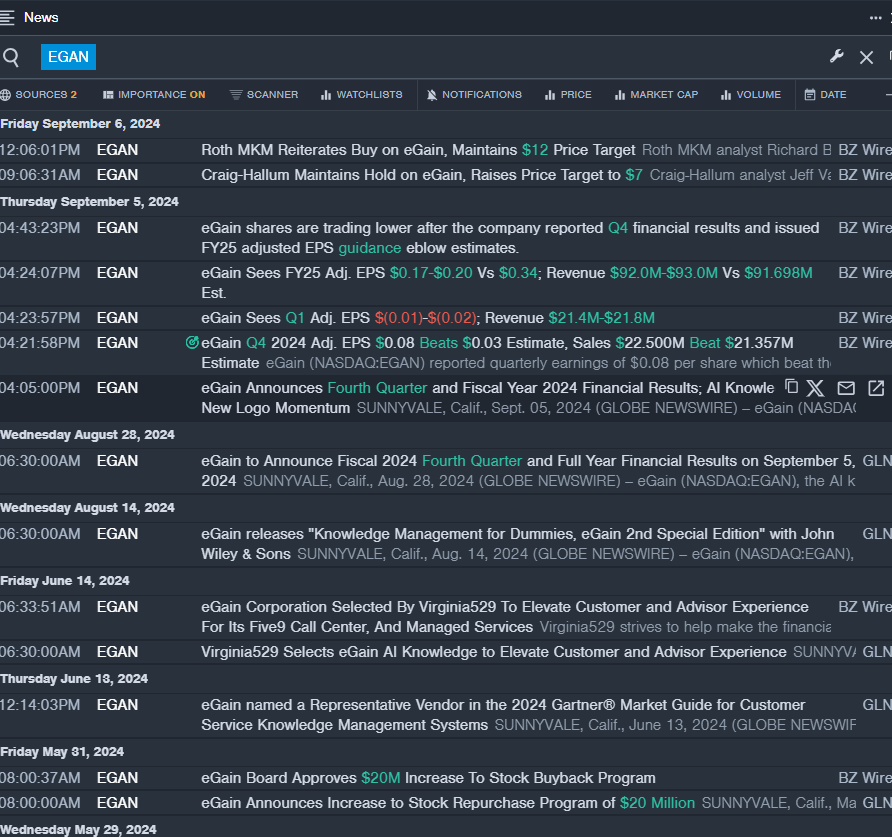

- On Sept. 5, eGain reported fourth-quarter financial results and issued FY25 adjusted EPS guidance below estimates. "As businesses invest in Gen AI at scale, our AI Knowledge Hub helps deliver trusted answers for customer service, reducing cost and improving experience," said Ashu Roy, eGain's CEO. "As a result, new logo wins and RFPs for AI Knowledge were up 50 percent in fiscal 2024, and we are investing into this growing market opportunity for AI Knowledge." The company's stock fell around 26% over the past five days and has a 52-week low of $4.81.

- RSI Value: 25.80

- EGAN Price Action: Shares of eGain fell 4.1% to close at $4.90 on Wednesday.

- Benzinga Pro's real-time newsfeed alerted to latest EGAN news.

- 9月5日,eGain公佈了第四季度財務業績,併發布了低於預期的25財年調整後每股收益指引。eGain首席執行官阿舒·羅伊表示:「隨着企業大規模投資Gen AI,我們的人工智能知識中心有助於爲客戶服務提供可信的答案,降低成本並改善體驗。」「結果,在2024財年,AI Knowledge的新標識獲勝率和RFP增長了50%,我們正在投資人工智能知識這一不斷增長的市場機會。」該公司的股票在過去五天中下跌了約26%,跌至52周低點4.81美元。

- RSI 值:25.80

- EGAN價格走勢:週三,eGain的股價下跌4.1%,收於4.90美元。

- Benzinga Pro的實時新聞提醒了最新的EGAN新聞。

Five9 Inc (NASDAQ:FIVN)

Five9 Inc(納斯達克股票代碼:FIVN)

- On Aug. 8, Five9 reported second-quarter 2024 results. Revenue was $252.1 million, beating the consensus of $245.2 million. Mike Burkland, Chairman and CEO,said, "We are pleased to report strong second quarter results, achieving a key milestone with annual revenue run rate exceeding $1 billion, primarily driven by LTM enterprise subscription revenue growing 21% year-over-year." The company's stock fell around 16% over the past month. It has a 52-week low of $26.60.

- RSI Value: 26.38

- FIVN Price Action: Shares of Five9 rose 1.3% to close at $27.33 on Wednesday.

- Benzinga Pro's charting tool helped identify the trend in FIVN stock.

- 8月8日,Five9公佈了2024年第二季度業績。收入爲2.521億美元,超過了市場普遍預期的2.452億美元。董事長兼首席執行官邁克·伯克蘭表示:「我們很高興地公佈強勁的第二季度業績,實現了關鍵的里程碑,年收入超過10億美元,這主要是由LtM企業訂閱收入同比增長21%的推動力。」該公司的股票在過去一個月中下跌了約16%。它的52周低點爲26.60美元。

- RSI 值:26.38

- FIVN價格走勢:週三,Five9股價上漲1.3%,收於27.33美元。

- Benzinga Pro的圖表工具幫助確定了FIVN股票的走勢。

RingCentral Inc (NYSE:RNG)

RingCentral Inc(紐約證券交易所代碼:RNG)

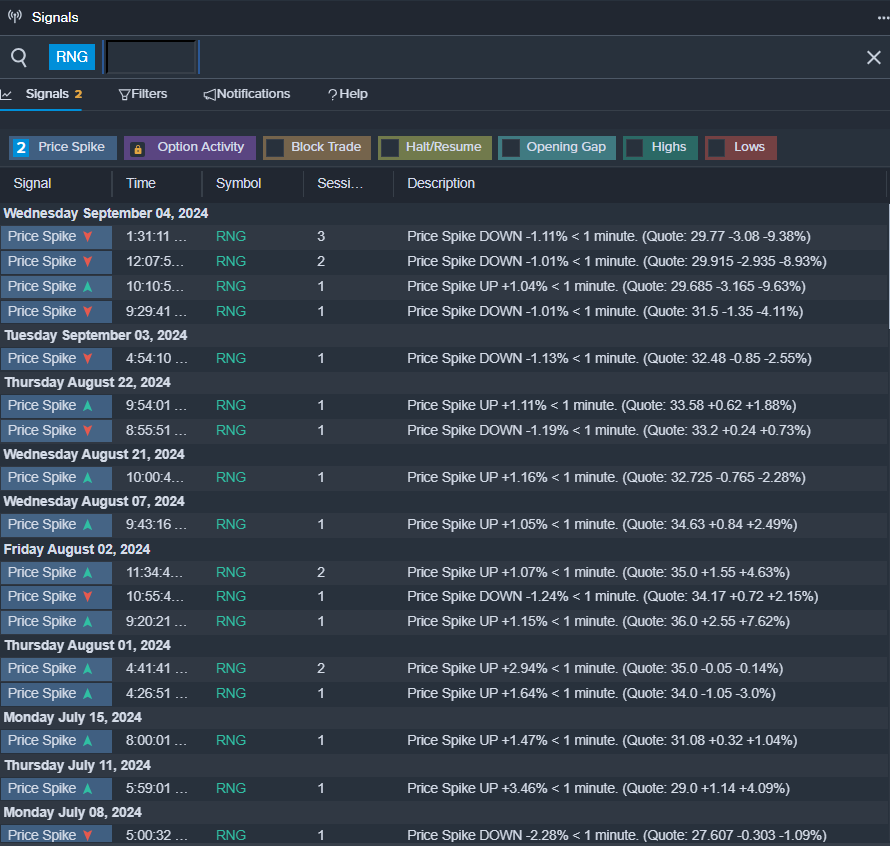

- On Sept. 3, RingCentral announced that CFO Sonalee Parekh will resign. Vlad Shmunis, Founder, Chairman and CEO of RingCentral, said, "On behalf of the Board and our entire team, I want to thank Sonalee for her many contributions to RingCentral, particularly improved profitability and free cash flow. She has been a trusted partner, and we wish her all the best in her future endeavors." The company's shares fell around 12% over the past month and has a 52-week low of $25.08.

- RSI Value: 29.93

- RNG Price Action: Shares of RingCentral rose 0.9% to close at $28.00 on Wednesday.

- Benzinga Pro's signals feature notified of a potential breakout in RNG shares.

- 9月3日,RingCentral宣佈首席財務官索納利·帕雷克將辭職。RingCentral創始人、董事長兼首席執行官弗拉德·什穆尼斯表示:「我要代表董事會和整個團隊感謝Sonalee爲RingCentral做出的許多貢獻,尤其是盈利能力和自由現金流的改善。她一直是值得信賴的合作伙伴,我們祝願她在未來的工作中一切順利。」該公司的股價在過去一個月中下跌了約12%,跌至52周低點25.08美元。

- RSI 值:29.93

- RNG價格走勢:週三,RingCentral的股價上漲0.9%,收於28.00美元。

- Benzinga Pro的信號功能被告知RNG股票可能出現突破。

Read More:

閱讀更多:

- Jim Cramer: 'Not The Time To Own Oil,' When Asked About Exxon Mobil; Says IBM Is 'Performing Well'

- 吉姆·克萊默:當被問及埃克森美孚時,「現在不是擁有石油的時候」;說IBM 「表現良好」