- 要聞

- 股東應該對yelp inc(紐交所:YELP)的股價感到滿意

Shareholders Should Be Pleased With Yelp Inc.'s (NYSE:YELP) Price

Shareholders Should Be Pleased With Yelp Inc.'s (NYSE:YELP) Price

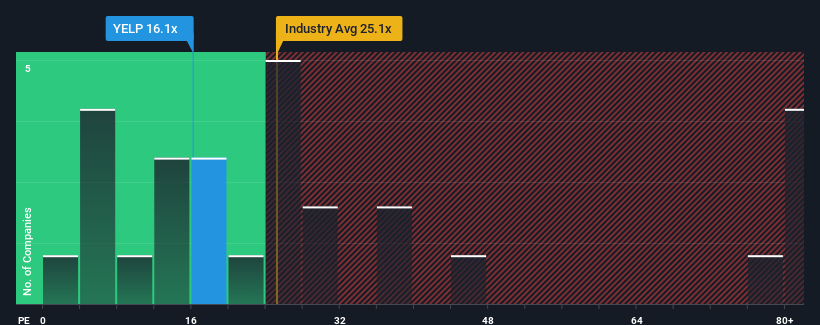

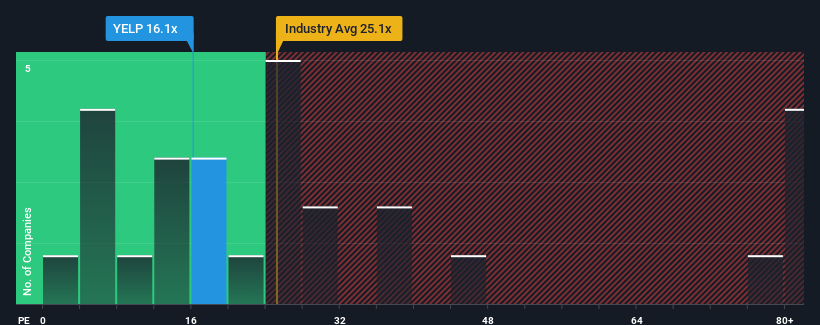

There wouldn't be many who think Yelp Inc.'s (NYSE:YELP) price-to-earnings (or "P/E") ratio of 16.1x is worth a mention when the median P/E in the United States is similar at about 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Yelp certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

How Is Yelp's Growth Trending?

In order to justify its P/E ratio, Yelp would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 228% gain to the company's bottom line. Pleasingly, EPS has also lifted 730% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Retrospectively, the last year delivered an exceptional 228% gain to the company's bottom line. Pleasingly, EPS has also lifted 730% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest earnings should grow by 9.5% per annum over the next three years. That's shaping up to be similar to the 10% per year growth forecast for the broader market.

With this information, we can see why Yelp is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Yelp's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Yelp with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than Yelp. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

在美國中位數P/E約爲17倍時,不會有多少人認爲Yelp Inc.(NYSE:YELP)的市盈率爲16.1倍值得一提。雖然這可能並不引起注意,但如果市盈率不合理,投資者可能會錯過潛在的機會或忽視即將出現的失望。

最近Yelp確實做得不錯,因爲其盈利增長是積極的,而其他大多數公司的盈利則開始下滑。一個可能的原因是,市盈率適度,因爲投資者認爲公司未來的盈利能力較弱。如果您喜歡這家公司,您希望這不是真實的情況,這樣您就可以在它不太受青睞時買入一些股票。

Yelp的增長趨勢如何?爲了證明其市盈率的合理性,Yelp需要產生與市場相似的增長。

爲了證明其市盈率的合理性,Yelp需要產生與市場相似的增長。

回顧過去一年,公司的底線出現了異常的228%增長。令人高興的是,_EPS也從三年前開始累計增長了730%,這要歸功於過去12個月的增長。因此,可以說公司最近的收益增長表現出色。

回顧過去一年,公司的底線出現了異常的228%增長。令人高興的是,_EPS也從三年前開始累計增長了730%,這要歸功於過去12個月的增長。因此,可以說公司最近的收益增長表現出色。

轉向未來,對該公司的十位分析師的估計顯示,未來三年每年的收益預計將增長9.5%。這似乎與更廣泛市場的每年10%增長預測相似。

根據這些信息,我們可以看到爲什麼Yelp的交易價格與市場的市盈率相當。大多數投資者似乎期待看到平均未來增長,並且願意爲股票支付適度金額。

最終結論

有人認爲,市盈率是某些行業內價值的劣質測量,但它可以是一個強有力的企業情緒指標。

正如我們所懷疑的那樣,我們對Yelp分析師預測的檢查顯示,其市場匹配的收益前景正在影響其當前的市盈率。目前股東對市盈率感到滿意,因爲他們相當確信未來收益不會出現任何意外。在這種情況下,很難看到股價在短期內明顯向任何一方向移動。

在公司的資產負債表上,還可以找到許多其他重要的風險因素。我們的免費資產負債表分析爲Yelp提供了六個簡單的檢查,可以幫助您發現可能存在的任何風險。

您可能能夠找到比Yelp更好的投資。如果您想要一些可能的候選公司,可以查看這個免費的低市盈率公司列表(但已經證明它們能夠增長利潤)。

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧