Ahead Of FOMC Meeting Paul Krugman Says Fed Rates Will Be Elevated Even With 50 Bps Cut: 'Argument For Incrementalism Is Very Weak'

Ahead Of FOMC Meeting Paul Krugman Says Fed Rates Will Be Elevated Even With 50 Bps Cut: 'Argument For Incrementalism Is Very Weak'

The Federal Reserve's rate-setting committee -the Federal Open Market Committee, kickstarts a two-day meeting on Tuesday and the futures market currently bakes in a 67% probability of a 50-basis-point rate cut. Ahead of the all-important meeting, Nobel laureate Paul Krugman said on Monday the fed funds rates are "too high."

聯儲局的利率決策委員會-聯邦公開市場委員會,將於週二開始爲期兩天的會議,目前期貨市場預計有67%的概率會減息50個點子。在這場至關重要的會議前,諾貝爾獎得主保羅·克魯格曼在週一表示,聯邦基金利率「太高了。」

Data Turns Benign: The Fed targets inflation of around 2% over the longer run, with its favorite inflation gauge being the annual rate of the price index for personal consumption expenditure. The latest available data show that the annual rate of headline and core consumer price inflation was 2.5% and 3.2%, respectively, in August.

數據穩定:聯邦儲備系統目標是在較長期內將通脹率維持在2%左右,其最喜歡的通脹衡量指標是個人消費支出物價指數的年度漲幅。最新可用的數據顯示,截至8月份,主要消費者物價指數的年度漲幅分別爲2.5%和3.2%。

Using the personal consumption expenditure as an inflation measure shows the annual headline and core rate at 2.5% and 2.6%, respectively, in July.

使用個人消費支出作爲通脹衡量指標,可以看出年度主要物價指數的漲幅分別爲2.5%和2.6%。

Krugman said inflation is basically in line with the target if the lagging shelter measures are accounted for. Pointing to the job openings data, he said, "The labor market is cooler than it was before the pandemic." Job openings fell to 8.83 million in July, the lowest since 2021, according to a Bureau of Labor Statistics report.

克魯格曼表示,如果考慮到滯後的住房指標,通脹基本符合目標。他指出:「從就業崗位數據來看,勞動力市場比疫情之前要冷淡。」根據美國勞工統計局的報告,7月份的職位空缺下降至883萬,爲2021年以來的最低水平。

Meanwhile, the labor market is cooler than it was before the pandemic 2/ pic.twitter.com/nkxhKFjpYd

— Paul Krugman (@paulkrugman) September 16, 2024

同時,勞動力市場比疫情之前要冷淡 2/ pic.twitter.com/nkxhKFjpYd

— 保羅·克魯格曼 (@paulkrugman) 2024年9月16日

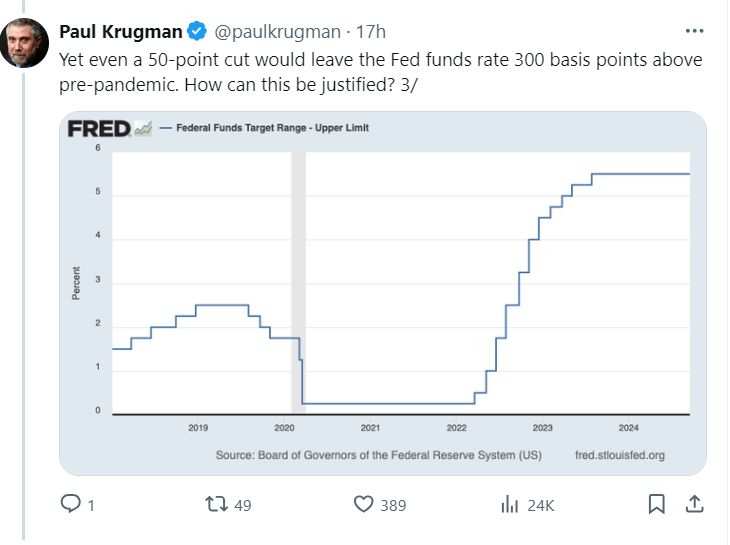

Rates Elevated: Juxtaposing that with the Fed funds rate, Krugman noted that even a 50-point cut would leave the Fed funds rate 300 basis points above pre-pandemic.

利率上升:將此與聯邦基金利率相對照,克魯格曼指出,即使減息50個點子,聯邦基金利率仍將比疫情前高出300個點子。

"How can this be justified?" he asked. While self-answering the question, the economist said the economy doesn't seem to be in a recession yet. The Fed is apparently waiting to adjust the taps until it turns ice-cold, he said, adding that "maybe it's PTSD from the unexpected inflation of 2021-22, but it's still a big mistake."

「這能被證明合理嗎?」他問道。在自問自答這個問題時,這位經濟學家表示經濟似乎還沒有陷入衰退。他說,聯儲局顯然在等待冷卻之前調整水龍頭,他補充說:「也許這是因爲2021-22年意外通脹而導致的創傷後應激障礙,但這仍然是一個大錯誤。」

"Also bear in mind that the risks are asymmetric: we're probably back in the world where excessively loose monetary policy will only gradually affect inflation, while a labor market downturn could happen very fast," Krugman said.

「還要記住風險是非對稱的:我們可能已經回到了貨幣政策過於寬鬆只會逐漸影響通脹的世界,而勞動力市場的下滑可能會來得非常快,」克魯格曼說。

Realistically, there is hope for a 50 basis-point cut, the economist said. He, however, said the argument for incrementalism is very weak.

這位經濟學家說,現實情況下,有希望減息50個點子,但他表示逐步調整的論點非常不充分。

Meanwhile, economists on the other end of the spectrum such as Peter Schiff think a rate cut now would be a huge mistake, as it would potentially weaken the dollar and fan inflationary pressure, with the vicious cycle continuing.

與彼得·希夫等立場截然不同的經濟學家認爲,現在減息將是一個巨大的錯誤,因爲它可能削弱美元並加劇通脹壓力,從而導致惡性循環繼續。

The iShares TIPS Bond ETF (NYSE:TIP), an ETF tracking the investment results of an index composed of inflation-protected U.S. Treasury bonds, ended Monday's session up 0.34% at $110.82, according to Benzinga Pro data.

根據Benzinga Pro數據,追蹤通脹保護美國國債的指數的etf-ishares通脹債券指數etf (NYSE: TIP)收盤上漲0.34%,報110.82美元。

- S&P 500 Implied Volatility Suggests 100-Point Swing As Fed Decision Looms: Experts Say Market May Collapse After Rate Cuts

- 標準普爾500指數暗示,聯邦決策來臨時可能會有100點的波動:專家表示在減息後市場可能會崩盤

Photo by TANYA LARA on Shutterstock

圖像提供者:Shutterstock的TANYA LARA

Krugman said inflation is basically in line with the target if the lagging shelter measures are accounted for. Pointing to the job openings data, he said, "The labor market is cooler than it was before the pandemic." Job openings fell to 8.83 million in July, the lowest since 2021, according to a Bureau of Labor Statistics report.

Krugman said inflation is basically in line with the target if the lagging shelter measures are accounted for. Pointing to the job openings data, he said, "The labor market is cooler than it was before the pandemic." Job openings fell to 8.83 million in July, the lowest since 2021, according to a Bureau of Labor Statistics report.