Gold Sets A New Record As Prices Rise Higher

Gold Sets A New Record As Prices Rise Higher

By RoboForex Analytical Department

由RoboForex分析部門提供

Gold prices surged to 2,570 USD per troy ounce on Friday. New record highs became possible amid the weakening position of the US dollar and declining yields on US government bonds.

黃金價格週五飆升至每盎司2570美元。在美元走弱和美國政府債券收益率下降的背景下,創下了新的歷史高點。

Gold prices began to rise after the release of another package of US macroeconomic statistics. The weekly initial jobless claims increased compared to the previous week and remained above average values. This signals a weakening employment market, which is confirmed by weak wage figures for August. Meanwhile, US producer prices increased slightly more than expected in August due to high maintenance costs. The overall trend still confirms easing inflationary pressures, which will allow the Federal Reserve to lower interest rates next week.

發佈了美國宏觀經濟統計數據後,黃金價格開始上漲。每週首次申請失業救濟人數較上週增加,並保持在平均水平以上。這表示就業市場疲軟,這得到了八月份工資數據的低迷證實。與此同時,由於高維護成本,美國生產者價格在八月份稍微增長超過了預期。總體趨勢仍然確認了通脹壓力的放鬆,這將使聯邦儲備系統能夠在下週降低利率。

According to the CME FedWatch tool, the odds of a 25-basis-point interest rate cut is 59% now, while the likelihood of a 50-basis-point rate cut is estimated at 41%. Yesterday, the ECB lowered its interest rate by 60 basis points to 3.65% per annum, which is a good signal for gold prices.

根據CME FedWatch工具,目前25個點子減息的可能性爲59%,而50個點子減息的可能性估計爲41%。昨天,歐洲央行將其利率下調60個點子至3.65%,這對黃金價格是一個好的信號。

XAU/USD Technical Analysis

黃金/美元的技術面分析

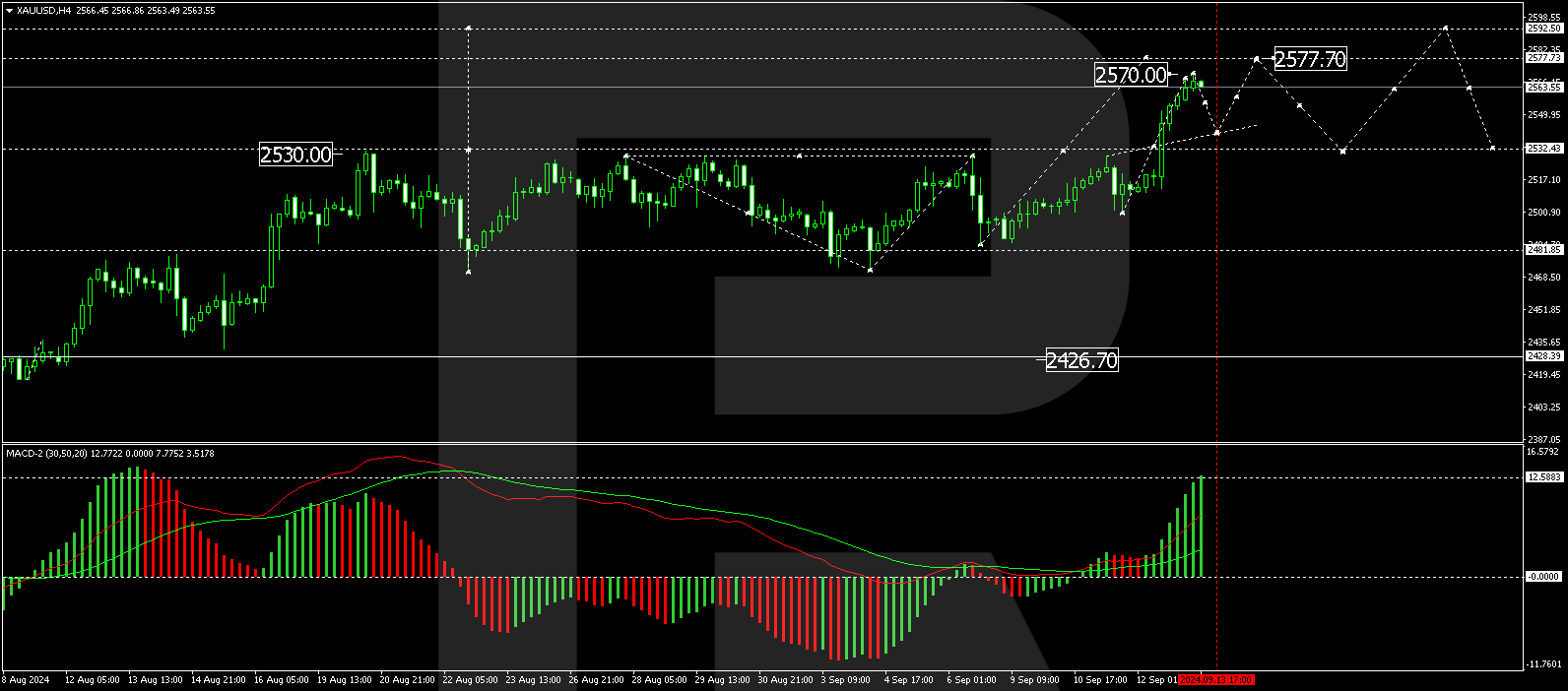

On the XAU/USD H4 chart, the market has broken above the consolidation range. A breakout of the 2,535.35 level can be considered as a market proposal to extend the growth wave to 2,570.00 and potentially further to 2,585.85. Today, the market has completed a wave, reaching 2,570.00. Subsequently, a technical decline to at least 2,541.55 (testing from above) could follow. Once the price hits this level, a growth structure might develop, aiming for the local target of 2,585.85. It is worth noting that breaking through the 2,535.35 level may result in a continuous growth structure to the 2,595.95 level, without a significant correction. This is the main target. This scenario is technically supported by the MACD indicator, whose signal line is above zero and pointing strictly upwards.

在黃金/美元H4圖表上,市場突破了區間。2,535.35水平的突破可以被視爲市場提出延長上漲浪的建議,目標是2,570.00,進一步可能達到2,585.85。今天,市場完成了一波上漲,達到2,570.00。隨後,可能會有一個技術性回調,至少測試2,541.55之上。一旦價格達到這個水平,可能會形成一個上升結構,目標是本地的2,585.85。值得注意的是,突破2,535.35水平可能導致連續上漲結構達到2,595.95的水平,沒有明顯的修正。這是主要目標。這個情景在技術上得到了MACD指標的支持,其信號線位於零上並且呈嚴格向上趨勢。

On the XAU/USD H1 chart, the market has completed a growth wave, reaching 2,570.00. A consolidation range is currently forming below this level. With a downward breakout, the price could decline to 2,541.55. An upward breakout will open the potential for a continuation of the trend to 2,585.85. This scenario is also technically supported by the Stochastic oscillator, whose signal line is around 80 and poised for a decline to 20.

在黃金/美元H1圖表上,市場完成了一波上漲,達到2,570.00。目前在該水平下方形成了一個區間。向下突破,價格可能下跌到2,541.55。向上突破將打開趨勢延續的潛力,目標是2,585.85。這個情景在技術上也得到了隨機指標的支持,其信號線在80左右,並有可能下降到20。

Disclaimer

免責聲明

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

本分析僅代表作者個人觀點,不得視爲交易建議。RoboForex不承擔基於本文所含交易建議和評論所產生的任何交易結果的責任。

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

本文來自非報酬的外部投稿人。它不代表Benzinga的報道,並且沒有因爲內容或準確性而被編輯。

According to the CME FedWatch tool, the odds of a 25-basis-point interest rate cut is 59% now, while the likelihood of a 50-basis-point rate cut is estimated at 41%. Yesterday, the ECB lowered its interest rate by 60 basis points to 3.65% per annum, which is a good signal for gold prices.

According to the CME FedWatch tool, the odds of a 25-basis-point interest rate cut is 59% now, while the likelihood of a 50-basis-point rate cut is estimated at 41%. Yesterday, the ECB lowered its interest rate by 60 basis points to 3.65% per annum, which is a good signal for gold prices.