Looking At Eli Lilly's Recent Unusual Options Activity

Looking At Eli Lilly's Recent Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards Eli Lilly (NYSE:LLY), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in LLY usually suggests something big is about to happen.

財力雄厚的投資者對禮來(紐約證券交易所代碼:LLY)採取了看漲態度,這是市場參與者不容忽視的。我們對本辛加公開期權記錄的追蹤今天揭示了這一重大舉措。這些投資者的身份仍然未知,但是LLY的如此重大變動通常表明即將發生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 90 extraordinary options activities for Eli Lilly. This level of activity is out of the ordinary.

我們從今天的觀察中收集了這些信息,當時Benzinga的期權掃描儀重點介紹了禮來公司的90項非同尋常的期權活動。這種活動水平與衆不同。

The general mood among these heavyweight investors is divided, with 55% leaning bullish and 33% bearish. Among these notable options, 20 are puts, totaling $654,388, and 70 are calls, amounting to $15,760,820.

這些重量級投資者的總體情緒存在分歧,55%的人傾向於看漲,33%的人傾向於看跌。在這些值得注意的期權中,有20個是看跌期權,總額爲654,388美元,70個是看漲期權,總額爲15,760,820美元。

Expected Price Movements

預期的價格走勢

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $240.0 to $1300.0 for Eli Lilly over the recent three months.

根據交易活動,看來重要投資者的目標是在最近三個月中將禮來的價格區間從240.0美元擴大到1300.0美元。

Volume & Open Interest Trends

交易量和未平倉合約趨勢

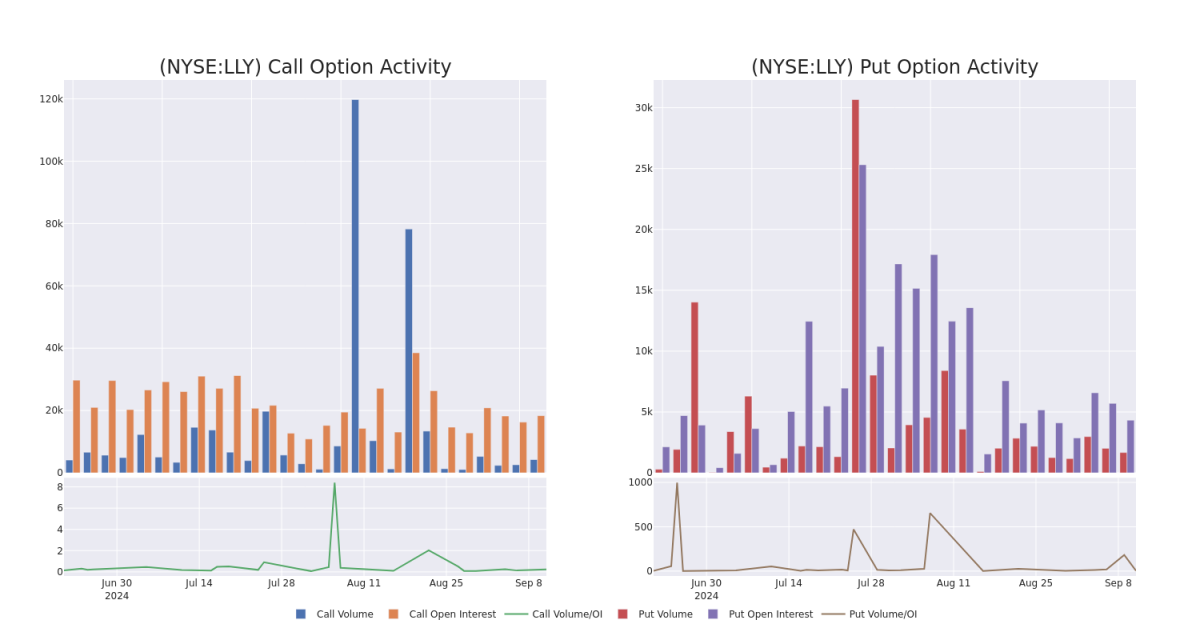

In terms of liquidity and interest, the mean open interest for Eli Lilly options trades today is 469.93 with a total volume of 18,909.00.

就流動性和利息而言,今天禮來期權交易的平均未平倉合約爲469.93,總交易量爲18,909.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Eli Lilly's big money trades within a strike price range of $240.0 to $1300.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天來在240.0美元至1300.0美元行使價區間內的看漲期權和看跌期權交易的交易量和未平倉合約的變化。

Eli Lilly Option Volume And Open Interest Over Last 30 Days

過去30天禮來期權交易量和未平倉合約

Significant Options Trades Detected:

檢測到的重要期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LLY | CALL | TRADE | BULLISH | 11/15/24 | $123.05 | $120.3 | $123.0 | $840.00 | $1.2M | 2.2K | 1.2K |

| LLY | CALL | TRADE | BULLISH | 11/15/24 | $121.3 | $119.9 | $121.0 | $840.00 | $1.2M | 2.2K | 1.6K |

| LLY | CALL | TRADE | BULLISH | 11/15/24 | $119.65 | $117.5 | $119.5 | $840.00 | $1.1M | 2.2K | 1.0K |

| LLY | CALL | TRADE | BULLISH | 11/15/24 | $119.25 | $117.0 | $119.1 | $840.00 | $1.1M | 2.2K | 1.1K |

| LLY | CALL | TRADE | BULLISH | 11/15/24 | $117.0 | $115.45 | $116.8 | $840.00 | $1.1M | 2.2K | 922 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 莉莉 | 打電話 | 貿易 | 看漲 | 11/15/24 | 123.05 美元 | 120.3 美元 | 123.0 美元 | 840.00 美元 | 120 萬美元 | 2.2K | 1.2K |

| 莉莉 | 打電話 | 貿易 | 看漲 | 11/15/24 | 121.3 美元 | 119.9 美元 | 121.0 美元 | 840.00 美元 | 120 萬美元 | 2.2K | 1.6K |

| 莉莉 | 打電話 | 貿易 | 看漲 | 11/15/24 | 119.65 美元 | 117.5 美元 | 119.5 美元 | 840.00 美元 | 110 萬美元 | 2.2K | 1.0K |

| 莉莉 | 打電話 | 貿易 | 看漲 | 11/15/24 | 119.25 美元 | 117.0 美元 | 119.1 美元 | 840.00 美元 | 110 萬美元 | 2.2K | 1.1K |

| 莉莉 | 打電話 | 貿易 | 看漲 | 11/15/24 | 117.0 美元 | 115.45 美元 | 116.8 美元 | 840.00 美元 | 110 萬美元 | 2.2K | 922 |

About Eli Lilly

關於 Eli Lilly

Eli Lilly is a drug firm with a focus on neuroscience, cardiometabolic, cancer, and immunology. Lilly's key products include Verzenio for cancer; Mounjaro, Zepbound, Jardiance, Trulicity, Humalog, and Humulin for cardiometabolic; and Taltz and Olumiant for immunology.

禮來是一家專注於神經科學、心臟代謝、癌症和免疫學的製藥公司。禮來公司的關鍵產品包括用於癌症的Verzenio;用於心臟代謝的Mounjaro、Zepbound、Jardiance、Trulicity、Humalog和Humulin;以及用於免疫學的Taltz和Olumiant。

Following our analysis of the options activities associated with Eli Lilly, we pivot to a closer look at the company's own performance.

在分析了與禮來相關的期權活動之後,我們將轉向仔細研究公司自身的表現。

Eli Lilly's Current Market Status

禮來公司當前的市場狀況

- Currently trading with a volume of 1,616,149, the LLY's price is up by 0.23%, now at $923.0.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 49 days.

- LLY目前的交易量爲1,616,149美元,價格上漲了0.23%,目前爲923.0美元。

- RSI讀數表明,該股目前可能接近超買。

- 預計業績將在49天后發佈。

Professional Analyst Ratings for Eli Lilly

禮來公司的專業分析師評級

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $991.2.

在過去的一個月中,5位行業分析師分享了他們對該股的見解,提出平均目標價爲991.2美元。

- Reflecting concerns, an analyst from Morgan Stanley lowers its rating to Overweight with a new price target of $1106.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $885.

- Consistent in their evaluation, an analyst from Berenberg keeps a Buy rating on Eli Lilly with a target price of $1050.

- Consistent in their evaluation, an analyst from Guggenheim keeps a Buy rating on Eli Lilly with a target price of $1030.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $885.

- 摩根士丹利的一位分析師將其評級下調至增持,新的目標股價爲1106美元,這反映了人們的擔憂。

- 坎託·菲茨傑拉德的一位分析師將其評級下調至增持,新的目標股價爲885美元,這反映了人們的擔憂。

- 貝倫貝格的一位分析師在評估中保持了對禮來公司的買入評級,目標價爲1050美元。

- 古根海姆的一位分析師在評估中保持了對禮來公司的買入評級,目標價爲1030美元。

- 坎託·菲茨傑拉德的一位分析師將其評級下調至增持,目標股價爲885美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Eli Lilly options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。通過Benzinga Pro的實時提醒,隨時了解最新的禮來期權交易。